Vertical Spread

Let’s revisit the concept of ITM and OTM once. If NIFTY 50 is at 9837.4. Then let’s think it does expire right away.

Will 9800 PE stay in profit? No. It will be zero.

Will 9850 PE stay in profit? Yes. It will have some value.

ATM is just a concept. But on the time of expiry ATM should be zero too which 9850 PE is not! Hence is no ATM or OTM.

Will 9800 CE stay in profit? Yes. It will have some value.

Will 9850 CE stay in profit? No. It will be zero.

9850 CE is OTM.

The perfect ATM here is 9837.4 CE and 9837.4 PE which is absurd. Because if NIFTY 50 spot is 9825 then you can not call 9800 CE/PE and 9850 CE/PE as ATM.

So, ATM is just a theoretical concept.

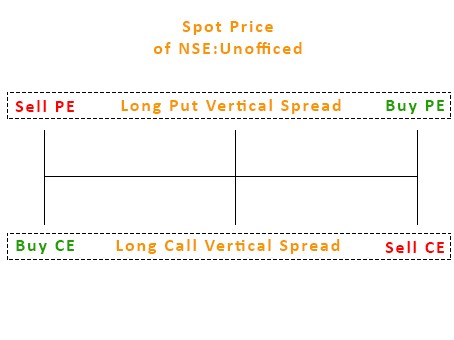

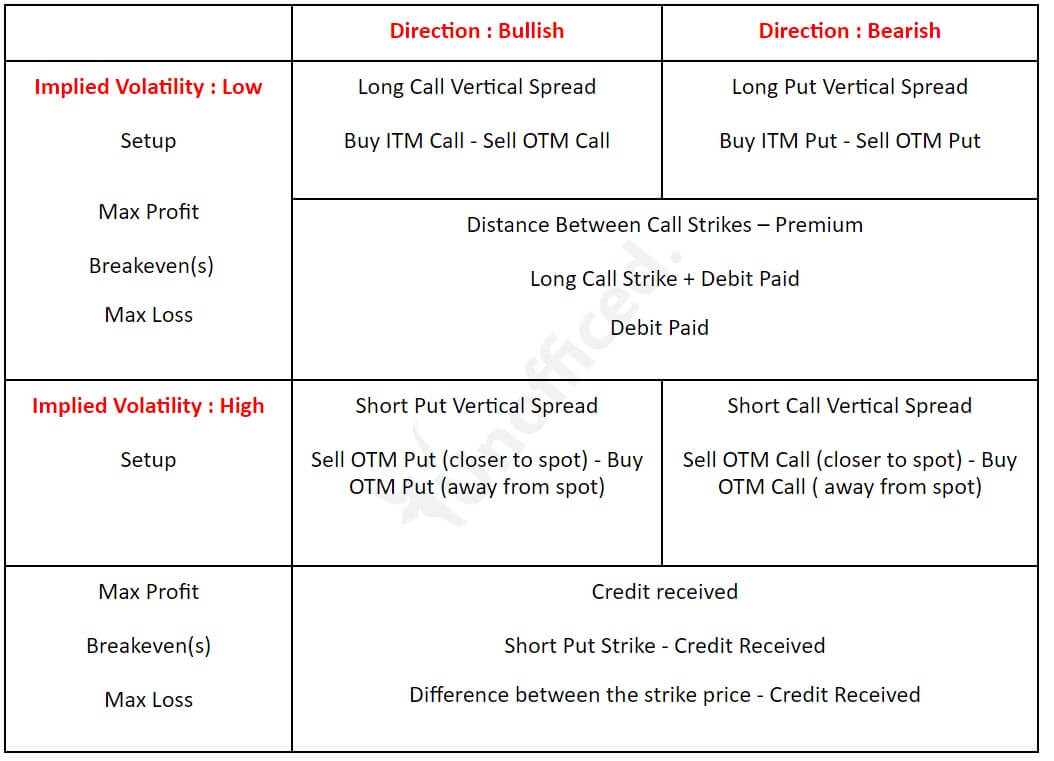

While thinking of vertical spread; there are two cases which you need to think of –

- What is the direction you want to bet? It is bullish or bearish?

- What is the implied volatility? Do you think it will consolidate? Moving up or down doing consolidation?

Like for Infosys, we are now bullish as it fell so much but the Implied Volatility is definitely high.

Also, let’s say when the Dr Reddy results are out you are bearish on it but in that case Implied Volatility is also high.

But for Amaraja Batteries you are bullish but there is no fundamental event that can trigger it and hence the implied volatility is low.

Why this is important?

Because when the implied volatility is high; the premium is high and hence selling of option is more recommended in this case. Samely when the implied volatility is low; the premium is low and hence the risk of buying option is more recommended in that case.

Long Call Vertical Spread = Bull Call Spread

Long Put Vertical Spread = Bear Put Spread

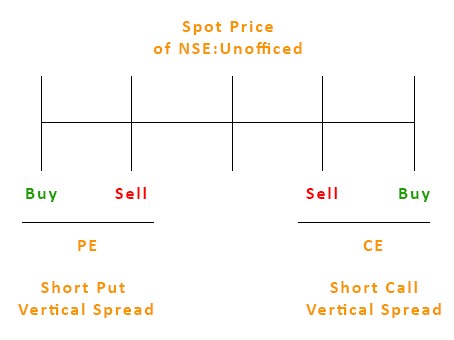

Short Put Vertical Spread =Bull Put Spread

Short Call Vertical Spread = Bear Call Spread

Long, “Bull Call”, “Bear Put” is low IV.

Short, “Bull Put”, “Bear Call” is high IV.

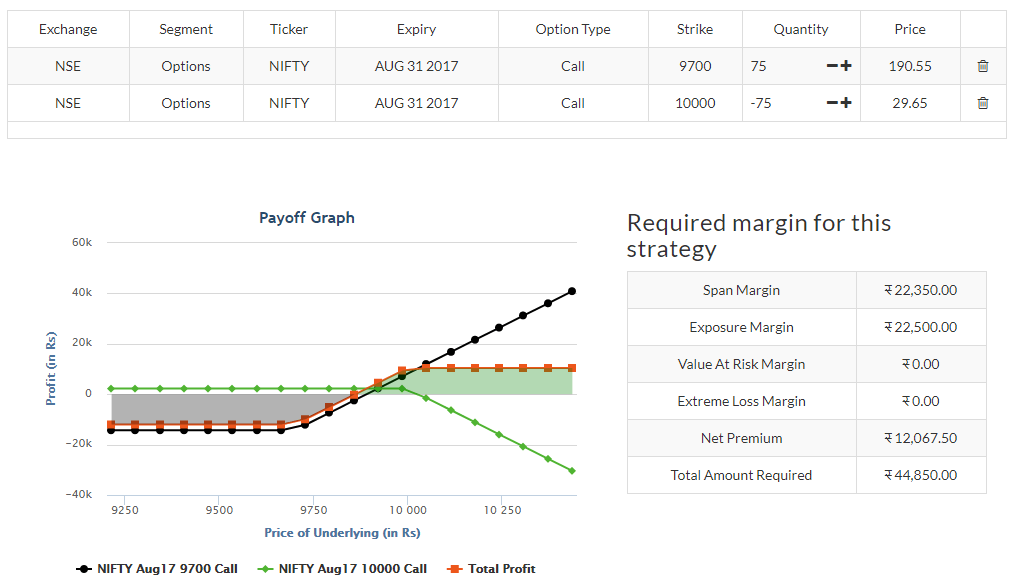

Long Call Vertical Spread

Buy 9700 CE; Sell 10000 CE

CMP of 9700 CE is 190.55

CMP of 10000 CE is 29.65

Premium Paid = 190.55

Premium Received = 29.65

Debit Paid = 190.55 – 29.65 = 160.9

Breakeven = Long Call Strike + Debit Paid = 9700 + 160.9 = 9860.9

Max Profit = (10000 – 9700) – 160.9 = 139.1

Max Profit Achieved When Price of Underlying >= Strike Price of Short Call >= 10000

Maximum loss cannot be more than the initial debit taken to enter the spread position.

Max Loss = Debit Paid = 160.9.

Max Loss Occurs When Price of Underlying <= Strike Price of Long Call <= 9700

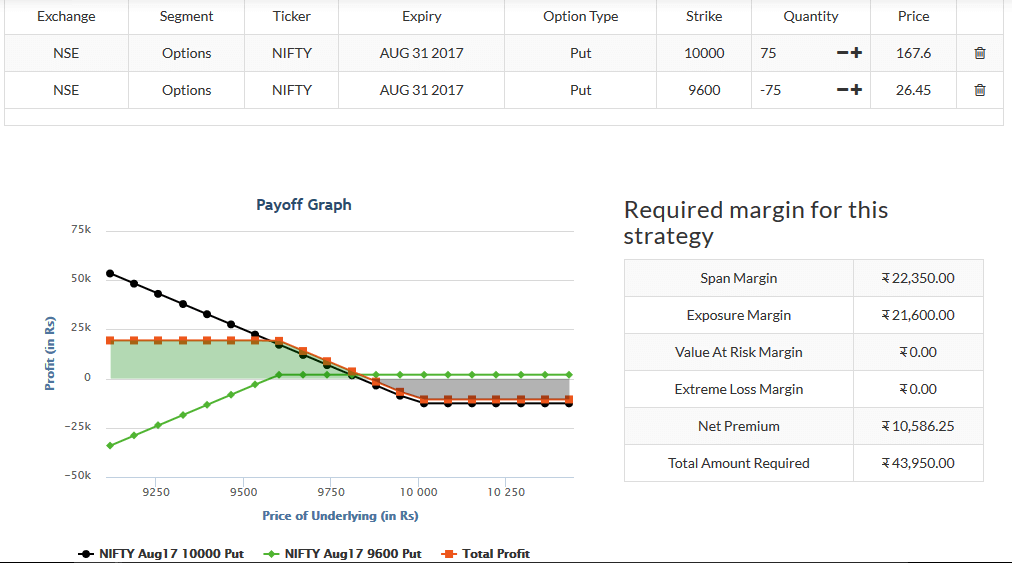

Long Put Vertical Spread

Buy 10000 PE; Sell 9600 CE

CMP of 10000 PE is 167.6

CMP of 9600 PE is 26.45

Premium Paid = 167.60

Premium Received = 26.45

Debit Paid = 167.60-26.45=141.15

Breakeven = Long Put Strike – Debt Paid = 10000-141.15 = 9858.85

Max Profit = (10000 – 9600) – 141.15 = 258.85

Max Profit Achieved When Price of Underlying <= Strike Price of Short Put <= 9600 Maximum loss cannot be more than the initial debit taken to enter the spread position. Max Loss = Debit Paid = 141.15 Max Loss Occurs When Price of Underlying >= Strike Price of Long Put >= 10000

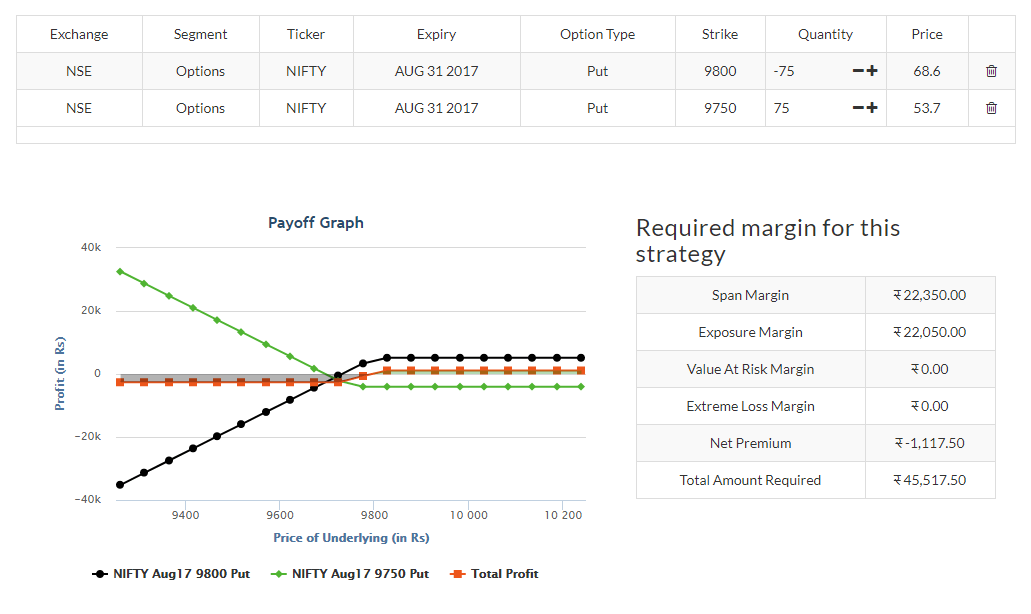

Short Put Vertical spread

Sell 9800PE; Buy 9750 PE.

CMP of 9800 PE is 68.6

CMP of 9750 PE is 53.7

Premium Paid = 53.7

Premium received = 68.6

Credit received = 14.9

Breakeven = Short put strike – Credit received = 9800 – 14.9 = 9785.1

Max profit = Premium received = 14.9

Max Profit Achieved When Price of Underlying >= Strike Price of Short Put >= 9800

Max loss = Difference between the strike price – net credit received = 50 – 14.9 = 35.1

Max Loss Occurs When Price of Underlying <= Strike Price of Long Put <= 9750

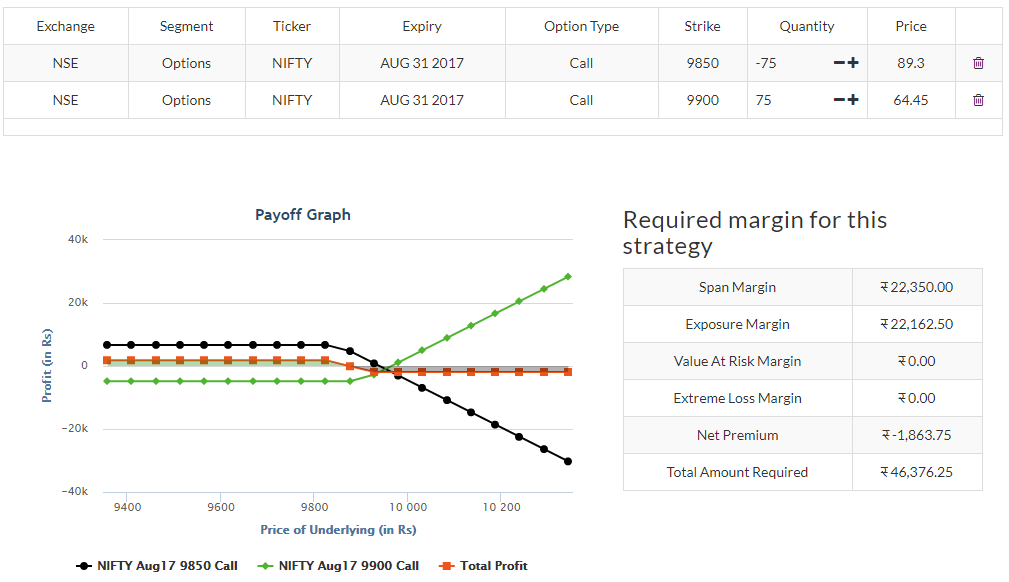

Short Call Vertical Spread

Sell 9850 CE; Buy 9900 CE

CMP of 9850 CE is 89.3

CMP of 9900 CE is 64.45

Premium Paid = 64.45

Premium received = 89.3

Credit received = 24.85

Breakeven = Short call strike + Credit received = 9850 + 24.85 = 9874.85

Max profit = Credit received = 24.85

Max Profit Achieved When Price of Underlying <= Strike Price of Short Call <= 9850 Max loss = Difference between the strike price – net credit received = (9900-9850) – 24.85 = 50- 24.85 = 25.15 Max Loss Occurs When Price of Underlying >= Strike Price of Long Call >= 9900

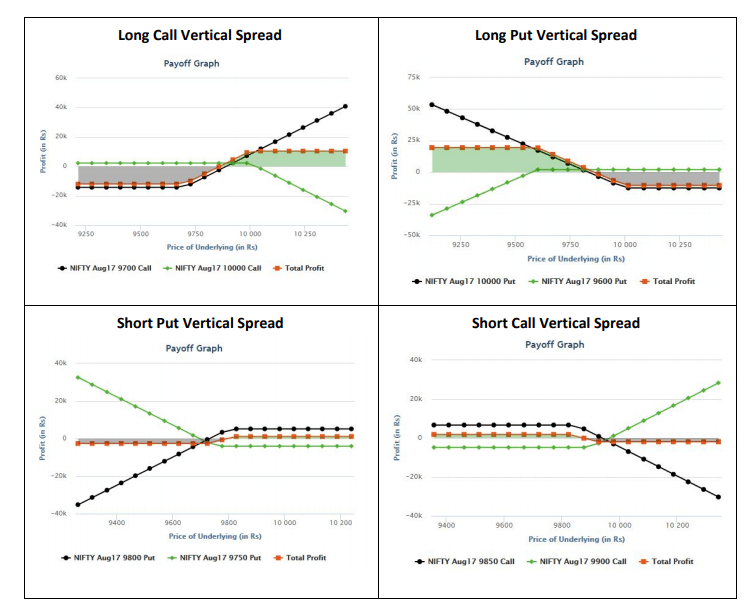

Payoff Graphs

What are the main difference long call and short put when they are meant for both bullish? What is the difference between the payoff graph between them? A similar question can be asked for a long put and short call too.

Let’s just compare them –

In the case where Implied Volatility is high (i.e. in the cases of Short Put and Short Call), we are limiting our profit as well as our losses!

Conclusion –

We prefer to sell premium in high IV environments, and buy premium in low IV environments.

When IV rank is low, we look to buy vertical spreads to stay engaged and also use it as a potential hedge against our short volatility risk. So it is “long call” and “long put” –

- For the Bull case, we buy CE and sell CE of the lower strike price.

- For Bear case, we buy PE and sell PE of the higher strike price.

When IV is high, we look to sell vertical spreads hoping for an IV contraction. So it is a “short call” and “short put” –

- For Bull case, we sell PE near the spot for maximum premium and buy PE of the lower strike price.

- For Bear case, we sell CE near the spot for maximum premium and buy CE of the higher strike price.

In the long vertical spreads, our hedges help to offset the cost of the put you buy with strike B but ultimately limits your risk. It’s just a better alternative than naked call options.

In the short vertical spreads, our hedges help to limit the unlimited loss part of option selling.

Here are some illustrations for visualizing Vertical Spreads in a better way –