Construction of Options Spreads: Session

This session on Construction of Options Spread was conducted live in Unofficed Slack Channel. This article is just an archive of the content.

Prerequisite:

https://unofficed.com/how-to-trade-options-in-the-stock-market/

https://unofficed.com/best-option-trading-strategy-iron-condor/

https://unofficed.com/short-straddle-option-strategy/

Read the shared articles above to get a basic understanding of options. Today we will talk about the construction of spreads. When you have a directional view and want to exercise options with limited loss; spreads are awesome!

There are four types of spreads.

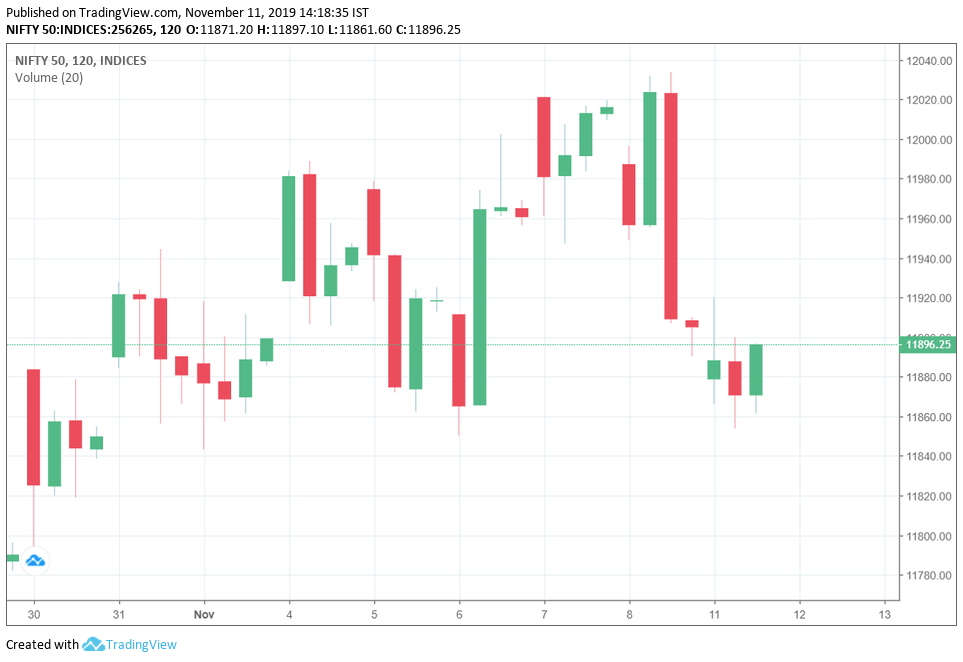

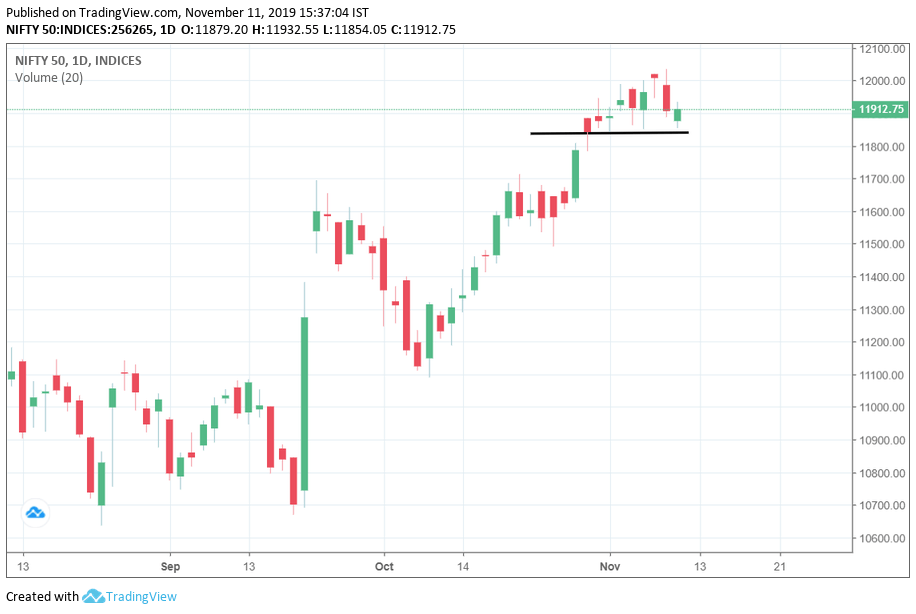

Let’s say, We are bullish in NIFTY. The spot is at 11896.25

The spot is at 11896.25

Short Put Vertical Spread

The strategy we are going to construct is called “Short Put Vertical Spread”. Setup –

- Sell OTM Put.

- Buy Further OTM Put.

In this case –

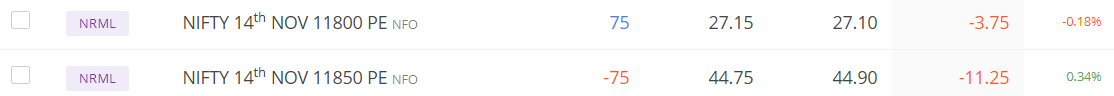

- We sold 11850 PE at 44.75

- We bought 11800PE at 27.15

https://unofficed.com/options-calculator/?save_id=5dc921a5dcbca141937628

- We will get the highest loss at and below 11800.

- We will get the highest profit at and above 11850.

Note – We have to take the strike price of the same expiry for constructing this.

Now another important point of what we are concerned is called breakeven point i.e. from what point we are going to make a loss. In this strategy, our BEP is where the PL (Profit/Loss) is 0

BEP = 11850-44.75+27.15 = 11832.4. As long as, NIFTY closes above or at 11832.4 on the day of 14th November; there is no loss.

Now it doesn’t look that cool it was looking couple minutes back when you put the Turtle Line in DTE i.e. Date to Expiry and changed the timeframe to D.

Note – This is not an intraday strategy unless it is the expiry day itself.

Long Call Vertical Spread

Now, there is another similar strategy that we can construct if we have a bullish view. It is called “Long Call Vertical Spread”. Setup –

- Buy ITM Call.

- Sell OTM Call.

In this case –

- We bought 11850 CE at 76.30

- We sold 11800CE at 55.15

https://unofficed.com/options-calculator/?save_id=5dc92a40701f9945922017

- We will get the highest loss at and below 11850.

- We will get the highest profit at and above 11900.

BEP = 11850+76.30-55.15 = 11871.15

BEP = 11850+76.30-55.15 = 11871.15

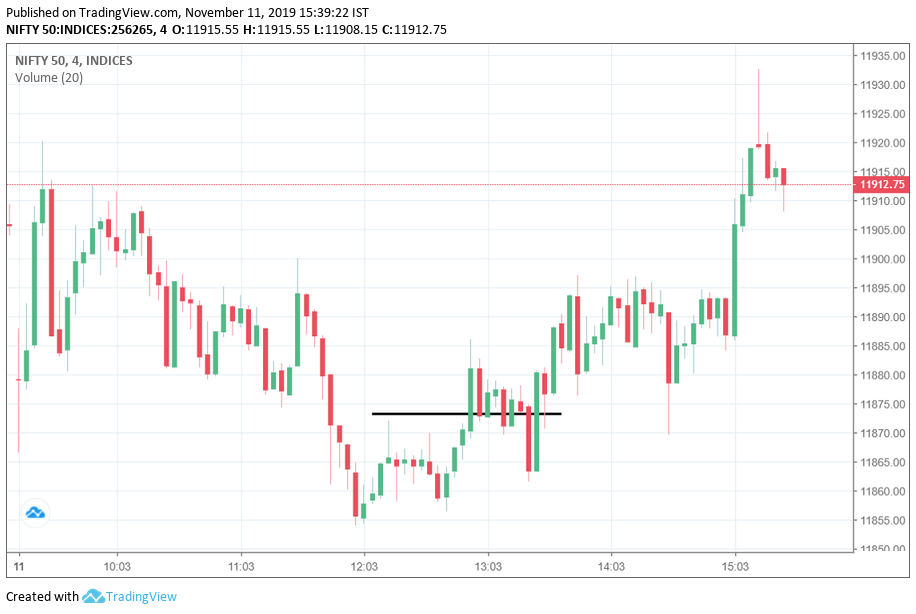

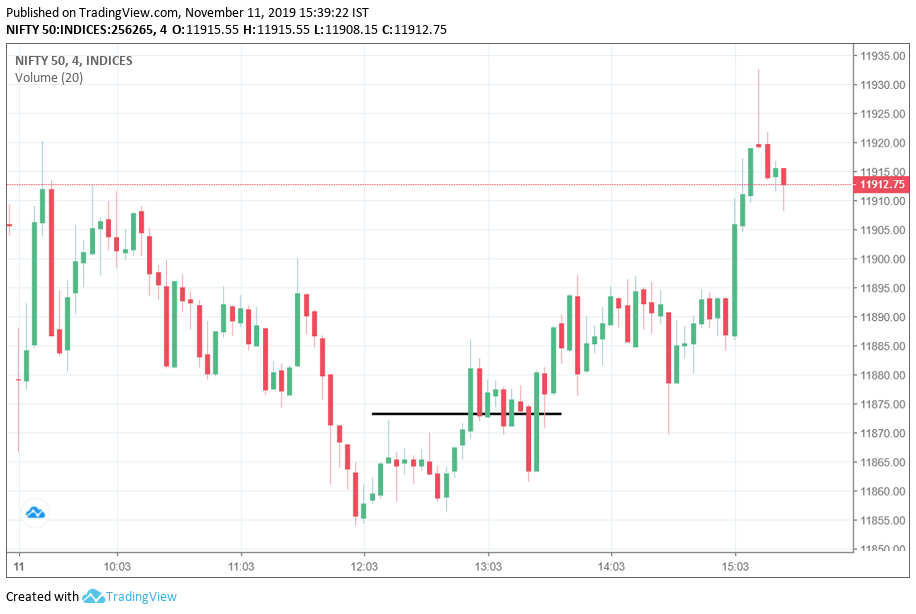

Also, NIFTY shot up while we are discussing this. Anyways, that was my view as well for intraday.

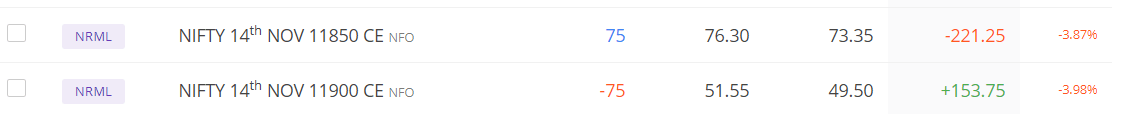

It made -682.5+1177.5+933.75-903.75 = 525 INR today itself

It made -682.5+1177.5+933.75-903.75 = 525 INR today itself

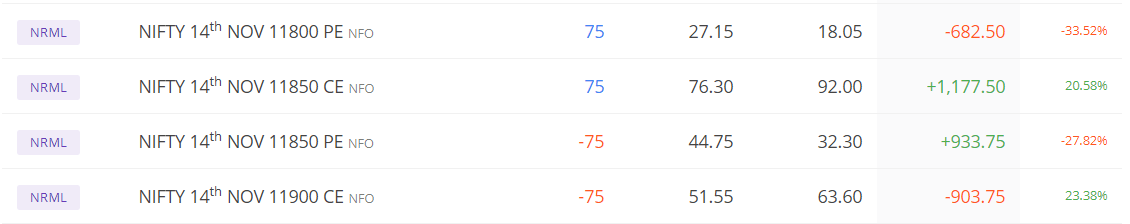

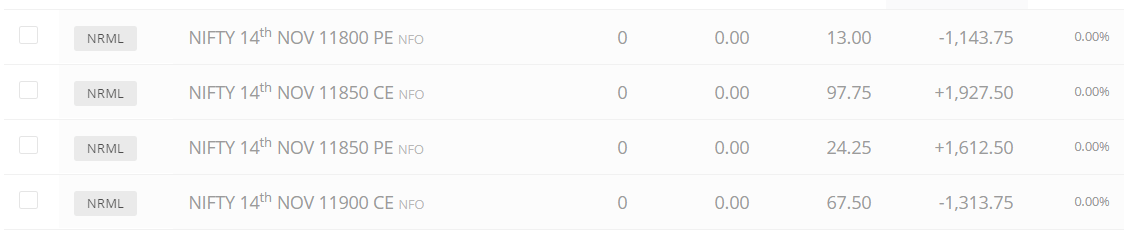

-1143.75+1927.5+1612.5-1313.75=1082.5

-1143.75+1927.5+1612.5-1313.75=1082.5

The difficult part is to find the directional view. Why?

When I started writing, the intraday direction for burst was like clean.

PRZ 1: It has technical support

PRZ 2: OI Support

PRZ 2: OI Support

PRZ 3: Bounce Downtrend break + PRZ 4: Double Bottom Breakout

PRZ 4: Weekend Buy

PRZ 4: Weekend Buy

The session is not about getting the direction view but about the implementation method of the view using options having a limited loss.

The session is not about getting the direction view but about the implementation method of the view using options having a limited loss.

How you decided short put vertical and not long call vertical, in other words how to decide what strategy to execute?

In Short Put Vertical Spread, We are earning by the put sold and ln Long Call Vertical Spread, We are earning by the call bought.

When shorting options is better?

- Answer 1 – When IV is high.

So, When IV is high, Short Put Vertical Spread is better. Now, note, as spreads are all vertical, mostly we drop the word “vertical” overall for ease. - Answer 2 – When Theta is high.

So, When Theta is high i.e. Option is near to its expiry i.e. one day before the expiry day or at the expiry day itself, Short Put Spread is better.

#1 If there is sudden movement like we just experienced, it inflates IV; Long Call Spread is better. It made 613.75 INR while Short Put Spread made 468.75 INR.

#2 In case of expiry days, Short Put will always have more advantage over Long Call due to massive theta no matter what the IV is.

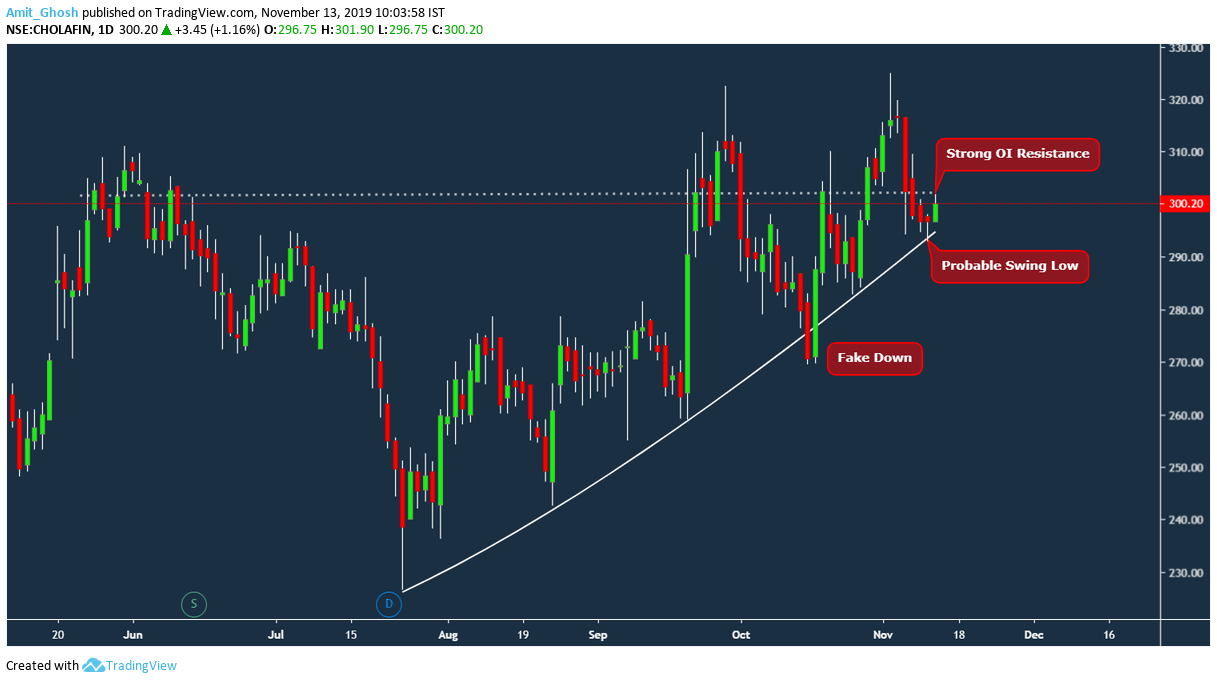

Chola Short Call Spread

- Sell Chola 300 CE at 11.4

- Buy Chola 310 CE at 6.55

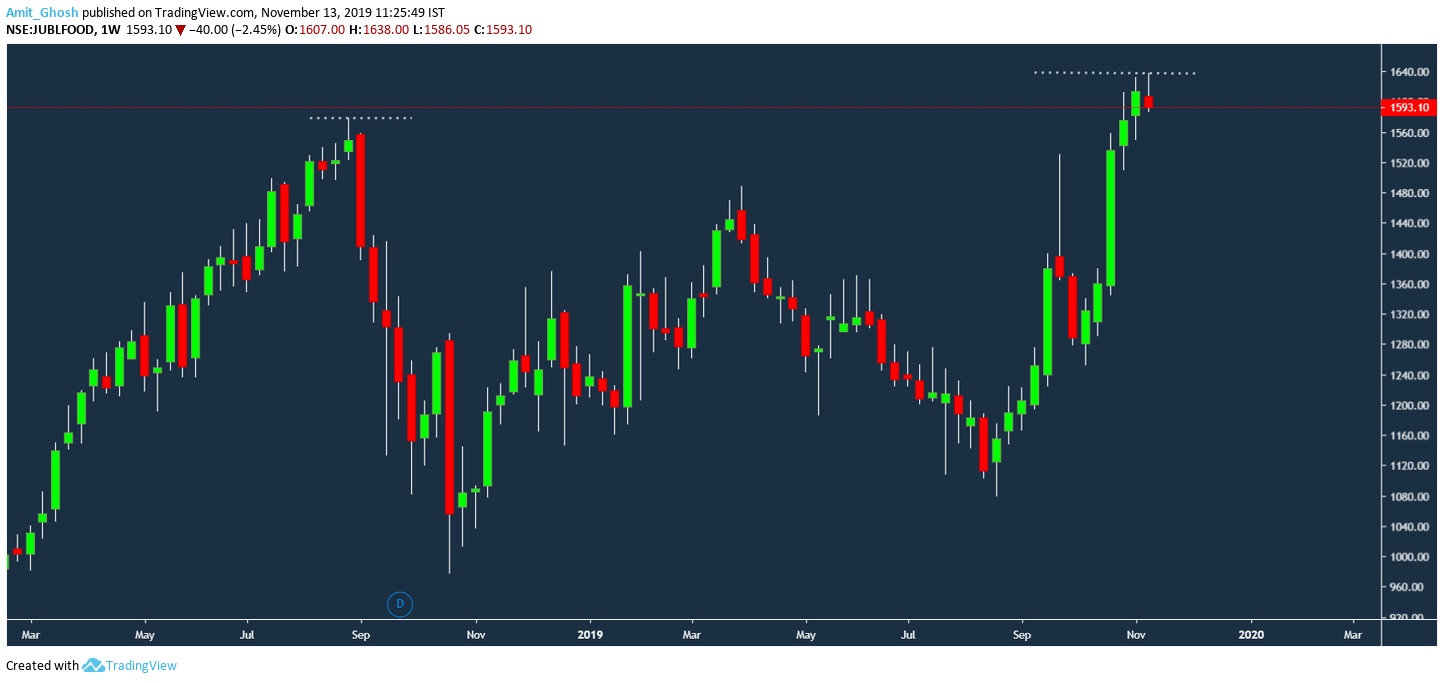

Jublfood Short Call Spread

- Short Jublfood 1640CE at 27.25

- Buy Jublfood 1680CE at 15.6

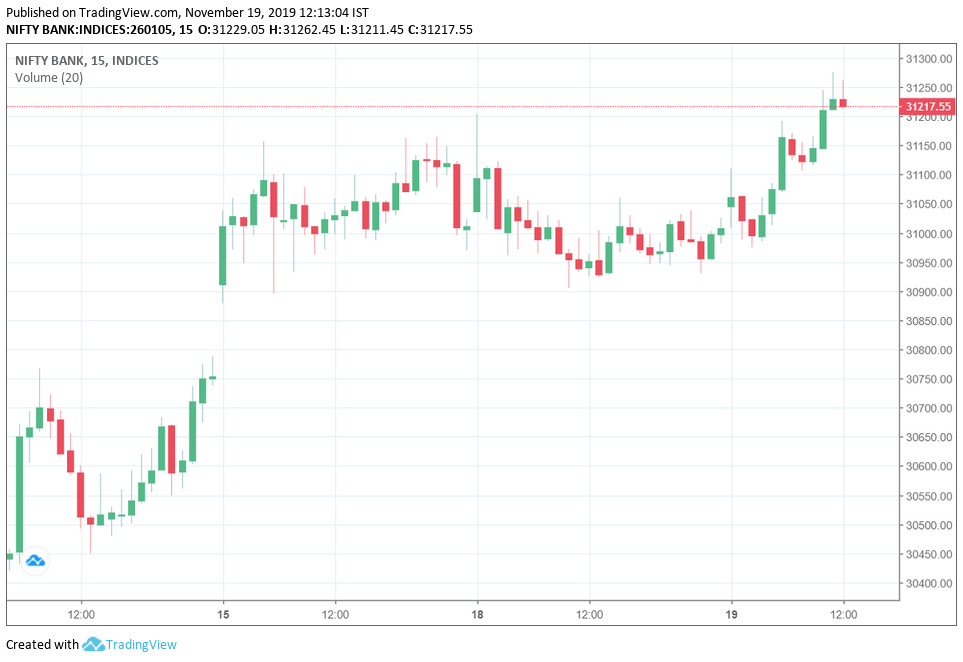

BankNIFTY Short Put Trade

- Short BankNIFTY 30400PE at 40

- Buy BankNIFTY 30300PE at 20

BankNIFTY Call Spread

- Short 31200CE at 236

- Buy 31300CE at 185