Introduction to Volatility Spreads

The true investor welcomes volatility … a wildly fluctuating market means that irrationally low prices will periodically be attached to solid businesses.

-Warren Buffet

Volatility doesn’t only create irrational pricing in stock prices only. It also creates irrational pricing in every other instrument which includes options as well. Our aim is to capture this mispricing.

Our main task is to understand the effect of option pricing in cases of volatility contraction and volatility expansion. Fear tends to manifest itself much more quickly than greed, so the downside markets tend to be highly volatile. Whereas, in upside markets, volatility tends to gradually decline.

Delta Neutrality

Anyways, Let’s start with the most important concept of delta neutrality which is the first necessary step to dynamically hedge options.

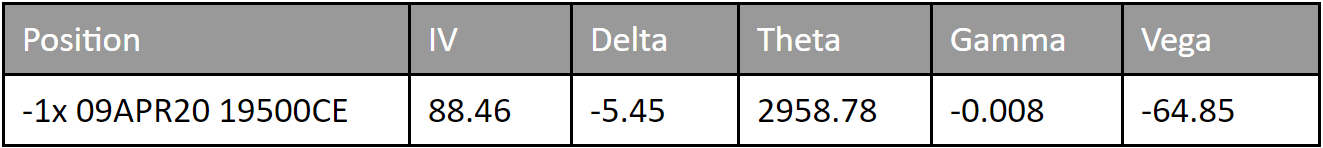

Let’s say we have a sell position on BankNIFTY 9th Apr 19500CE at 141. Let’s have a look at the greeks for better understanding –

Now as we can see the Delta is -5.45. It means we shall lose ₹5.45 for every ₹ 1 BANKNIFTY goes up by. Our primary job is to make it near 0.

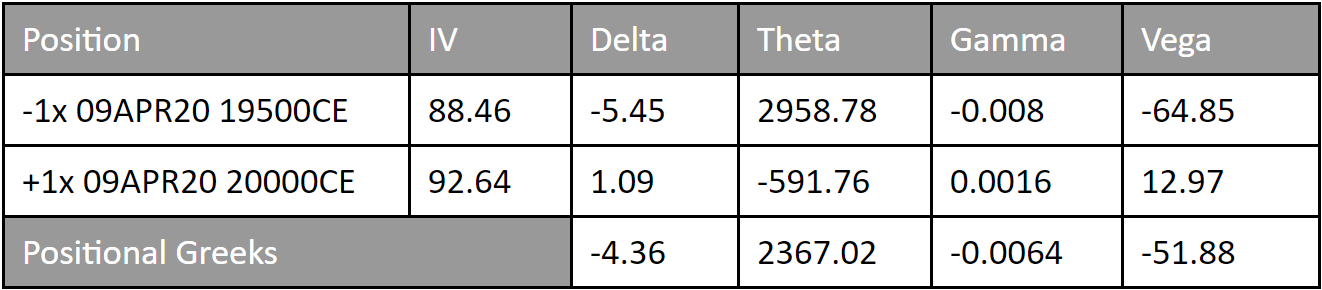

We can do it by two ways [1]– Either We need to sell Put Options or We need to buy Call Options. Let’s buy 9th Apr 20000CE at 60.

The delta reduced. If we buy two lots it will be near 0. But the more we buy call options the more theta decreases and we make less money with the time value. Here is another approach –

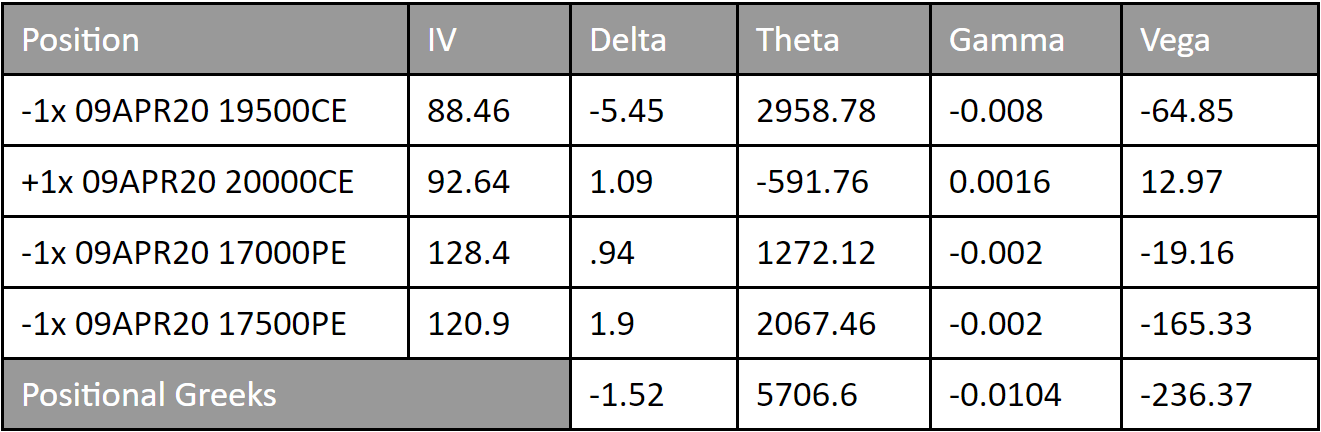

We have sold 9th Apr 17000PE and 17500PE. As we can see, there are many ways to hedge our initial call trade setup. But, whatever is the results, it will be affected by the greeks –

- Delta – As we have already discussed, each spread should be approximately near 0 i.e. Delta Neutral.

- Vega – The less vega, the less sensitivity towards change of IV.

- Gamma – It tells about how delta will change when the underlying asset moves. So, the less gamma, the better!

- Theta – The more theta, the more time decay, the more money!

- Obviously, the movement of the spot itself!

So, Volatility spread means –

A delta-neutral option spread which is usually established in order to take a view on changes of market volatility rather than the market direction.

A volatility spread is a delta-neutral option strategy primarily executed to speculate on the changes in market volatility, rather than the direction of the underlying asset.

This strategy typically maintains a neutral stance on the market’s direction by balancing positive and negative deltas, thereby focusing on the impact of volatility (vega) on the options’ pricing.

We shall be looking into most common types of volatility spreads.

Volatility Spreads – Delta Neutrality and Other Greeks:

Delta Neutral:

- Volatility spreads are structured to be delta neutral, meaning they have a net delta value close to zero.

- This implies that the position is relatively insensitive to small price movements in the underlying asset.

- Achieving delta neutrality involves balancing long and short positions in such a way that the positive and negative deltas offset each other.

Vega (Volatility Sensitivity):

- These spreads are highly sensitive to changes in implied volatility, reflected in their vega value.

- The primary goal of a volatility spread is to capitalize on changes in volatility rather than price movement.

- A high positive vega means the position will benefit from an increase in implied volatility.

Theta (Time Decay):

- Volatility spreads often have a mixed relationship with time decay.

- While some components of the spread may lose value over time (negative theta), the overall position is usually constructed to minimize this effect or even benefit from it under certain conditions.

Gamma (Rate of Delta Change):

- The gamma of volatility spreads is an important factor, as it affects how the delta of the position changes as the underlying asset’s price moves.

- In delta-neutral positions, gamma needs careful monitoring and management to maintain delta neutrality over time.

Rho (Interest Rate Sensitivity):

- Rho is typically a minor concern in volatility spreads, as these strategies are more focused on volatility and less on interest rate changes.

- However, in certain market conditions or for very long-dated options, rho can become more significant.

Since market conditions can alter the Greek values of a volatility spread, continuous adjustment and monitoring are often necessary to maintain delta neutrality and manage the other Greeks effectively. This can involve rebalancing the position through additional trades or by rolling options to different strikes or expiration dates.

We shall be looking into most common types of volatility spreads.

India VIX[2]

In India, We gauge the “volatility” (or, “fear” or, “risk”) in the stock market by the India VIX index.

It is based on the NIFTY Index Option prices. From the best bid-ask prices of NIFTY Options contracts, a volatility figure (%) is calculated which indicates the expected market volatility over the next 30 calendar days.

[1]We are not talking about Calendar Spreads, Diagonal Spreads etc. Let’s talk about options with the same expiry as of now.

[2] (“VIX” is a trademark of Chicago Board Options Exchange, Incorporated (“CBOE”) and S&P’s has granted a license to NSE, with permission from CBOE, to use such mark in the name of the India VIX and for purposes relating to the India VIX.)