Types of Moving Averages

This article is outdated. Please refer to the updated content.

At its core, a moving average (MA) is a technical indicator that tracks the average price of a security over a specified number of time periods. MAs are often classified as trend-following or lagging indicators because they rely on historical price data to provide insights into potential future price movements. They are invaluable tools for traders seeking to identify trends, reversals, and key support or resistance levels.

The Simple Moving Average (SMA)

One of the foundational MAs is the simple moving average (SMA). As its name suggests, the SMA is a straightforward calculation that involves taking the average of a security’s closing prices over a defined number of time periods. This results in a line that smooths out price fluctuations, making it easier to spot underlying trends.

Contrary to the simplicity of its calculation, SMAs offer valuable insights. They are particularly effective for identifying long-term trends and are a favorite among investors who prefer a more stable and less volatile approach to trading.

The Exponential Moving Average (EMA):

While the SMA is a robust choice for trend analysis, the exponential moving average (EMA) takes a slightly different approach. EMA assigns more significant weight to recent prices, making it more responsive to short-term price changes. This characteristic allows EMA to adapt quickly to shifts in market sentiment and provides traders with a more dynamic tool for decision-making.

For traders seeking a balance between the stability of SMAs and the responsiveness of EMAs, the EMA is often the go-to choice. It strikes a middle ground that captures both short-term fluctuations and long-term trends.

DEMA: Double Exponential Moving Average

In the world of moving averages, there exists a less commonly known yet intriguing option known as the Double Exponential Moving Average (DEMA). DEMA combines elements of both a single exponential moving average (EMA) and a double EMA. The result is an indicator that exhibits heightened volatility, making it ideal for certain trading scenarios.

DEMA’s increased sensitivity to price changes makes it a valuable tool for traders working with low-beta stocks that tend to move at a slower pace. For instance, stocks like Coal India, known for their relatively stable price movements, can benefit from DEMA’s ability to capture subtle shifts in market dynamics.

EMA: The Middle Path

While DEMA offers unique advantages in specific situations, the EMA often occupies the sweet spot for many traders. It sits between the stability of the SMA and the volatility of DEMA in terms of price responsiveness. This positioning makes EMA a versatile choice suitable for various trading styles and preferences.

Traders often opt for the EMA when they require an indicator that can adapt to changing market conditions without sacrificing stability.

Moving Averages and Their Extended Utility

Moving averages go beyond merely identifying trends; they also form the basis for several other critical indicators used in technical analysis. One such indicator is the Moving Average Convergence Divergence (MACD), which leverages moving averages to reveal potential changes in the strength and direction of a trend.

Another prominent indicator built upon moving averages is the Bollinger Bands. These bands consist of an SMA at the center and upper and lower bands based on standard deviations. Bollinger Bands help traders identify volatility and potential reversal points, making them a valuable tool in market analysis.

The Practical Application: Calculating Moving Averages

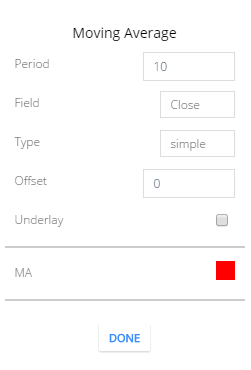

Here go the settings of Moving Average. This is a representation of SMA (10) which means signifies a simple moving average calculated over ten time periods. In this context, the average considers the closing prices of the last ten data points. If you’re working with daily data, this translates to the last ten trading days.

Type = Simple means it’s Simple Moving Average.

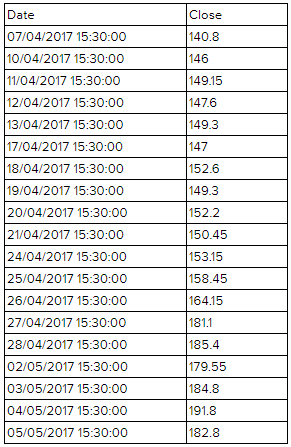

Let’s calculate the moving average of the Bank of India. Calculate me SMA(10) on 24/04/2017 –

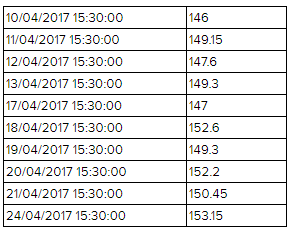

When we mention SMA (10) it is generally assumed to be in daily timeframe over a close field (We take close prices here). So last 10 prices from 24/04/2017 are

So the average of the dataset (146, 149.15, 147.6, 149.3, 147, 152.6, 149.3, 152.2, 150.45, 153.15 ) is 149.675