Iron Albatross Spread

The Iron Albatross Spread is a refined version of the well-known Iron Condor strategy in options trading.

The Iron Albatross Spread is a refined version of the well-known Iron Condor strategy in options trading.

It is crafted to capitalize on low volatility in the underlying asset, much like the Iron Condor, but with certain distinct characteristics.

It is also called a Wide Iron Condor Spread.

Relationship to Iron Condor

- Similar Foundation: Both the Iron Albatross and Iron Condor are constructed using a combination of four options – two calls and two puts, all with the same expiration date.

- Neutral Outlook: Each strategy is designed for a market where minimal price movement is expected, making them neutral strategies.

Distinct Features of Iron Albatross

- Wider Strike Range: The key difference lies in the strike prices chosen. The Iron Albatross typically employs a wider range between the strike prices of the sold and bought options, compared to the Iron Condor.

- Adjusted Risk and Reward: Due to the wider strike range, the Iron Albatross often results in a lower maximum profit potential but also reduced risk, as it allows more room for the underlying asset to fluctuate without incurring losses.

In options trading, many strategies are named for their graphical representation, especially when it comes to multi-leg strategies like spreads and condors. The albatross, a bird known for its exceptionally long wingspan, serves as a metaphor for the wide range of strike prices used in this strategy.

Directional Assumption

Neutral Outlook: The Iron Albatross is best suited for situations where the trader does not expect significant price movements in either direction.

Setup

- Sell OTM Call: Choose a call option with a strike price above the current price of the underlying asset and sell it.

- Buy Further OTM Call: Purchase a call option with a strike price higher than the sold call.

- Sell OTM Put: Sell a put option with a strike price below the current price of the underlying asset.

- Buy Further OTM Put: Purchase a put option with a strike price lower than the sold put.

Ideal Implied Volatility Environment: High

The strategy tends to be more profitable in high implied volatility environments. Higher volatility increases the premium received from the sold options, enhancing potential profits.

Risk and Reward

- Limited Risk: The maximum risk is the difference between the strike prices of the bought and sold options, minus the net premium received.

- Limited Reward: The maximum reward is limited to the net premium received when entering the trade.

Profit and Loss

- Maximum Profit: Achieved when the underlying asset’s price stays between the strike prices of the short call and put at expiration.

- Maximum Loss: Incurs if the price of the underlying asset moves significantly beyond either the higher call strike or the lower put strike.

Comparison with Iron Condor

- Trading Range: The Iron Albatross offers a wider trading range than the Iron Condor, making it more forgiving of price fluctuations in the underlying asset.

- Profit vs. Risk Trade-off: It typically offers a lower maximum profit in exchange for lower risk compared to the Iron Condor.

The Iron Albatross Spread is a strategic choice for traders who anticipate low volatility and prefer a wider range for the underlying asset’s price movement. While it shares similarities with the Iron Condor, its distinct setup provides a different balance of risk and reward, making it suitable for different market conditions and trader preferences.

Live Example:

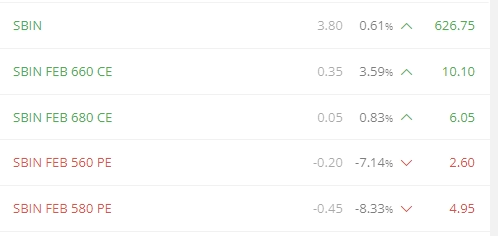

Let’s take this massive range in SBI and construct an Iron Albatross Spread.

So,

- Sell 660CE at 10.1

- Buy 680CE at 6.05

- Sell 580PE at 4.95

- Buy 560PE at 2.6

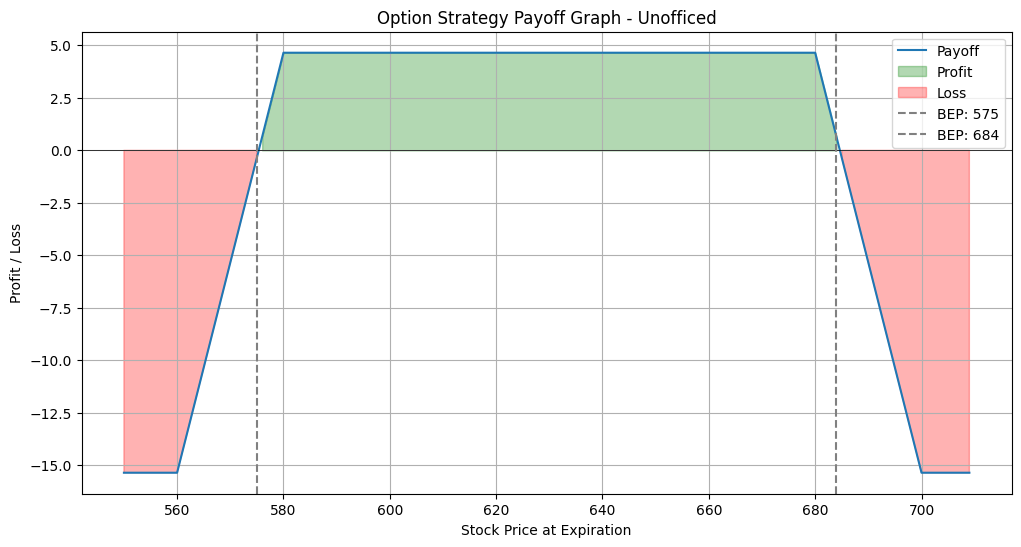

The payoff graph will look like –

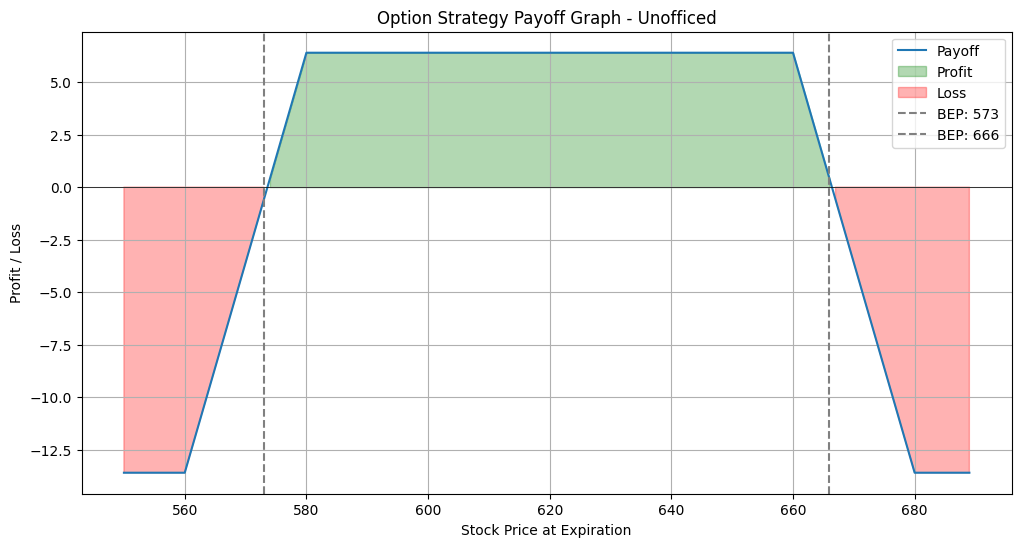

You can make it wider by swapping the 660 – 680 short call spread with the 680 – 700 short call spread. SBIN 700CE is trading at 3.75. So, the setup will be now –

- Sell 680CE at 6.05

- Buy 700CE at 3.75

- Sell 580PE at 4.95

- Buy 560PE at 2.6