RSI Indicator

- What the RSI is.

- How to find potential market turning points in the market.

- How to use the RSI and what the different levels represent.

- How to gauge an overbought and oversold market environment.

- How to use the RSI for exiting trades.

- How to change the settings and what the effects are.

RSI indicator

- The overbought.

- The oversold and,

- The mid-level.

Using RSI For Entering a Trade

- When the RSI line moves up through the mid-level or 50-level, it indicates that there are more buyers in the market, causing price to rally.

- And if the RSI line moves down below 50 or mid-level, it shows that there are more sellers in the market, causing price to drop.

- When looking to trade using the RSI, you want to pay close attention to the 30 and 70 level as these are what the majority of traders monitor.

- The market is said to be oversold when levels of 30 or below are reached, and overbought when levels of 70 or more are reached.

For Bearish Signals

and eventually starts to turn down.

For Bullish Signals

And it eventually starts to turn up. You can use the RSI indicator to help confirm your entry into the market by waiting for it to move into the oversold or overbought level. This normally happens after an asset has made a substantial price move in one direction.

Remember to assess the market environment as some trades will be with the trend and others will be against the trend, which can be lower probability.

Using RSI For Exiting a Trade

Another useful way traders use the RSI is to confirm exits when already in the market.

For example, if you were long and price was heading up strongly and the RSI was giving an overbought reading above 70, you may want to exit or reduce your position size.

In this chart, You can see the theory applied and it says to exit or reduce the position size.

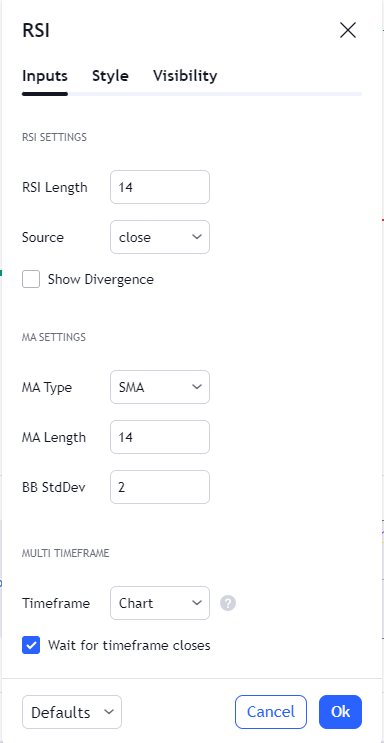

Changing the RSI Settings

Most trading platforms will allow you to change the indicator settings of your RSI indicator.

You have the choice of either making the indicator more or less sensitive to changes in price. The default setting for the RSI indicator on Tradingview is set to 14 periods.

In this example, the RSI setting has changed to 28 periods. As You can can compare the 14 Period RSI from the same chart, Notice how infrequently the line moves into the 30 and 70 levels. It is not even showing the buy signal as it never touched the 30 level.

Similarly, If you wanted to make the indicator more sensitive, you would look to decrease the setting value. This would result in the indicator moving into overbought and oversold levels more frequently, giving regular trading signals. However, this will lead to more false signals. It is important to note that most traders do not change the settings, keeping them at the default of 14 periods. This provides them with a reliable indicator for most market conditions.

Notice how frequently the line moves in between the 30 and 70 levels. It became overbought three times during the same tenure of the trade generated in the 14 period RSI.

If we had used 7 period RSI for our trading, We would have exited the trade lot early.

Conclusion

- The RSI indicator is an oscillator that shows when the market may be overbought or oversold.

- You can use the RSI to time entries and exits from the market.

- Traders can change the settings to make the indicator more or less sensitive to price movement.