Straddle

The two most powerful warriors are patience and time

-Leo Tolstoy, War and Peace

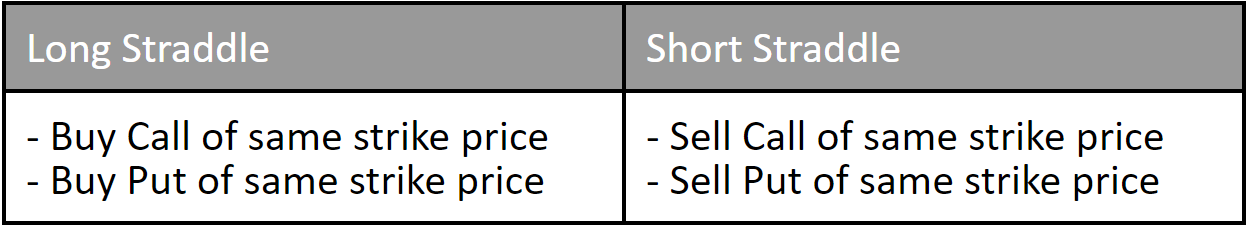

A Straddle consists of a call option and a put option that have the same strike price and the same expiration date.

Directional Assumption: Neutral

Setup:

- Sell/Buy ATM Call

- Sell/Buy ATM Put

Ideal Implied Volatility Environment: High

Variations of Straddle:

If both options are purchased then it is called Long Straddle and vice versa.

We mostly choose ATM strike price. The reason we execute straddles in ATM strike price is because it makes it almost delta neutral as delta values of ATM calls and puts are respectively -50 and +50 almost.

Anyways let’s revisit the concept of ATM options. Let’s assume that the NIFTY Spot price is 9925. What do you call an ATM option in this case? 9925CE or 9925PE doesn’t exist. Then?

The nearest strike price is 9900 and 9950. Theoretically, none are ATM options. 9950 and 9900 is equidistant from 9925. So, to make it simple, if NIFTY is trading between 9900 to 9924 we take 9900 as an ATM and if it is trading between 9925 to 9950 we take 9950 as an ATM.

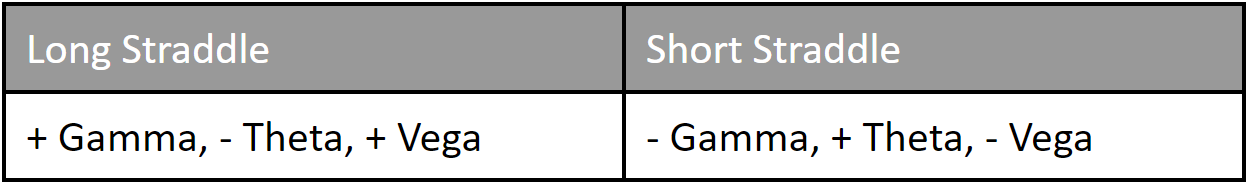

Risk Measures:

– Gamma means movement on the underlying will hurt the position.

+ Theta means the more time goes, we will get money.

– Vega means the value of the position decreases .

When to do straddle?

- The day before the expiry of that option because theta and vega drops exponentially at the last.

- When IV is too high. Generally when there is Company Returns, Corporate Announcements, Board Meetings – Companies having any kind of strong fundamental news, the IV goes high. But, it has both pros and cons in these types of scenarios.

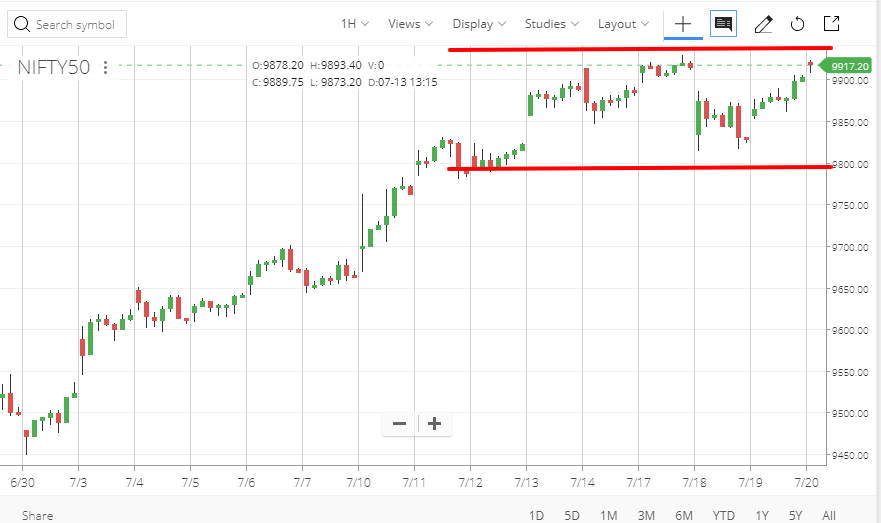

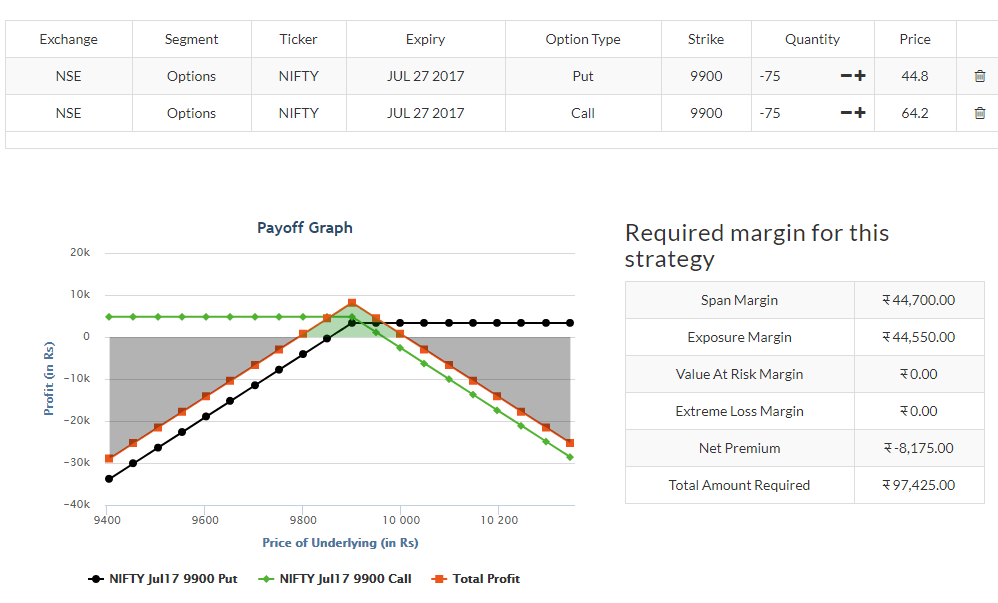

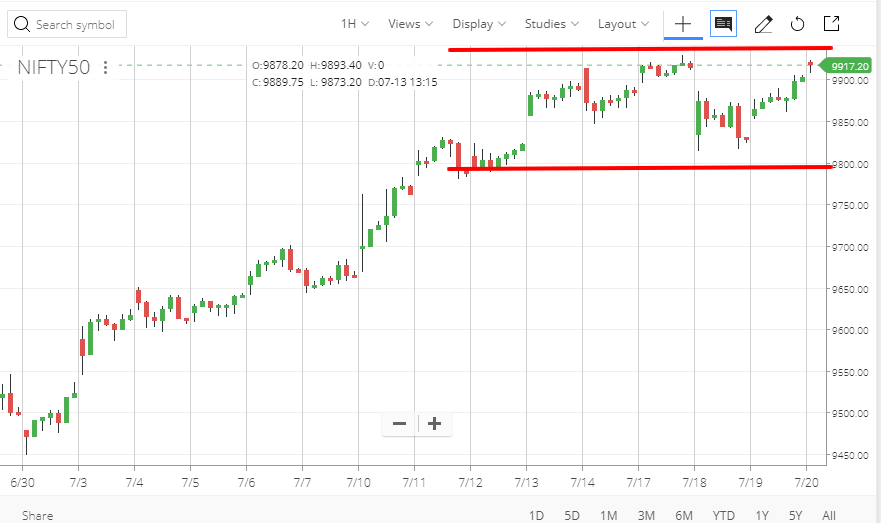

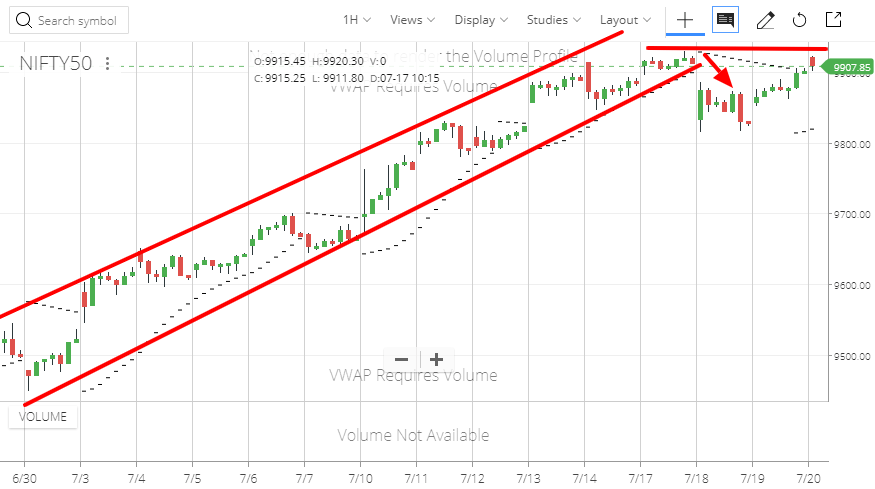

Let’s look at the above chart here and Let’s assume we want to short straddles. Now as discussed, the setup is Selling ATM Call and ATM Put. But, Unless you have algorithms to execute it when the NIFTY spot is perfectly 9900 you can not catch ATM strike prices perfectly. (Like, We are supposed to sell 9900PE and 9900CE when NIFTY touches 9900 right?)

Let’s look at the above chart here and Let’s assume we want to short straddles. Now as discussed, the setup is Selling ATM Call and ATM Put. But, Unless you have algorithms to execute it when the NIFTY spot is perfectly 9900 you can not catch ATM strike prices perfectly. (Like, We are supposed to sell 9900PE and 9900CE when NIFTY touches 9900 right?)

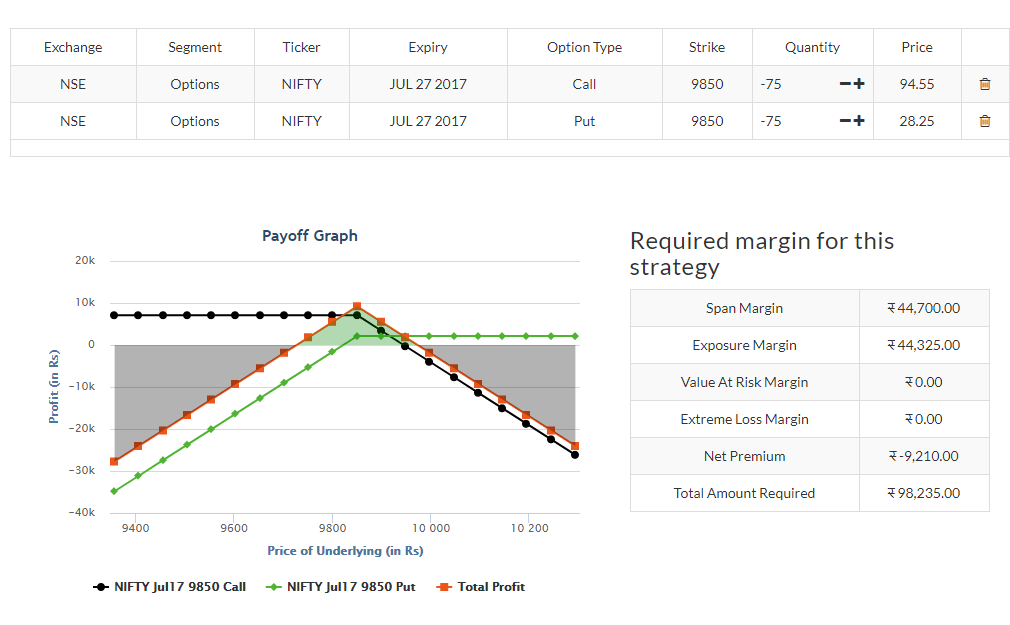

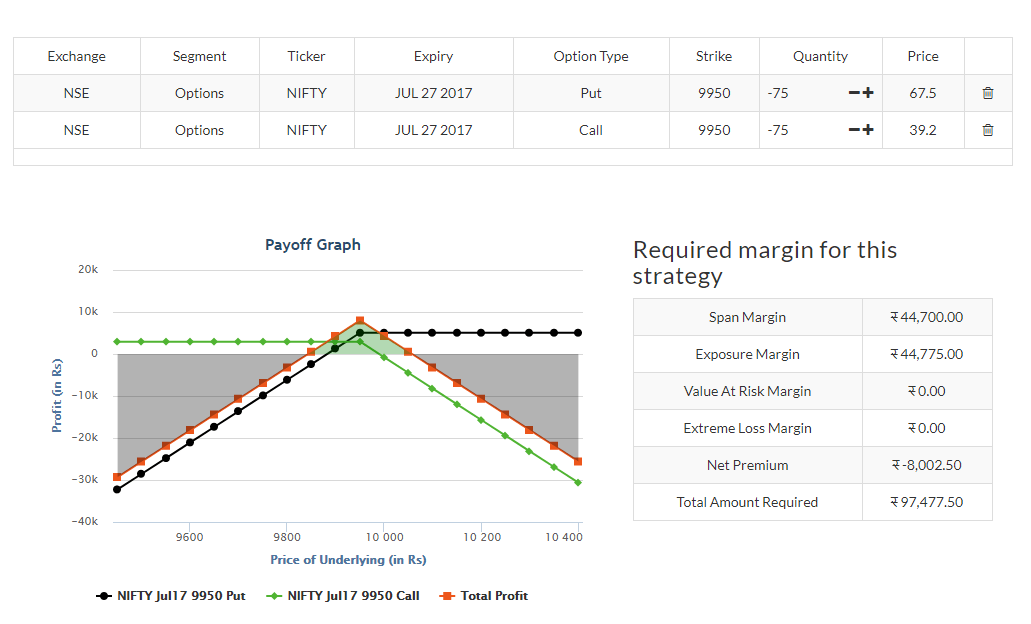

So You have three options here –

Sell 9850 CE, Sell 9850 PE

Sell 9900 CE, Sell 9900 PE

Sell 9950 CE, Sell 9950 PE

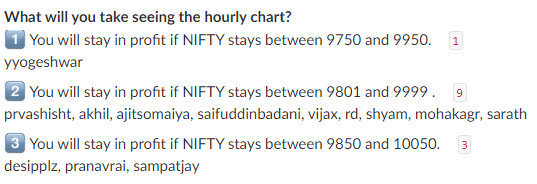

Now you have three options-

- You will stay in profit if NIFTY stays between 9750 and 9950.

- You will stay in profit if NIFTY stays between 9801 and 9999.

- You will stay in profit if NIFTY stays between 9850 and 10050.

See the charts and take the decision. Here is an image of poll organized in our trading group –

Q. How to choose which one is most profitable?

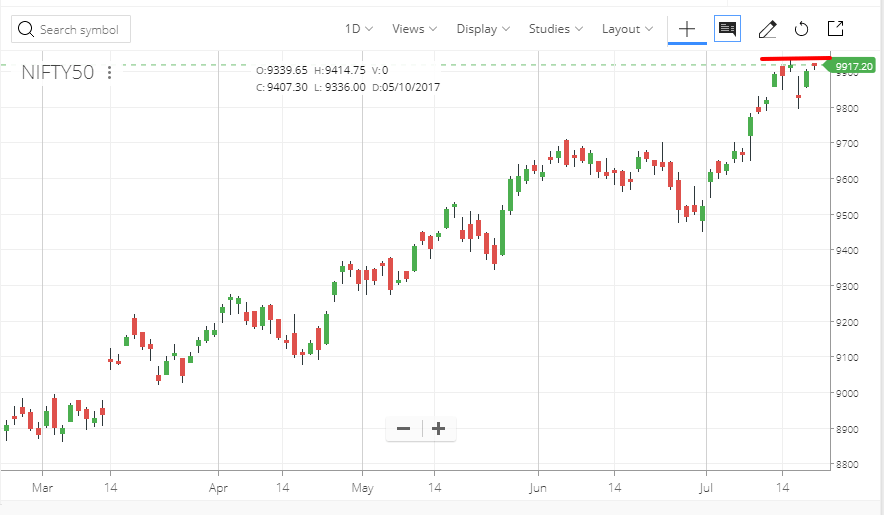

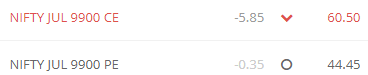

A. Which one is more profitable comes late. Which one has more success in winning comes first. However, Every trader will have their own personal view. Right now if we see the daily chart of NIFTY –

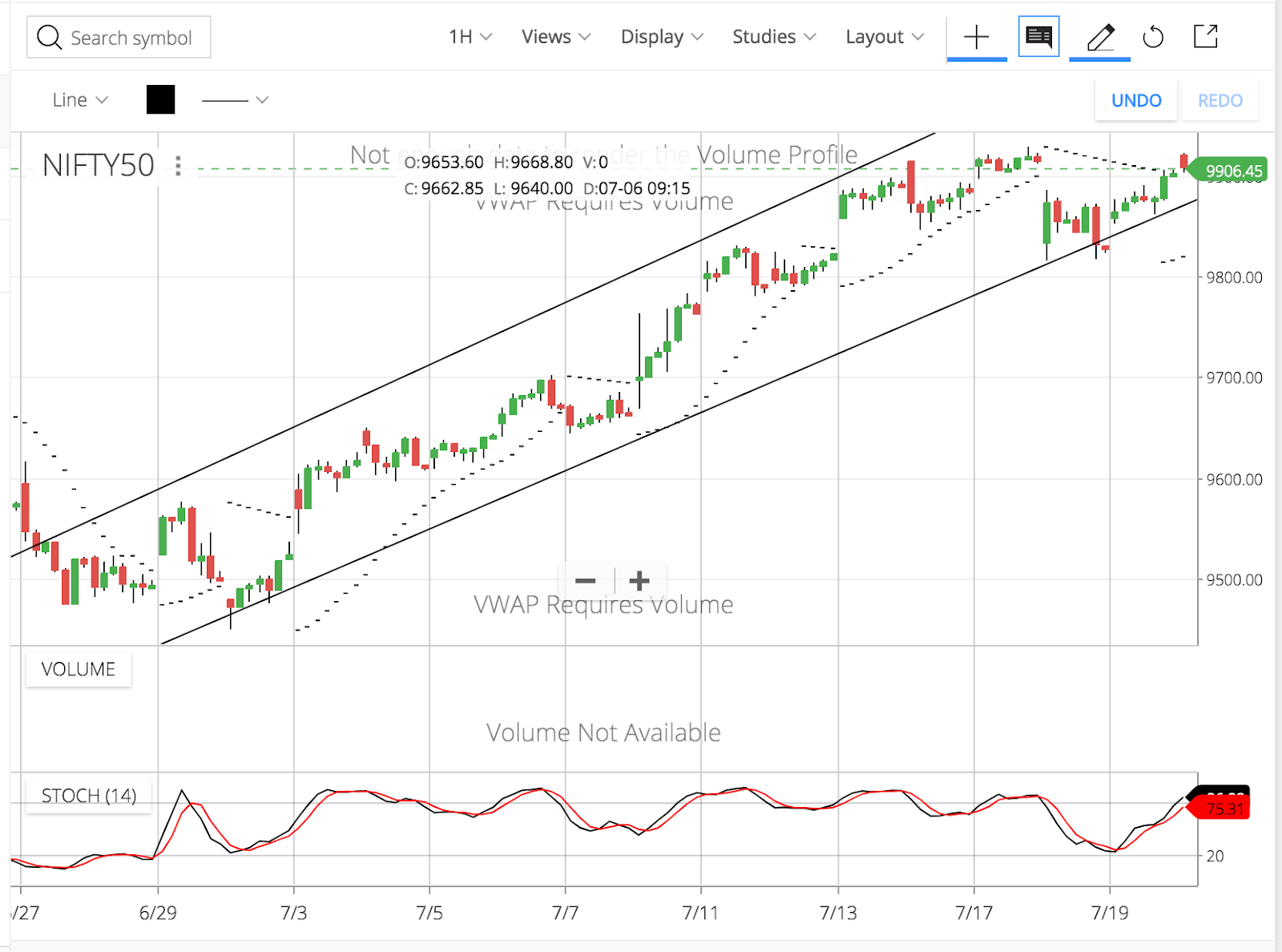

The assumption/bet is that NIFTY will make resistance in the red line

If we zoom into 1 hour timeframe further –

We get a range as marked with the red line. Anyways, Mass psychology will follow price action as that is the definition of price action. That’s why the majority chose the second setup!

A straddle is a technique which we just discussed. Now the choice of those three options and their rationality will depend on the application of knowledge over technicals and perception of the user which will differ.

Q. What about taking Fundamental Analysis in consideration also?

A. You can not predict NIFTY or any index with Fundamental Analysis. When the market dropped because of coronavirus, the buyers are thinking that the market will go up shortly and the sellers are thinking that the market will not go up anytime too and will go down.

It is hard to quantify rationality and perception of different users.

The concept of Stop Loss:

You just close the trade when you see it doesn’t satisfy the underlying concept. So, in this case, the trade should be closed if NIFTY crosses the range as marked by the red line. It invalidates our initial bet. So, in that case, the straddle needs to be closed or hedged with a new bet.

Anyways your chance of staying in profit is high because – Theta decay. If it moves beyond the range when it is near expiry, there is a high chance that erosion in extrinsic value would compensate for the increase in intrinsic value in the option premium.

How to Calculate Breakeven(s):

Downside: Subtract initial credit from Put strike price.

Upside: Add the initial credit to the Call strike price.

So, in this case –

- Initial credit = 44.45 + 60.50 = 104.95

- Downside: 9900 -104.95 = 9795.05

- Upside: 9900 + 104.95 = 10004.95

The spread of 104.95 between downside and upside will keep decreasing each day because the value of both 9900 CE/PE will tend to decrease due to theta decay giving the option sellers profit!

Q. But, can we draw a line like this?

A. Yes. That’s why different people have different views and perceptions. This is a matter of technical analysis which is not a subject of discussion here. But we can see an interesting observation that the channel is broken if seen like this –

Profit on the capital employed is always high on naked selling of 9900 CE. But it is riskier than the combined setup of 9900 PE and 9900 CE. Whenever you try to decrease the risk; you need to pay the fees of doing it by the margin to let’s say. Otherwise, who won’t try the less risky option setup when the profitability is same.

If I sell KOTAKBANK17JUL990CE at 29.65 now.

- KOTAKBANK17JUL990CE will become 0 if KOTAKBANK’s price is 990 by the time of expiry.

- KOTAKBANK17JUL990CE will become 1 if KOTAKBANK’s price is 991 by the time of expiry.

- KOTAKBANK17JUL990CE will become 2 if KOTAKBANK’s price is 992 by the time of expiry.

So to make me profit KOTAKBANK17JUL990CE should stay below or at 29.65 by the time of expiry.

So to make me profit KOTAKBANK should stay below or at 29.65 990+29.65 = 1019.65 by the time of expiry.

If I sell NIFTY17JUL9900PE at 46.15 now.

- NIFTY17JUL9900PE will become 0 if NIFTY’S price is 9900 by the time of expiry.

- NIFTY17JUL9900PE will become 1 if NIFTY’S price is 9899 by the time of expiry.

- NIFTY17JUL9900PE will become 2 if NIFTY’S price is 9898 by the time of expiry.

So to make me profit NIFTY17JUL9900PE should stay below or at 46.15 by the time of expiry.

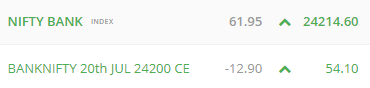

If you see this BankNIFTY 20th July 24200 CE at 54.1 you can not make the loss unless NIFTY BANK goes above 24254.1.

If you are bearish on bank nifty will you short Bank NIFTY futures or BankNIFTY 20th July 24200 CE?

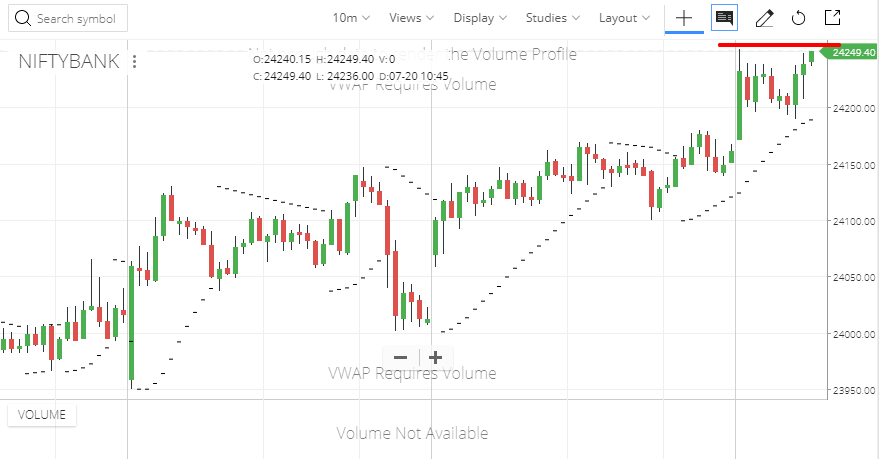

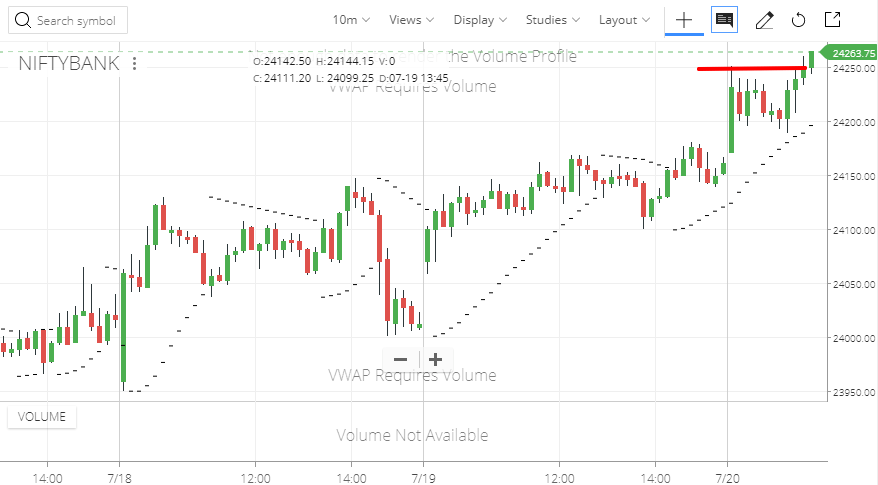

Well, you should wait for price action first. If it crosses there it will go upside in a spike. Now it is a resistance but wait for candle completion.-

Resistance is broken.

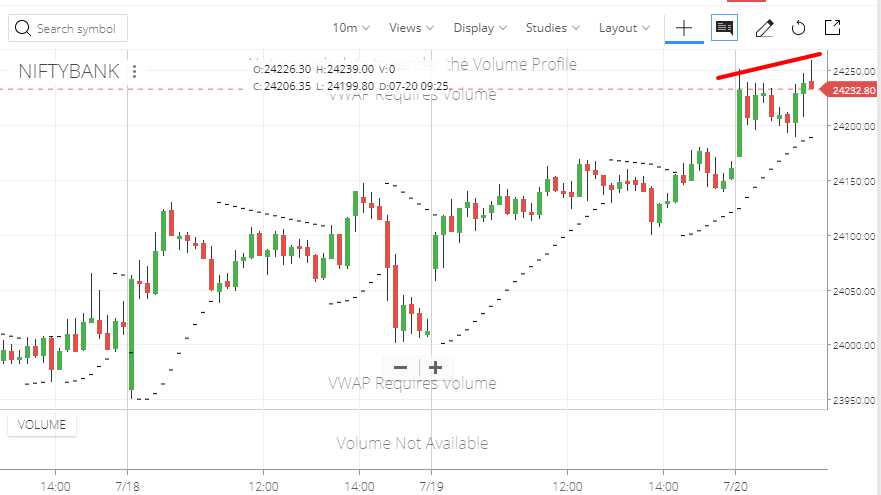

Q. So better to go with 24300 CE?

A. No, not yet. Wait for candle completion.

Q. Should we wait till it forms any red? Or this was the candle you were expecting to be turned red?

A. Well, Bull trend is the bull trend. When you told me 24300 CE was at 19; now it is at 22. You saved 120 INR per lot. Wait for confirmation always.

With straddles, it is important to remember that we are working with truly undefined risk in selling a naked call. We focus on probabilities at trade entry and make sure to keep our risk/reward relationship at a reasonable level.

Implied volatility (IV) plays a huge role in our strike selection with straddles. The higher the IV, the more credit we will receive from selling the options. A higher credit ultimately means we will have wider breakeven points since we can use the credit to offset losses we may see to the upside or downside. At the end of the day, a larger relative credit results in a higher probability of success with this strategy.

When there is an event that is likely to impact the price of an equity (e.g., earnings; RBI ruling; new product release; etc.,) you will see an increase in the option pricing. This rise in pricing is attributed to an increase in the option’s implied volatility. When the implied volatility is high, that means that the market anticipates a greater movement in the stock price.

Right now Axis Bank’s results are near; so the implied volatility is high on its options.