Short Call Diagonal Spread

The short call diagonal spread is a nuanced options strategy with a neutral to slightly bearish outlook, designed to profit from time decay and a decrease in implied volatility.

This strategy is used to capture premium while managing risk through the long call position.

Setup:

- Sell ITM/ATM call option in a near-term expiration cycle.

- Buy OTM call option in a longer-term expiration cycle.

Example:

Right now, NIFTY’s LTP is 21530.55.

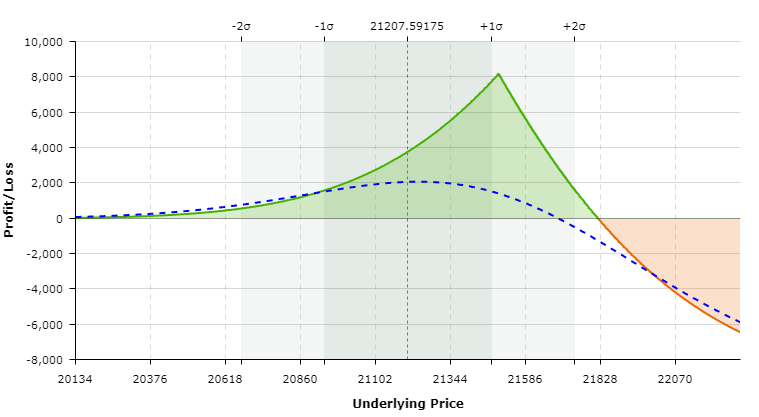

Here is an example of a payoff graph where –

- Sell NIFTY 1st Feb 21500CE at 199.35

- Buy NIFTY 8TH Feb 21700CE at 199.95

Let’s have a look at the greeks for better understanding –

| Position | IV | Delta | Theta | Gamma | Vega |

| -1x 01FEB2024 21500CE | 29.87 | -23.31 | 4310.95 | -0.08 | -399.59 |

| +1x 08FEB2024 21700CE | 20.65 | 24.36 | -1241.45 | 0.05 | 1008.11 |

| Positional Greeks | 1.05 | 3069.5 | -0.03 | 608.52 | |

Ideal IV Environment: PreferablyHigh at the initiation, as the strategy benefits from a decrease in IV, especially on the short leg.

Directional Assumption: Neutral to slightly bearish. The strategy profits if the underlying stays flat, declines slightly, or even if it rises modestly, as long as it stays below the strike price of the short call.

Cost Management: The long-term OTM call acts as a hedge, reducing the risk of the short call and potentially lowering the margin requirement.

Risk and Reward:

- Maximum Profit: Limited to the net premium received after setting up the spread, if the underlying expires below the strike price of the short call.

- Maximum Loss: Not strictly capped and can be significant if the underlying rises sharply. The loss is mitigated by the premium received and the long call position.

Management Techniques:

- Active Monitoring: Keep a close eye on the short call as it approaches expiration. Be prepared to adjust or close the position based on the underlying asset’s performance and market conditions.

- Adjustments: Depending on the market movement, rolling the short call to a different strike or expiration can manage risk and potentially lock in profits or reduce losses.