Long Call Diagonal Spread

The long call diagonal spread is a sophisticated options strategy with a bullish outlook, designed to manage risk while aiming for profitability.

Setup:

- Buy ITM/ATM call option in a longer-term expiration cycle

- Sell OTM call option in a near-term expiration cycle

Example:

Right now, NIFTY’s LTP is 21530.55.

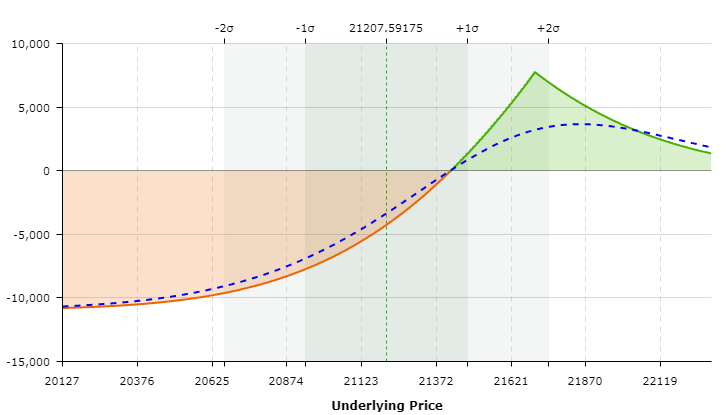

Here is an example of a payoff graph where –

- Buy NIFTY 8TH Feb 21500CE at 296.25

- Sell NIFTY 1st Feb 21700CE at 77.6

Let’s have a look at the greeks for better understanding –

| Position | IV | Delta | Theta | Gamma | Vega |

| -1x 01FEB2024 21700CE | 21.16 | -4.15 | 880.51 | -0.03 | -116.83 |

| +1x 08FEB2024 21500CE | 21.17 | 34.91 | -1500.99 | 0.05 | 1191.69 |

| Positional Greeks | 30.76 | -620.48 | 0.02 | 1074.86 | |

This is definitely will result in a debit spread and the effect of implied volatility will be more extreme due to high vega because of the buy leg satisfies all best possible cases –

- It is a call option.

- It is ITM.

- The expiry cycle is far.

Ideal Conditions for This Strategy:

Implied Volatility Environment: Preferably low, as the long ITM call option benefits from an increase in IV.

Directional Assumption: Bullish, expecting the underlying asset to rise in value. Aims to profit from an upward movement in the underlying asset, with the long call benefiting from significant moves.

Cost Reduction: Selling the short-term call reduces the overall cost of the long call, improving the strategy’s efficiency.

- Risk and Reward:

- Maximum Profit: Not strictly capped, as significant upward movements can increase the value of the long call substantially.

- Maximum Loss: Limited to the net debit paid for the spread if the underlying declines below the long call strike.

Management Techniques:

Monitor the short call, especially as it approaches expiration. Adjust the strategy based on the underlying’s performance and market conditions.

Poor Man’s Covered Call

The “Long Call Diagonal Spread” strategy, commonly known as the Poor Man’s Covered Call (PMCC), is an options trading strategy that mimics the profit potential of a covered call but with a lower capital requirement and reduced risk.

This strategy is particularly appealing to traders looking to capitalize on bullish market sentiments without the substantial capital outlay required to own the underlying stock.

As the risk is limited, the margin requirement is also low.