Short strangle option strategy in BankNIFTY

Short strangle option strategy in BankNIFTY: Short Strangles on BankNIFTY Weekly Options is my favourite. Execution doesn’t matter. What matters is the psychology and people or media that influence you.

That’s how an options strategy should be executed –

- Write about your rationale.

- See which strategy best fits your rationale.

- Shut Off, Other people.

- Execute it.

Index: BankNIFTY

Strategy: Short Strangle Spread

View: Range bound Movement with bearish sentiment due to Trump’s Tariff and upcoming Corporate Earnings

Contract: 12th April 2018

Sell 1 lot 24000 PE at 35.55

Sell 1 lot 25200 CE at 54.20

Initial Credit: 89.75 (Spread to be executed in the range of 89-91)

Breakeven: 23910.25 – 25289.75

Rationale:

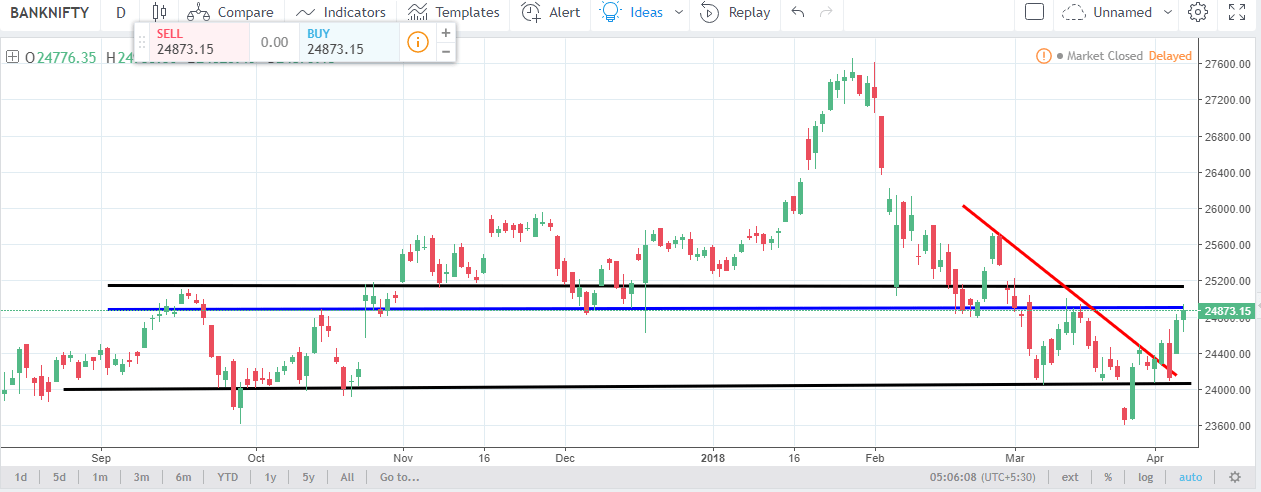

As per the below chart on the Daily timeframe of aforesaid scrip, we can see support at 24000 levels which are often getting broken towards 100 points only to come back at the support level.

We can see resistance at 25200 but we are adamant to keep the upper breakout with slightly more legroom considering price action breakout at these levels.

Chart Reference – Click here

Points To Note:

- As Trump announces more tariff to come and We’ve Fed comment on Friday end. We feel it will be a black Friday for DOW JONES as investors won’t be comfortable to hold overnight positions. We can get a better premium for 24000 PE on the wait. It will have a synthetic effect.

- Buy 24000 PE; the premium is low and will burst on vega on slight downfall which has high probability thanks to our current global fiasco. And, then reverse the trade. In case our small gamble fails and our rationale holds; We shall close 24000 PE buy on half profit erosion and reverse the trade which will still make a decent profit.

Effective Margin: 71,222 INR

Profit Percentage: 5.04%