Ratio Straddle

As we discussed about Straddle, We saw that we mostly use ATM options to make it delta neutral. What if we do not do that?

To understand the concept of Ratio Straddle, We need to discuss Bull Straddle and Bear Straddle[1].

Bull Straddle

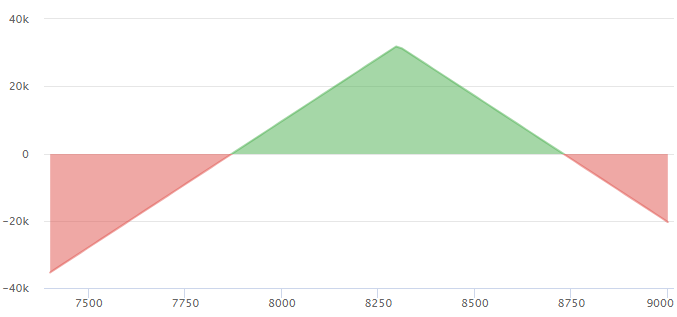

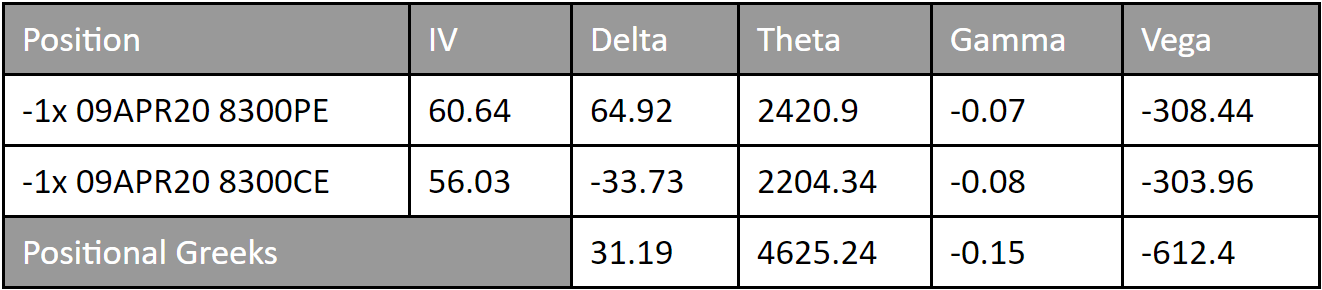

Let’s say NIFTY is trading at 8100. Right now, instead of selling ATM strike prices i.e 8100PE and 8100CE. But, instead of 8300 Let’s take this following setup with 8100 –

- Sell NIFTY 9th Apr 8300PE at 327.4

- Sell NIFTY 9th Apr 8300CE at 101.1

Let’s have a look at the greeks for better understanding –

We are getting a delta of 31.19. It is called a Bull Straddle as we will make more profit if the spot moves towards upside.

Bear Straddle

Similarly, if we sell 7700PE 7700CE it will be a Bear Straddle.

Ratio Straddle

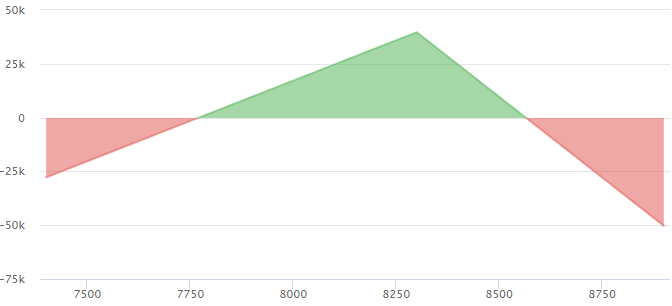

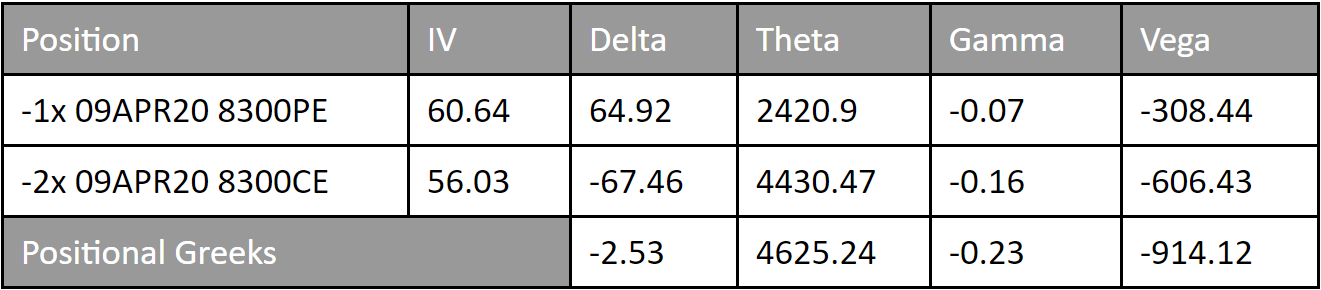

Now, what if we want our Bull Straddle and Bear Straddle to be delta neutral? We will need to add more contracts. In this example of Bull Straddle we need to sell 2 8300CEs (Delta = -33.73) to balance 1 8300PE (Delta = 64.92)

This is called Ratio Straddle. Although we have more theta, but the gamma and vega increases as well making this strategy unpopular!

[1]Note – Bull Straddle and Bear Straddle are not delta neutral and hence, it doesn’t fall under the category of volatility spreads!