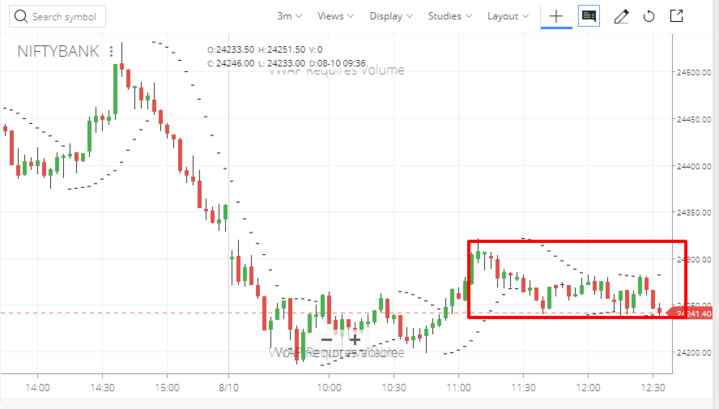

Bank Nifty Expiry – 10th Aug | Trading Diary

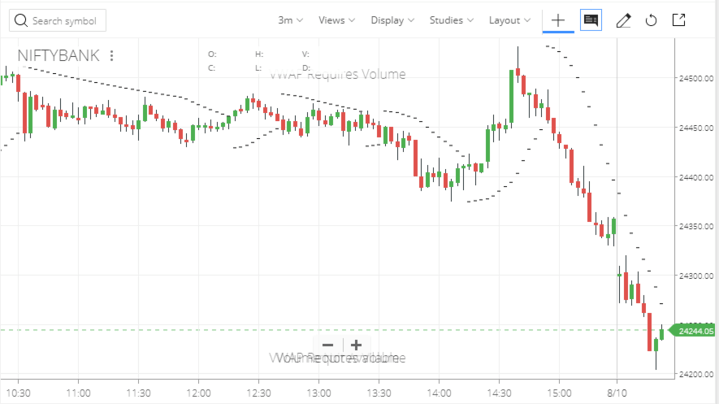

This trade setup is all about low risk and high gain. The same chart can have different viewpoints (like buy and sell both) based on different timeframes. But the higher the time frame the stronger the setup is –

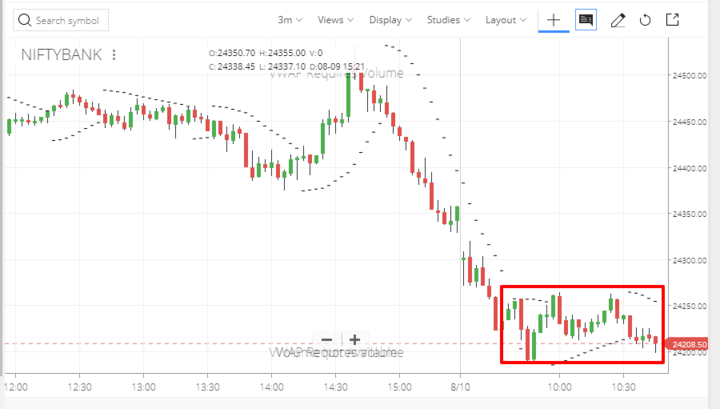

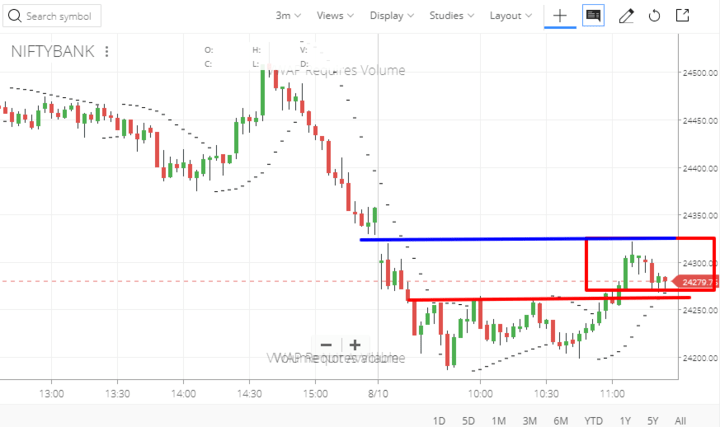

In this setup, we can see Banknifty is having more downside but before the downside, it needs to touch the C point. So it is long in the short term and short in the long term (as it is estimated to fall from C). But as this setup is totally speculative being based on just two points of A and B. Let’s observe how it pans out here

https://in.tradingview.com/chart/BANKNIFTY/T867Y10q-BankNifty/

But,

- AB=CD setup is not set up with a 100% win ratio. It has a stop loss and a take profit level.

- AB=CD setup needs all 4 points to call it a setup. Otherwise, it is called speculation.

Without CD formation we won’t be doing this trade but this gives a directional viewpoint that it may go up now. Also, it was a Thursday with the effect of theta on an exponential level.

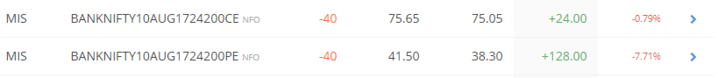

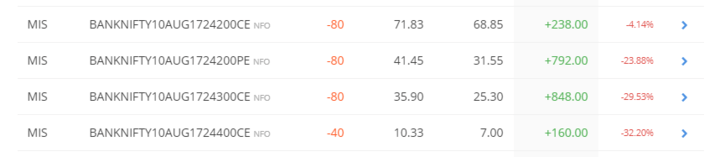

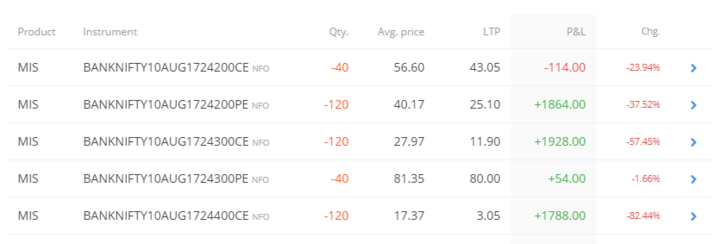

So our first trade is shorting the PE of OTM strike price to keep us a safety buffer.

![]()

9:38 AM

So we are continuing to holding the PE. BankNifty is going to our direction now.

9:44 AM

Crashed and hit TSL. So our AB=CD setup is invalid now but glads we made money out of it. Now we are waiting for the next opportunity.

9:51 AM

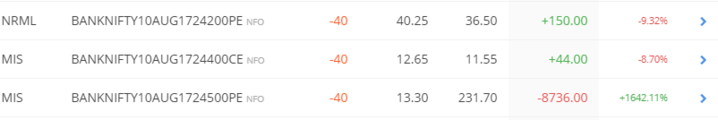

Now it is showing a red candle; so we are selling a far OTM CE i.e. 24400 CE at 12.65 (as the market is already in a downtrend in long time frame) along with 24200 PE again as it is up that our initially sold price (from the closed trade).

Shorted 24200 PE 42.95

Shorted 24400 CE at 12.65

9:53 AM

Update the TSL of 24200pe at 40

9:56 AM

Close the TSL of 24200pe at 35. Some people encounter the margin problem towards MIS conversation when the unrealized is high. In that case, close the position and re-open it on MIS again.

10:10 AM

Let’s execute this straddle now –

Refer –

We have seen this has started consolidation. We shall book the profit or update the trailing stop loss when we get 25% of our initial credit.

When to shift to the lower timeframe?

Suppose we are looking into a scrip that is going in a downtrend and started making a green candle in 15m timeframe. How to ensure that it will stay green during the complete formation of a 15m candle.

You can’t tell that right?

You can not tell that while the candle is forming in the first minute. But you can take a guess based on the candles forming the lower timeframe in the first 5 minutes also but you can take a better guess based on the candles forming the lower timeframe in the first 10 minutes. The probability of your guess increases with the time spent. After 15 mins, the candle is formed anyway. So, I shift to a 5m candle timeframe sometimes in this case.

Did you short PE and CE based on support and resistance level for intraday and also by checking direction on a higher time frame?

Two cases –

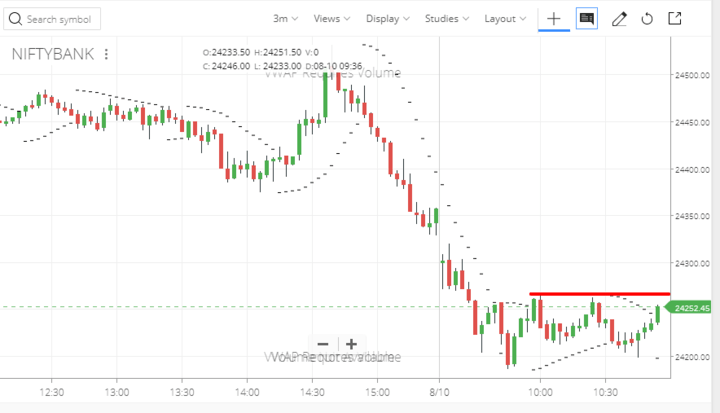

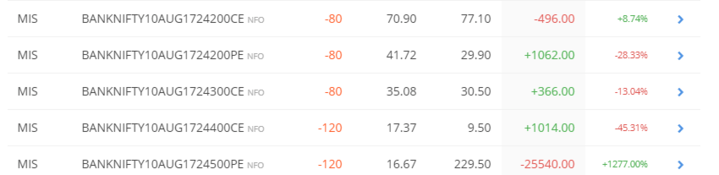

The first time I did a strangle and closed one pair.

- Shorted 24200 PE 42.95

- Shorted 24400 CE at 12.65

- Closed 24200 PE here.

So it became naked CE. I took the help of a higher timeframe here. Some risk is always there but how can you then earn money without the risk.

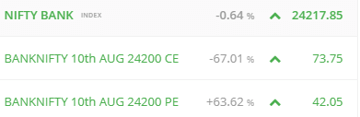

Then we did the straddle –

- Shorted 24200 CE at 73.75

- Shorted 24200 PE at 42.05

Also, how did you started to strangle when it was consolidating at one level?

I saw with a lower timeframe that the consolidation is there to sustain with good probability.

Case of Stop loss –

Supposed we have shorted 24200 PE 42.95. It means we are in the loss if Bank NIFTY ends lower than 24200-42.95 =24157.05.

The best way to hedge this in a consolidating market is to deploy a straddle which is 24200CE at 73.75 in this case! Earlier you were protected till 42.95 points downside. Now you have 42.95+73.75 = 116.7 points both sides. If that consolidates in that 116.7 points; we are in profit. Also if the market is going aggressively in one direction; you can ladder CE PEs. Like in this case – 24200CE to 24100CE.

Laddering totally depends on the risk appetite. Generally as an aggressive trader; I ladder up while most institutions ladder down.

Would you have closed the straddle if it breached that 24320 levels?

When we get into a trade.

- It will either start going into immediate loss.

- It will either start going into immediate profit.

- In the first case, I close it on -1000 or -2000 INR.

- In the second case, I keep my profits as SL with a -100 to -500 INR buffer. Sometimes thinking with a number after you enter the trade helps. But we shall close the trade when in the chart it crosses the underlying.

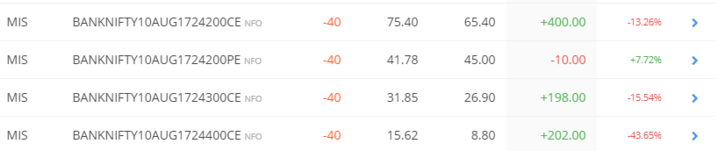

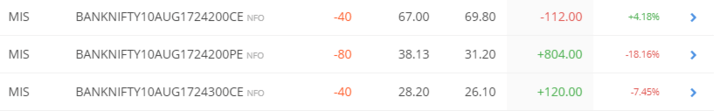

Right now our previous straddles are going good –

10:15 AM

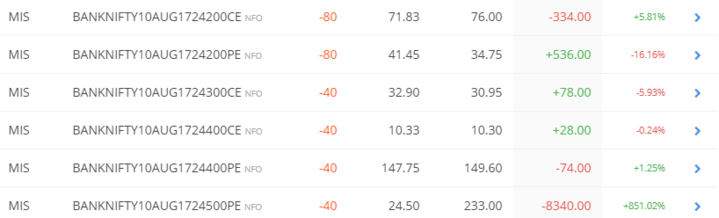

Apart from this straddle; this is also a logical setup –

In the case of the straddle, an underlying bet is it will stay within 100 point range of 24200. Strangle bet is a bit aggressive but the breakeven range is good giving you laddering opportunity. Note, 24500PE is a past trade.

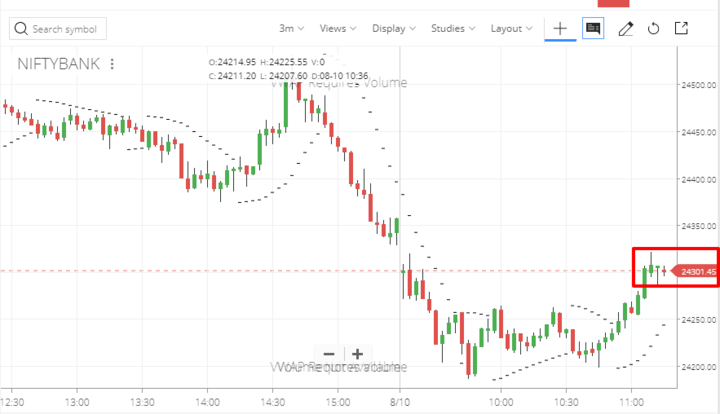

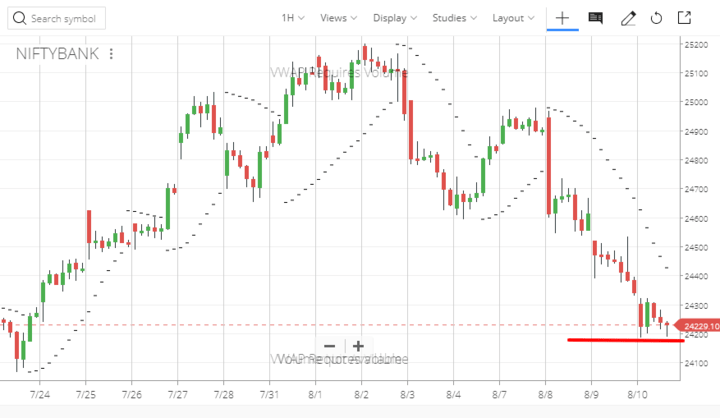

Right now Bank NIFTY is still in consolidation –

10:41 AM

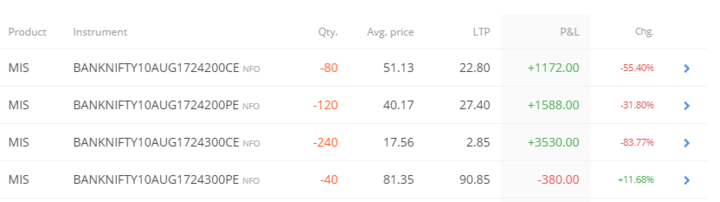

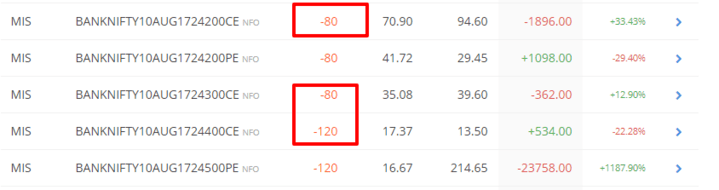

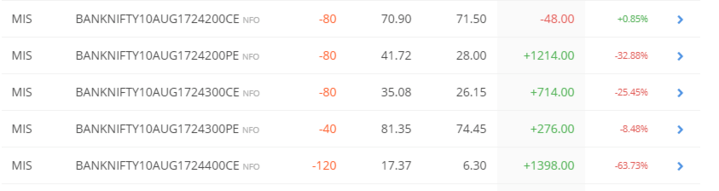

We just let the consolidation happen and keep slaughtering the premium. Here is an update of the positions deployed at different time.

10:47 AM

The consolidation is being continued. So we are going with a straddle.

As we have already had a past straddle we are just increasing the quantity. I have increased my straddle quantity.

10:55 AM

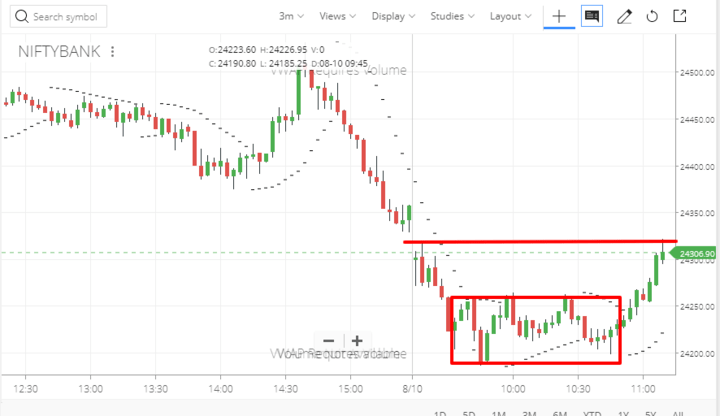

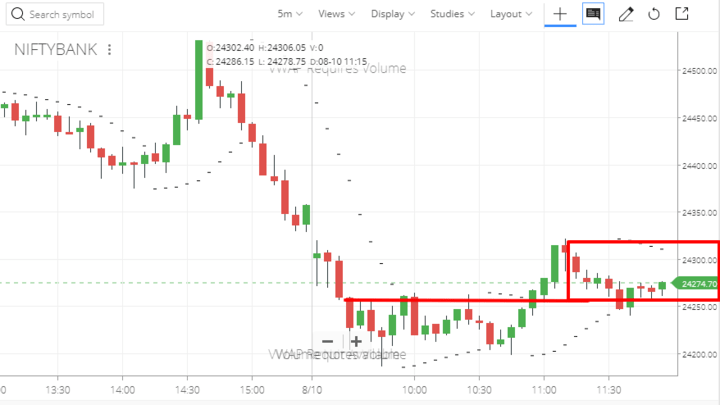

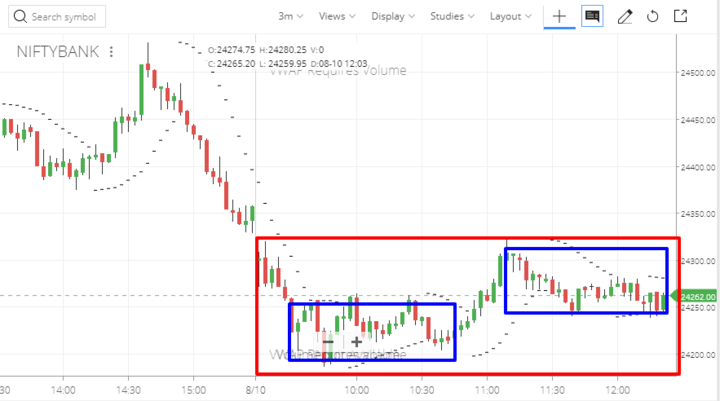

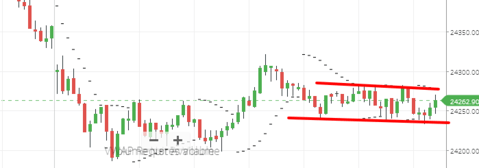

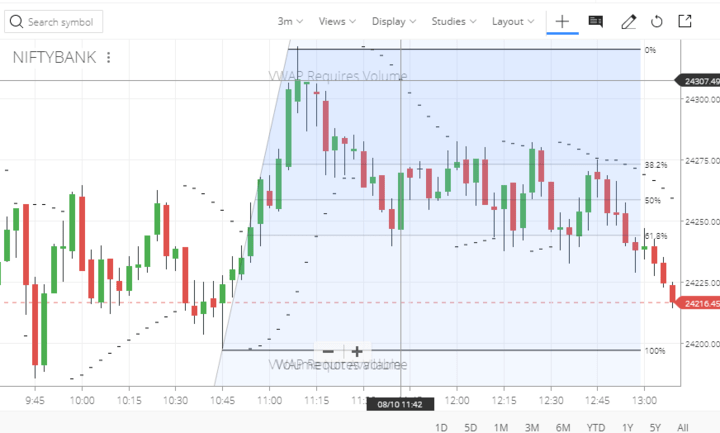

Here we can see a possible chance of upside break. As it is consolidating and moving towards the upside. In the below image you can see the support is getting moved along with the tilt line. The tilt shows narrowing support on the downside.

10:59 AM

Now it is supposed to reverse but’s call it the moment of decision because it can break it this time as it has tested this level couple of time and the upside retracement has a lot of room –

11:03 AM

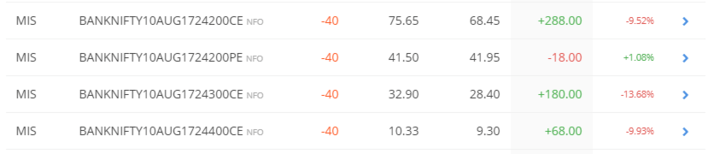

Here is an update to our positions –

The straddle is in profit. One can just close it but as we have a 24500 PE open we can afford to keep 24200 CE open as it will act as a hedge to it.

11:12 AM

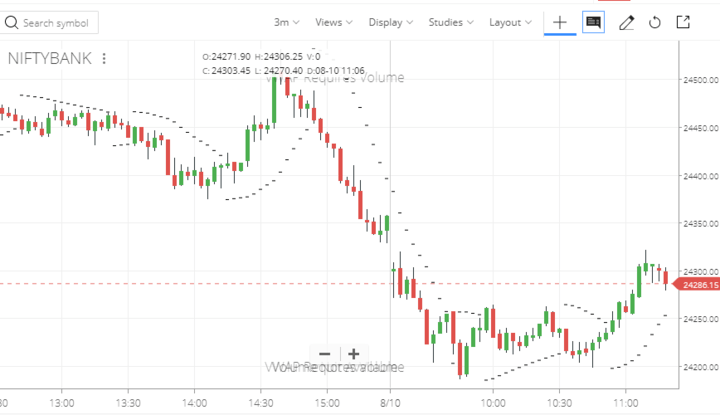

So it broke and went up and facing resistance.

It is the potential reverse zone right now. Greed will tell to short PE and logic guided me to sell (increase 1 more lot) on 24300 CE due to two things –

- We need more CE with a higher premium to balance it and obviously betting on slight reversal.

- 24200 CE PE gives me 100 points breakeven both sides!

11:17 AM

It has already started consolidating

11:20 AM – It cracked!

Now, will this level act as support? Or is it irrelevant?

It “may act” as support then we shall close the straddle of 24200 and sell 24300 PE to create a straddle of 24300. we already have 24300 CE at a better price.

11:27 AM

It took it as support and started consolidation.

11:31 AM

Estimating Slight fall if that level holds.

Assuming we have a straddle of 24200 CE and 24200 PE and 24300 CE. We shall close 24200 CE then 24300 CE and 24200 PE will act like our further setup. But there is a strong chance it will just consolidate there.

11:39 AM

Now it should bounce –

11:46 AM

We got a slight bounce as expected. let’s hope it holds –

11:55 AM

11:55 AM

11:59 AM

It is again in the range of consolidation

12:13 PM

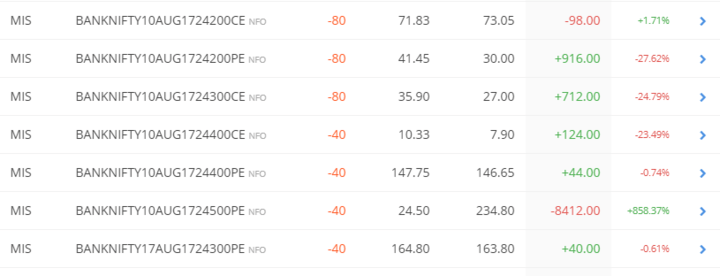

As it started consolidating in this level – Adding BANKNIFTY17AUG1724300PE to form straddle on 24300. We will close the 24200 straddles anytime.

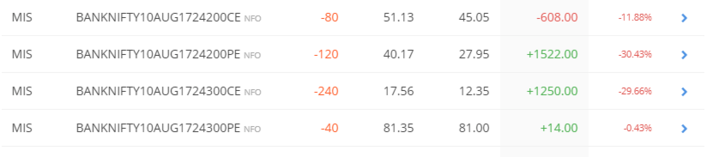

Here are our updated positions –

12:17 PM

When Bank NIFTY goes down this time we shall close up 24200 CE. Here is our current updated position –

24245 is the current resistance!

12:20 PM

It has got a good amount from its initial credit so we can just close it. However, so far, we have talked about different conditions on Bank NIFTY hedge –

- Setup1

- Setup2

- Setup3

12:24 PM

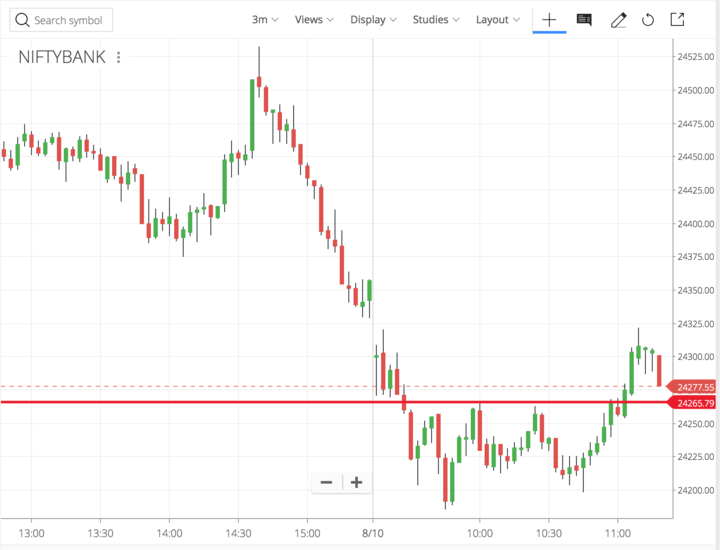

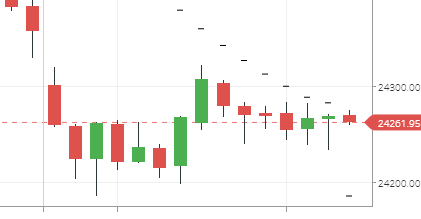

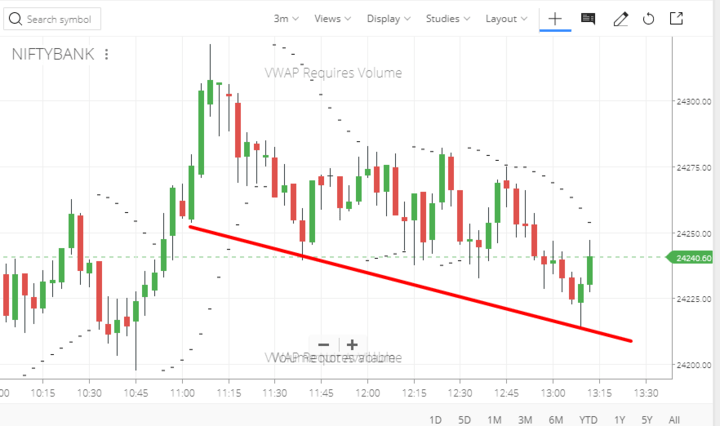

Here you can clearly see boxes of consolidation. All the trades are based on basic candlesticks.

12:36 PM

The positions we have are called hedged positions!

We know the rationale behind each trades. We know what is the underlying concept and when to exit and we can afford to go to the bathroom for a while as it is not directional.

12:45 PM

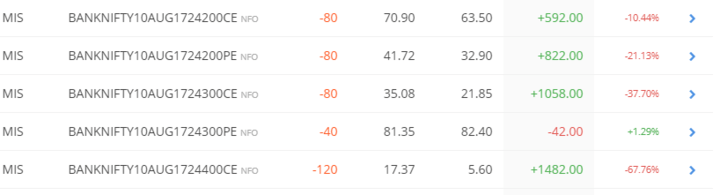

Updated

Now it is time for Bank NIFTY to shoot up anytime breaking the consolidation!

The reason of speculating why it may shoot up lies on the higher timeframe where we can see breach of parabolic SAR.

12:51 PM

We are closing 24200 CE now.

1:01 PM

1:09 PM

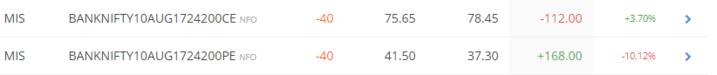

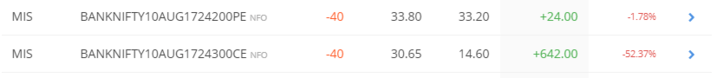

BN support broke. Here is an update of the last positions –

This is the closed position.

![]()

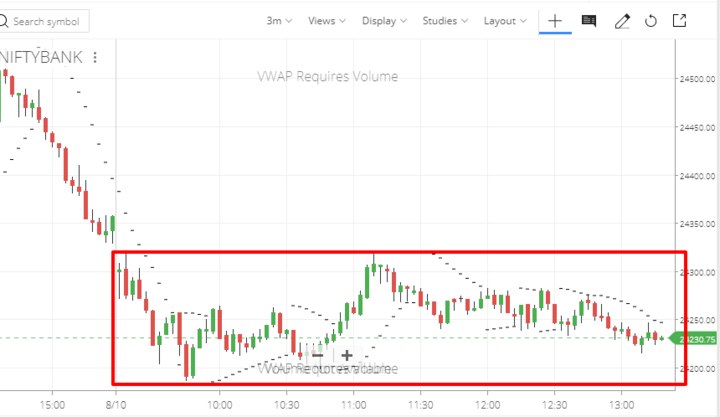

It is showing a huge retracement in terms of Fibonacci –

And we can see our new swing is created –

But if you see with more candles you can see a big consolidation –

So we are increasing our lot size –

1:34 PM

Bank NIFTY cracked 24200. We sold 24200 CE again to get more breakevens. We can see BANK NIFTY is at crucial support; breaking which we need to close all the PEs.

1:41 PM

Bank NIFTY bounced from the support and here is our updated position –

If you ask where the stop loss for PE was; it was here –

Breaking this line means straight 100 points down!

1:44 PM

We closed 24400 CE at 1.75 and opening 24300 CE. Here you go –

2:36 PM

We shall close the straddles as it reached sufficient profit and there can be a huge move on expiry! So here is where we end –