Long Put Butterfly Spread

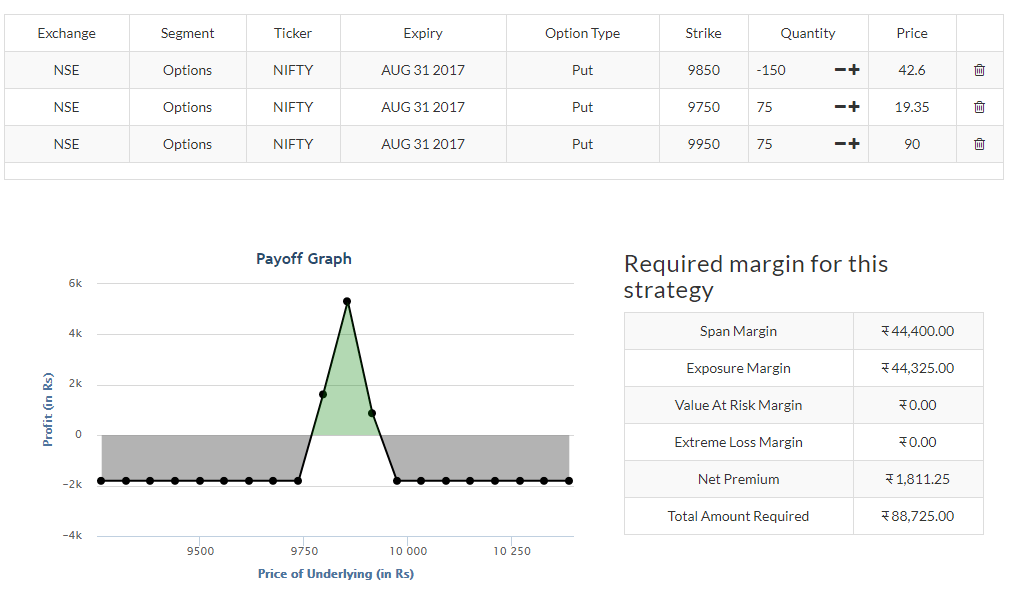

So here is our setup with PEs –

- Buy 1 Put option (below short strike) ~ Buy 9750 PE at 19.35

- Sell 2 Put options ~ Sell 9850 PE at 42.6

- Buy 1 Put option (above short strike) ~ Buy 9950 PE at 90

Debit Paid = 19.35 + 90 – 42.6 – 42.6= 24.15

Upper Breakeven:

Higher Long Option Strike – Debit Paid = 9950 – 24.15 = 9925.85

Lower Breakeven:

Lower Long Option Strike + Debit Paid = 9750 + 24.15 = 9774.15

Max Profit

= The distance between the short strike and long strike – Debit Paid

= 9950 – 9850 – 24.15

= 75.85

[1] The term “Long” comes from the fact that it mostly generates a Debit Spread.

[2]Although it looks like it should be neutral. But, A long butterfly will tend to act like a short straddle, while a short butterfly will tend to act like a long straddle but the risk is limited in this case.