Iron Condor

The term “Iron” in Iron Butterfly and Iron Condor does indeed signify the use of both calls and puts, but the primary purpose of using “Iron” in the name is not necessarily to imply robustness or strength akin to the metal. Instead, it indicates a specific structure of these spreads.

Similarly, like Iron Butterfly, When we have Strangle with a similar setup with limited loss, We call it Iron Condor.

The name condor came from vultures. The payoff graph of Iron Condor looks similar to the picture of a vulture flying. We approached Iron Butterfly setup with vertical spreads in the last discussion. Let’s have a different approach this time with a live trading scenario.

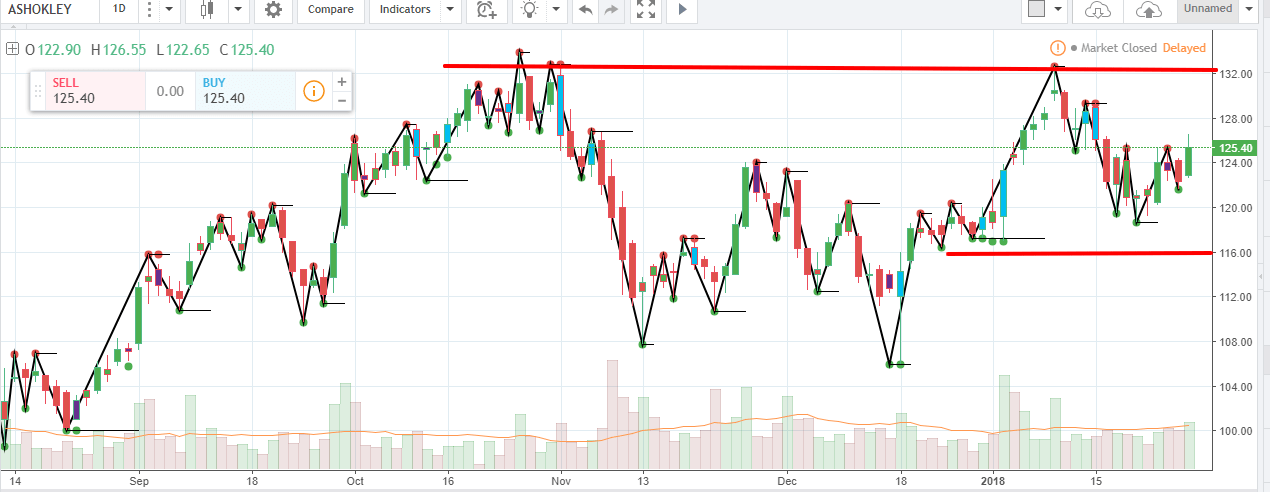

Let’s take an example of Ashok Leyland –

This month We’re betting on the range of 116-132. So if Ashok Leyland stays in this range We’ll make a profit.

But wait, We have a fundamental event – budget! It can give wild movement and can break our range costing us six-figure loss (as the lot size of Ashok Leyland is 7000; a one-point move means 7000 INR).

So how to limit the loss? We use Iron Condor.

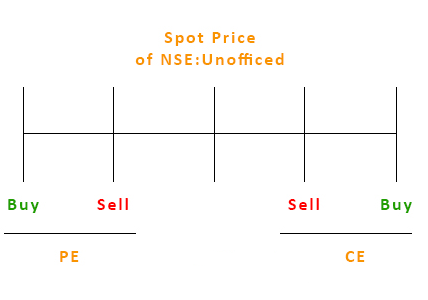

- Short a Put Options (closer to spot).

- Hedge the downside by buying a put option ( away from the spot)

- Short a Call Options (closer to spot).

- Hedge the downside by buying a call option ( away from the spot).

Calculations of Breakevens, Max profit etc. and effects of greeks will be the same as Iron Butterfly. And, if we visualize the strategy, it will look like this-

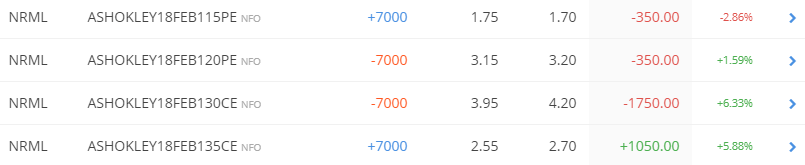

And here is the screenshot after execution –

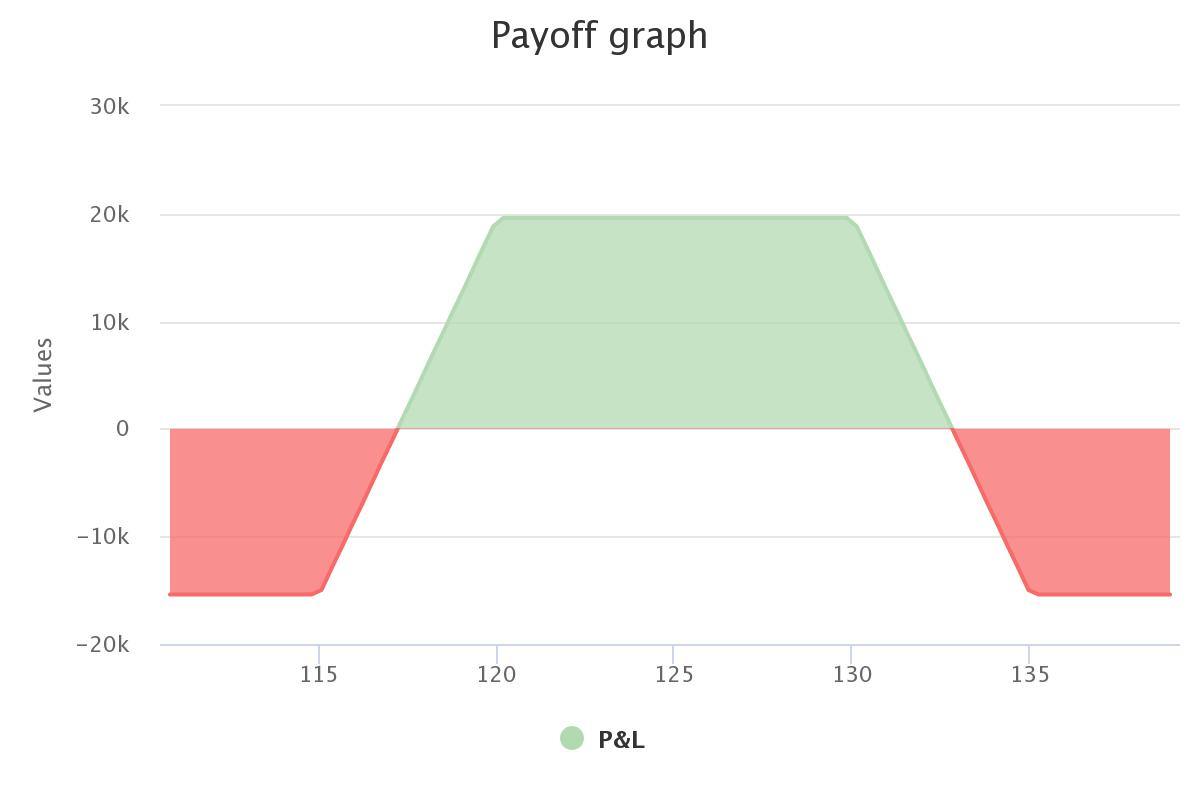

The Payoff Graph will looks like –