Short Put Diagonal Spread

Right now, BankNIFTY’s LTP is 19913.6.

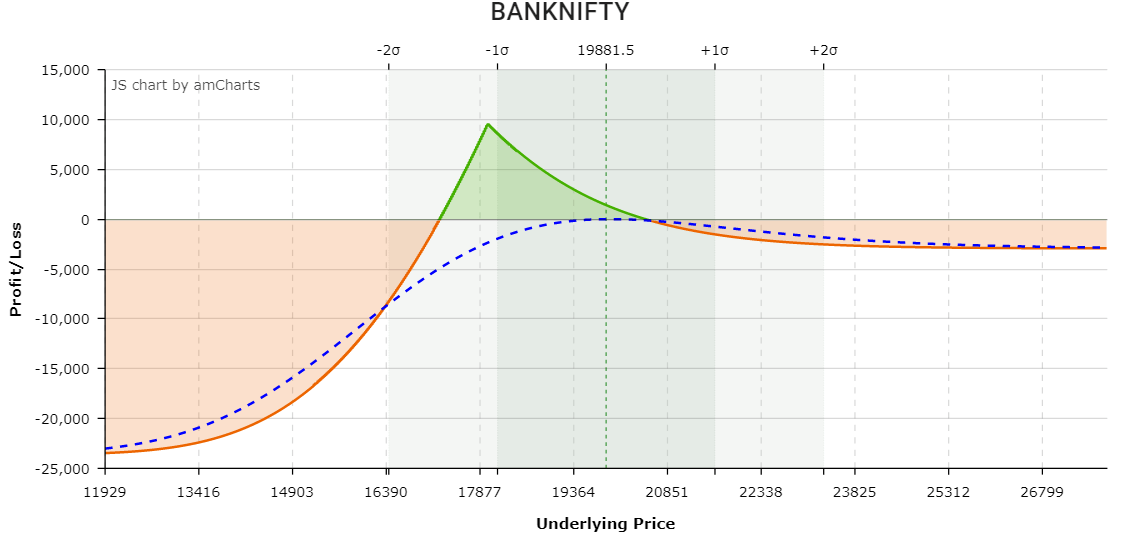

Here is an example of a payoff graph where –

- Sell BankNIFTY 16th Apr 18000PE at 220.15

- Buy BankNIFTY 30th Apr 17000PE at 367.1

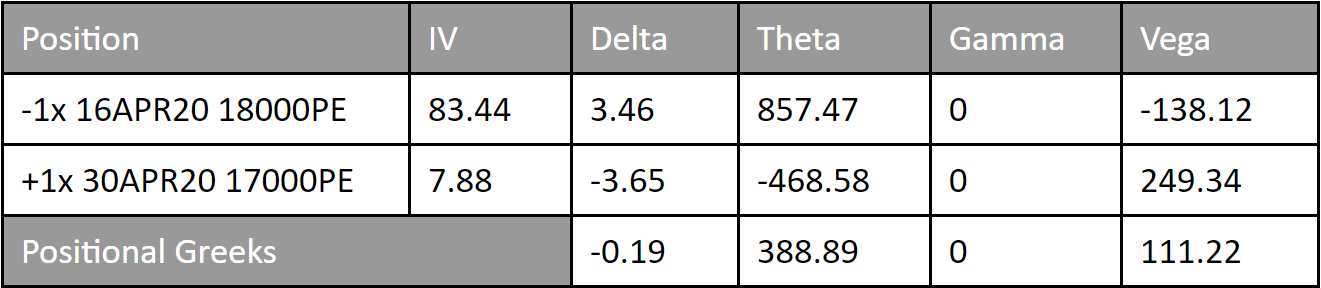

Let’s have a look at the greeks for better understanding –

Ideal IV Environment: Low

Directional Assumption: Moderately Bullish

It looks similar to the payoff graph of a Put Ratio Front Spread. But, while the Put Ratio Front Spread doesn’t like an increase in IV, this setup mostly gets benefited by an increase in IV.

The delta is almost neutral here.

- The selection of strike price of the near-term expiration cycle is independent.

- The selection of strike price of the far-term expiration cycle is dependent as we choose the strike price in a way that the delta becomes almost zero.

The names of these setups, like in this case – “Short Put” comes from the similarity of choice of strike prices with vertical Spreads.

But, While “Short Put Vertical Spread” is credit spread, “Short Put Diagonal Spread” mostly results in a debit spread. It is because the premium of the far expiry cycle usually results in higher premium.

Setup:

- Sell an OTM put option in a near-term expiration cycle

- Buy further OTM put option in a longer-term expiration cycle

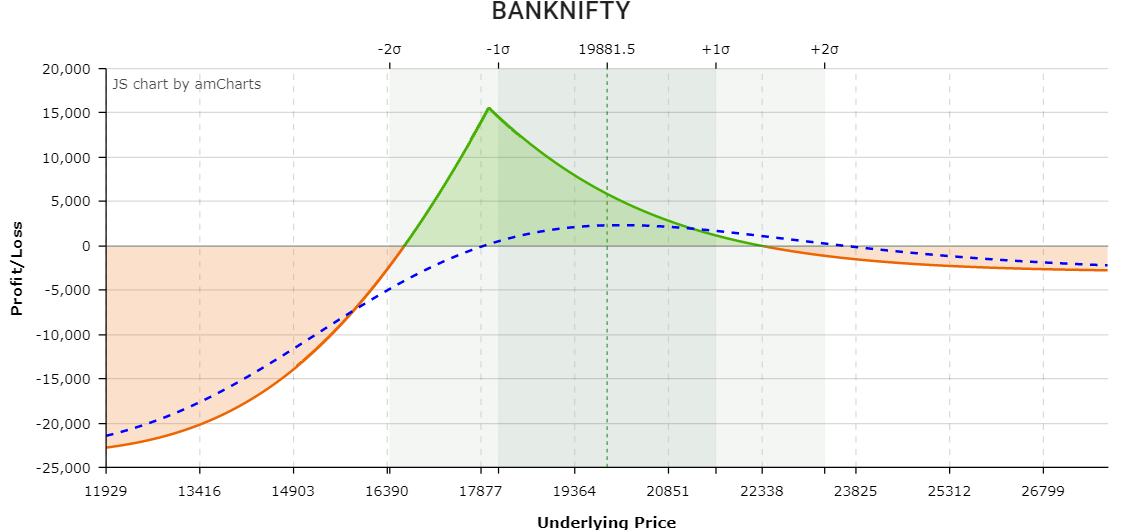

Here you can see the payoff graph of the same setup where IV is increased by 30%. Mathematically, The probability of profit increases from 57.25% to 87.08%.

Long Put Diagonal Spread

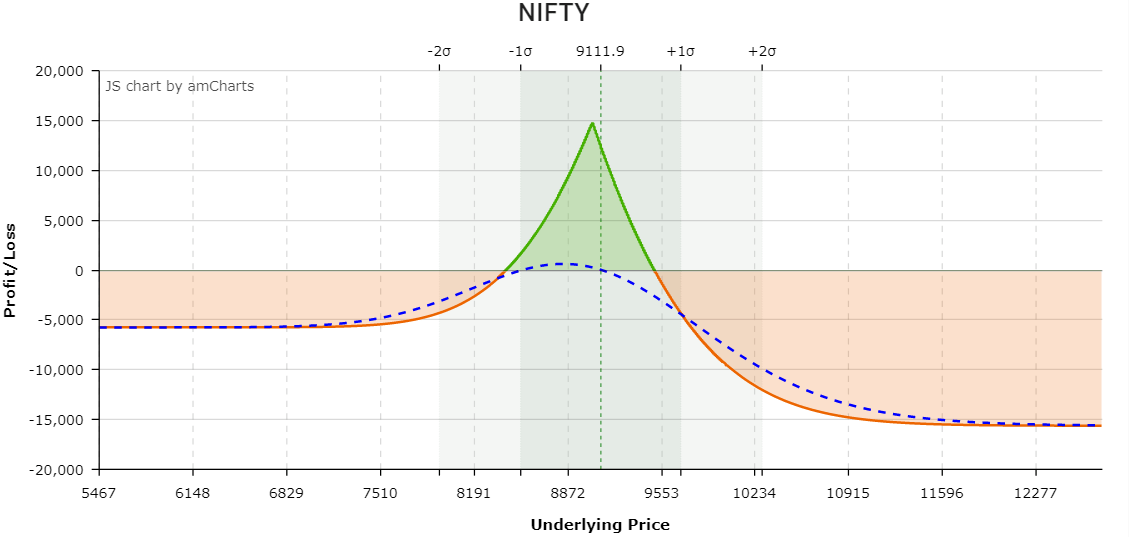

Right now, NIFTY’s LTP is 9111.9. Similarly, like Short Put Diagonal Spread, Let’s construct Long Put Diagonal Spread.

Here is an example of a payoff graph where –

- Sell NIFTY 16th Apr 9050PE at 231.8

- Buy NIFTY 30th Apr 9200PE at 440.1

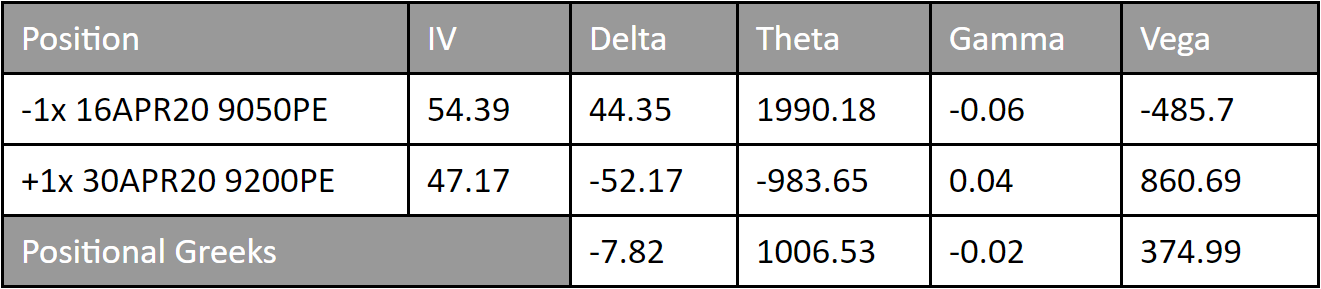

Let’s have a look at the greeks for better understanding –

This is definitely will result in a debit spread and the effect of implied volatility will be more extreme due to high vega because of the buy leg satisfies all best possible cases –

- It is a put option.

- It is ITM.

- The expiry cycle is far.

Ideal IV Environment: Low

Directional Assumption: Bearish

Like the previous setup, The delta is almost neutral here.

Note: Usually, it is widely followed that the net debit paid is not more than 75% width of the strike prices. It is because if IV decreases, the loss will be more steep! But, the construction of this strategy while keeping the delta neutral satisfies the previous condition most of the time.

In this case,

- Net Debit = 440.1-231.8=208.3

- Width of the Strike Prices = 9200-9050 = 150

Net Debit > 75% of Width of the Strike Prices in this case.

So, the trade doesn’t look healthy.[2] It happened because – the underlying asset i.e. NIFTY is trading at 9111.9, the LTP of NIFTY futures is 9086.7.

Generally, the futures trade higher than the spot and the option prices will have similar reflection.

Setup:

- Buy ITM put option in a longer-term expiration cycle

- Sell OTM put option in a near-term expiration cycle

Poor Man’s Covered Put[3]

The “Long Put Diagonal Spread” strategy is also popularly known as Poor Man’s Covered Put (PMCP). It is because it has limited risk compared to a normal covered put[4].

As the risk is limited, the margin requirement is also low.

[1]In Options Chain, Options are listed like a matrix of strike prices and expiration dates. The names like Horizontal, Vertical, Diagonal Spreads come from that only.

[2]This is specific to this example only. It is not a general statement.

[3]Similarly, “Long Call Diagonal Spread” is called Poor Man’s Covered Call.

[4]Covered Put is constructed by Sell 1 lot futures + Sell 1 lot ATM put options.