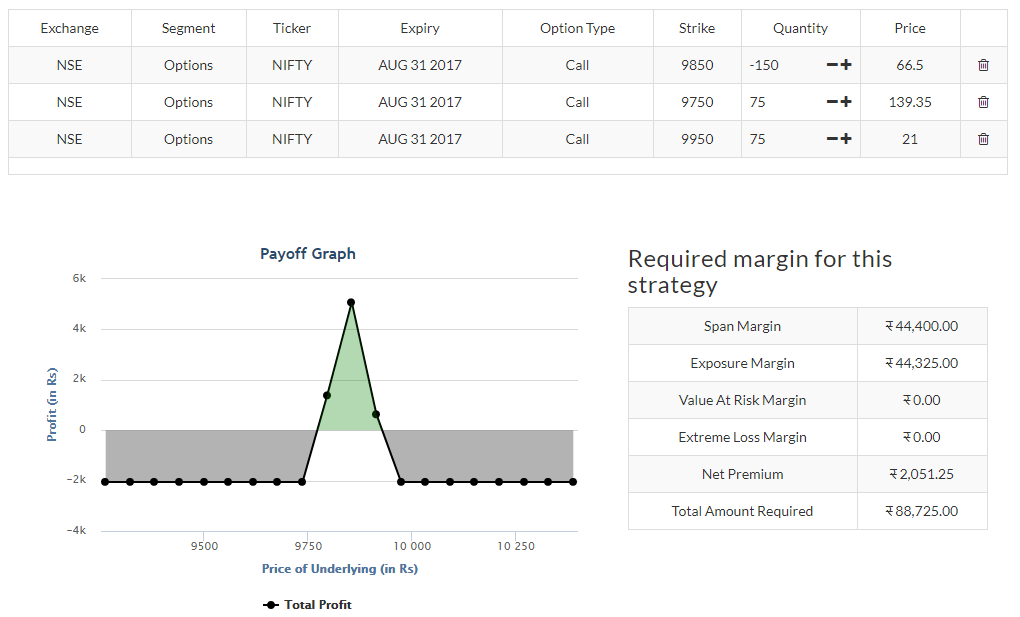

Long Call Butterfly Spread

So here is our setup with CEs –

- Buy 1 Call option (below short strike) ~ Buy 9750 CE at 139.35

- Sell 2 Call options ~ Sell 9850 CE at 66.5

- Buy 1 Call option (above short strike) ~ Buy 9950 CE at 21

Debit Paid = 139.35 + 21 – 66.5 -66.5 = 27.35

Upper Breakeven:

Higher Long Option Strike – Debit Paid = 9950 – 27.35 = 9922.65

Lower Breakeven:

Lower Long Option Strike + Debit Paid = 9750 + 27.35 = 9777.35

Max Profit

= The distance between the short strike and long strike – Debit Paid

= 9850 – 9750- 27.35

= 72.65