Double Short Strangle

The Double Short Strangle is a more advanced and aggressive version of the standard Short Strangle strategy in options trading.

This strategy involves selling two sets of strangle options (a call and a put with different strike prices) on the same underlying asset. It’s typically used by experienced traders in specific market conditions.

Structure of Double Short Strangle

- Two Sets of Strangles: Involves selling two calls and two puts on the same underlying asset.

- Strike Prices: The calls are out-of-the-money (OTM) with a higher strike price, and the puts are OTM with a lower strike price.

Market Outlook

- Neutral to Slightly Volatile Markets: Ideal in markets where significant movement is expected but within a wider range than a single short strangle.

- Predicting Range-Bound Movement: The trader expects the underlying asset to stay within a certain range but wants to protect against wider swings.

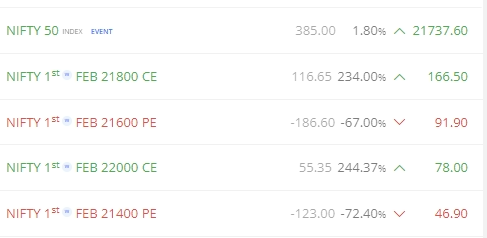

NIFTY is trading at 21737.6.

So, Let’s explore Double Short Strangle in this context.

- Short Strangle at 21600-21800.

- Short 21600PE at 91.9

- Short 21800CE at 166.5

- Short Strangle at 21400-22000.

- Short 21400PE at 46.9

- Short 22200CE at 78

The prices of Call Options and Put options can be seen in the image shared above. Now, Let’s plot the payoff graph in the same range so visualize it in the same scale.

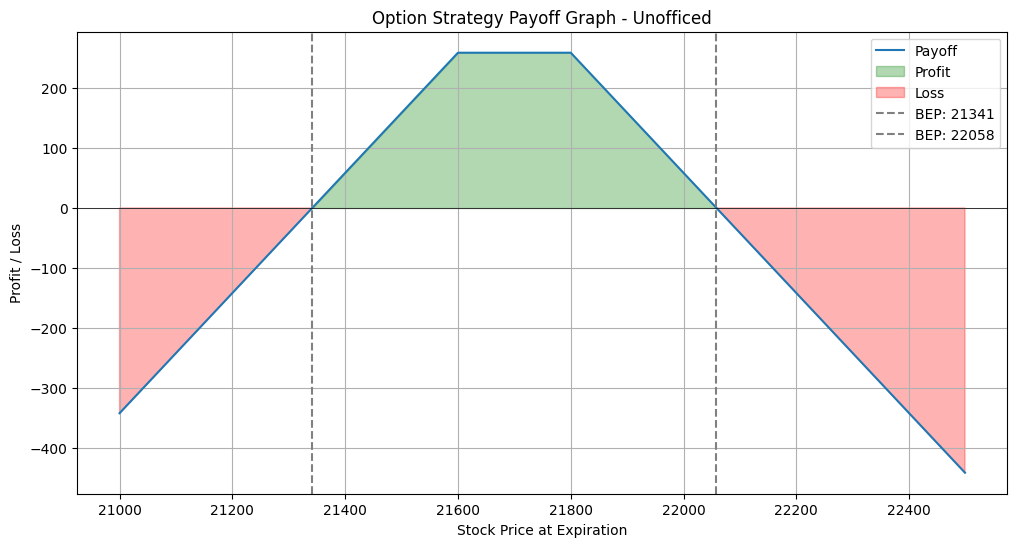

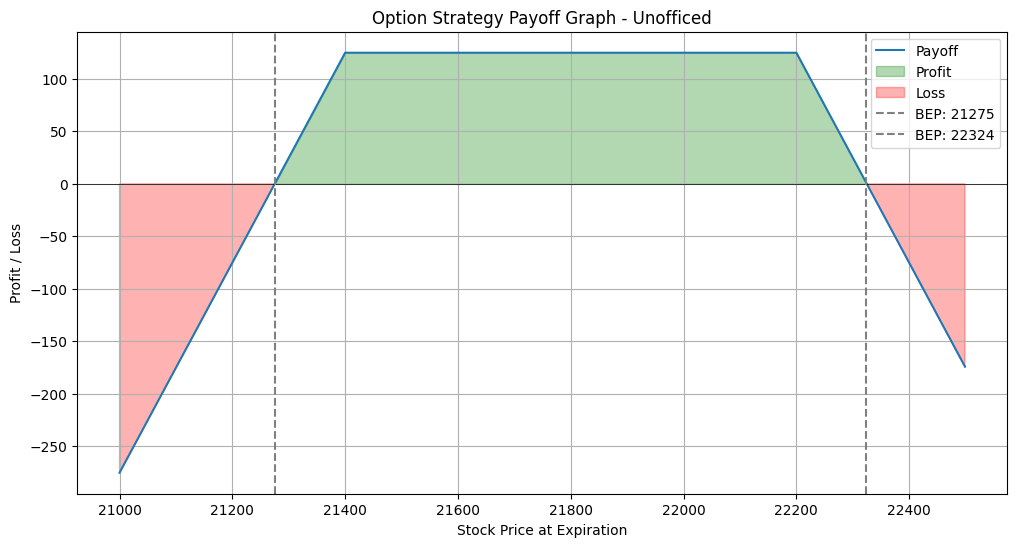

Both of the payoff graphs are plotted within the range of 21000 and 22500.

Short Strangle at 21600-21800 Payoff Characteristics:

- The 21600PE – 21800CE strangle has a relatively narrow range.

- This tighter range results in a higher potential profit.

- The proximity of the strike prices (21600 and 21800) leads to a smaller range of price movement where the strategy is profitable.

Short Strangle at 21400-22000 Payoff Characteristics:

- The 21400PE – 22000CE strangle offers a wider range.

- This wider range typically results in lower potential profit compared to the first strangle.

- The strike prices (21400 and 22000) are further apart, allowing a broader range of price movement but reducing the maximum potential profit.

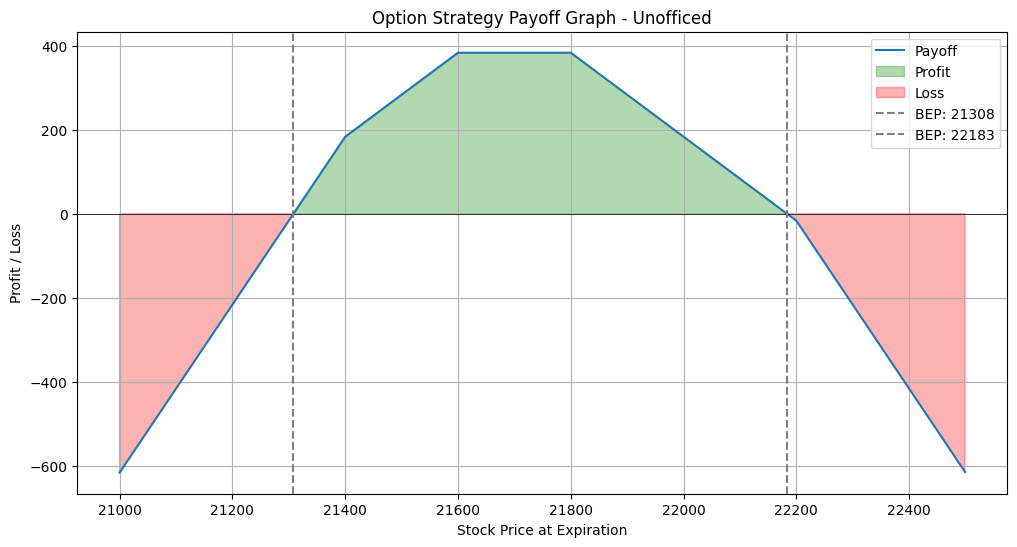

Here is the payoff graph of combined Strangles –

The profit in the payoff graph appears to shift drastically after certain levels.

Diversification through Different Strikes:

- Instead of executing two sets of short strangles at the same strike, using different strikes can be a strategic form of diversification.

- Using varied strike prices can diversify risk.

- The selection of these strikes can be aligned with key support and resistance levels in the market.

Dynamic Rebalancing:

- This approach allows for adjustments based on market changes.

- For instance, if the market breaks through the first support level, the strategy can still be profitable at the next two support levels.

- If market conditions start deviating from initial expectations, the strategy can be rebalanced.

- This could involve adjusting strike prices or quantities to realign with the new market scenario and maintain profitability.

Such a strategy enables continuous alignment with market dynamics, providing a more responsive approach to options trading, particularly suitable for larger accounts where managing risk exposure is critical.

Risk and Reward

Increased Premium Collection: The strategy allows for collecting premiums from two sets of options, potentially increasing profitability.

Expanded Breakeven Points: The breakeven points are wider, giving the trader a larger range for potential profit.

Higher Risk: The risk is also significantly increased. If the underlying asset moves beyond the wider range, losses can be substantial.

Unlimited Loss Potential: Like the standard short strangle, the loss potential is theoretically unlimited if the underlying asset moves significantly beyond the strike prices.

Note:

- Risk (Inverse Short Strangle) > Risk ( Short Strangle)

- POP (Inverse Short Strangle) > POP ( Short Strangle)

- Risk (Inverse Short Strangle) + Risk (Short Strangle) > Risk ( Double Short Strangle)

- Risk (Double Short Straddle) > Risk ( Double Short Strangle)

- POP (Double Short Straddle) > POP ( Double Short Strangle)