Kurtosis

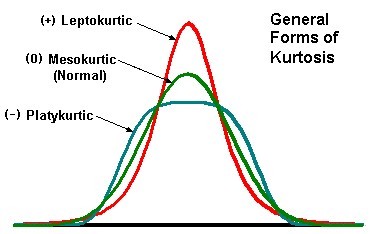

Kurtosis is sometimes confused with a measure of the peakedness of a distribution. However, kurtosis is a measure that describes the shape of a distribution’s tails in relation to its overall shape. There are three categories of kurtosis that can be displayed by a set of data.

A data set that shows kurtosis sometimes also displays skewness or a lack of symmetry. However, kurtosis can be evenly distributed so that both it’s tails are equal.

- Mesokurtic distribution – Distributions with zero excess kurtosis are called mesokurtic. The standard normal distribution has a kurtosis of three, which indicates data that follow a Gaussian distribution have neither fat or thin tails.

- Leptokurtic distribution – Lepto means skinny. Here kurtosis is less than three, it has extremely thick tails and a very thin and tall peak.

- Platykurtic distribution – Platy means broad. Here kurtosis is more than three, it has extremely thin tails and a very broad and short peak.

Neither Stock prices nor stock price returns follow a standard normal distribution. Stock price returns consist of lots of extremely high returns and extremely low returns. So while normal distribution has a very thin tail (i.e. not many extreme values), stock price returns have a fat tail.

Stock price returns have had price action outside of 3 SD. Still, they’re assumed to follow a normal distribution.