Long Condor Spreads

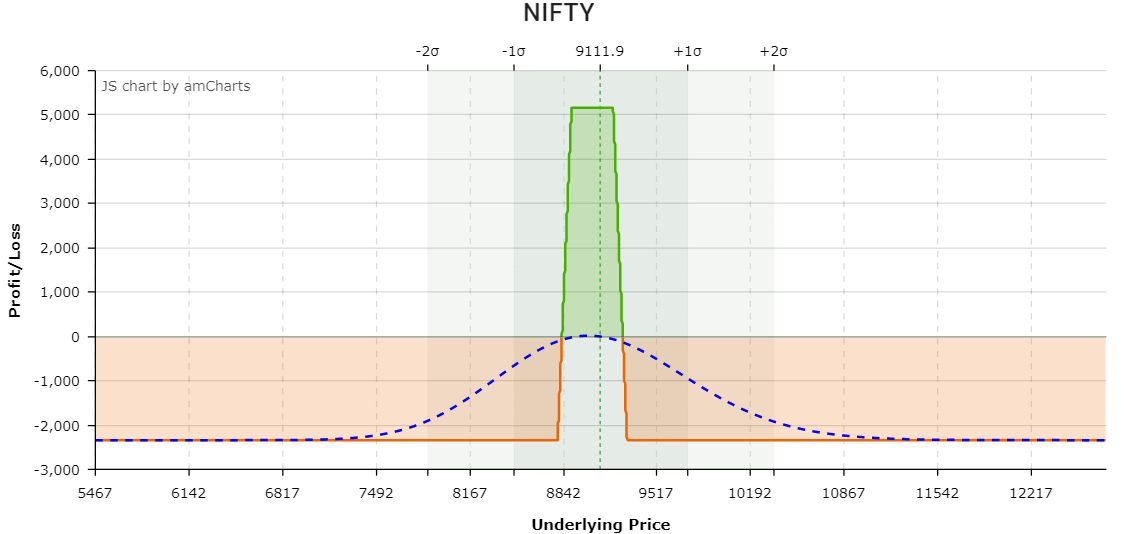

The Condor Spread is an advanced neutral option trading strategy which profits from stocks that are stagnant or trading within a tight price range (Range Bound). It is a cousin of the butterfly spread but involves 4 strike prices instead of 3 strike prices, resulting in a much wider profitable range at the cost of a lower maximum profit.

Call Condor Spread

Directional Assumption: Neutral

Setup: Bull Call Spread + Bear Call Spread

- Bull Call Spread : Buy 1 Lot Far ITM + Sell 1 Lot ITM

- Bear Call Spread : Sell 1 Lot OTM + Buy 1 Lot Far OTM

Ideal Implied Volatility Environment: High

A call condor spread will be delta neutral by construction.

Choice of Strike Price:

- The choice of which strike prices to buy the long legs at depends on the range within which the underlying asset is expected to trade in.

- The further away from the money the 2 long legs are, the lower the risk (as the underlying stock needs to move further in order to exit the breakeven range), and the lower the potential profits (as the further in the money options will cost a lot more to buy).

- Similarly, the choice of which strike prices to buy the two short legs at depends on how wide you want the range within which the maximum profit will occur.

The further from each other the two short legs are, the wider the price range will be where you will get the maximum profit potential of the Condor Spread at the cost of a lower maximum profit.

Right now, NIFTY’s LTP is 9111.9.

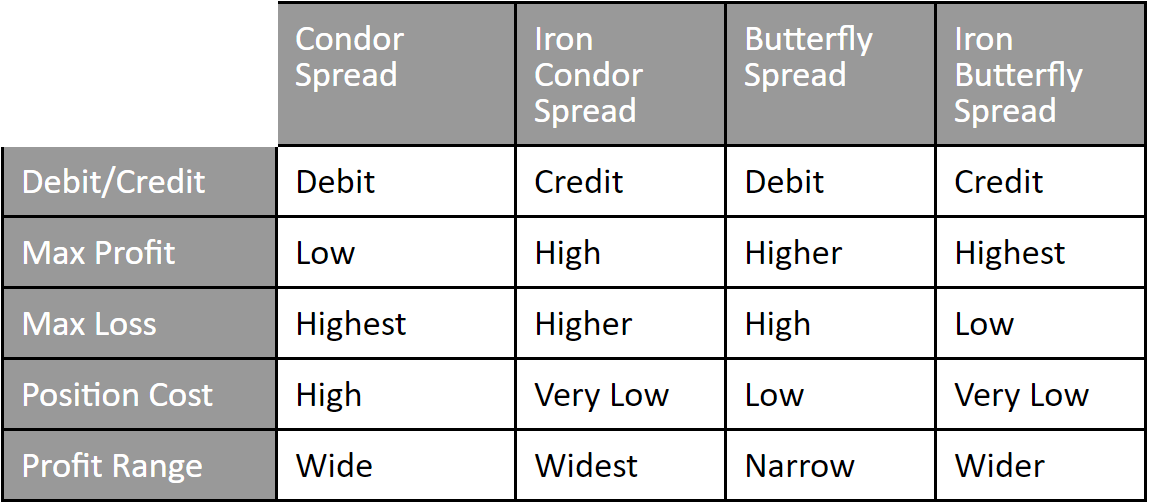

Here is an example of a payoff graph where –

- Buy NIFTY 16th Apr 9300CE at 124.65

- Buy NIFTY 16th Apr 8800CE at 394.6

- Sell NIFTY 16th Apr 9200CE at 164.3

- Sell NIFTY 16th Apr 8900CE at 329.8

Breakeven:

As you can see,

- It will be profitable between the strike prices where we have bought the long legs i.e. 8800-9300.

- Maximum Profit Range: The maximum profit happens between the strike prices where we have sold the short legs i.e. 8900-9200

Max Profit: Net Extrinsic Value in the position i.e. The distance between the short strike and long strike, less the debit paid.

In this case, 100-(124.65+394.6-164.3-329.8) = 74.85 points. As the lot size of NIFTY comes to 75[15], the max profit will come to 74.85*75 = 5613.75

How to Calculate Breakeven(s):

- Upside: Higher Long Option Strike – Debit Paid

- Downside: Lower Long Option Strike + Debit Paid

Put Condor Spread

Directional Assumption: Neutral

Setup: Bull Put Spread + Bear Put Spread

- Bull Put Spread : Buy 1 Lot Far ITM + Sell 1 Lot ITM

- Bear Put Spread : Sell 1 Lot OTM + Buy 1 Lot Far OTM

Ideal Implied Volatility Environment: High

A put condor spread will be delta neutral by construction.

Right now, NIFTY’s LTP is 9111.9.

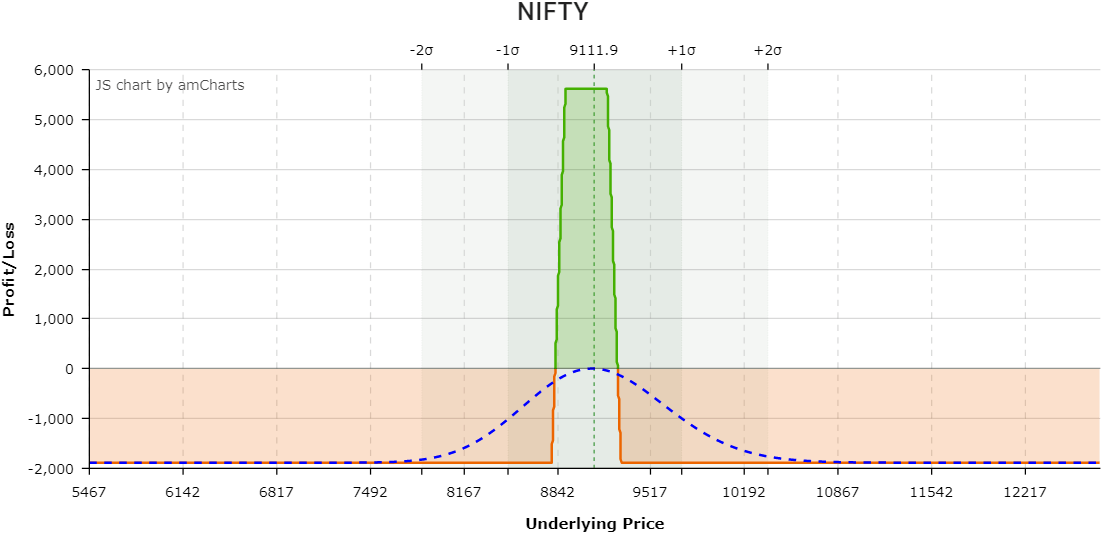

Here is an example of a payoff graph where –

- Buy NIFTY 16th Apr 9300PE at 364.5

- Buy NIFTY 16th Apr 8800PE at 137.7

- Sell NIFTY 16th Apr 9200PE at 303.1

- Sell NIFTY 16th Apr 8900PE at 167.9

Breakeven:

As you can see,

- It will be profitable between the strike prices where we have bought the long legs i.e. 8800-9300.

- Maximum Profit Range: The maximum profit happens between the strike prices where we have sold the short legs i.e. 8900-9200

Max Profit: Net Extrinsic Value in the position i.e. The distance between the short strike and long strike, less the debit paid.

In this case, 100-(364.5+137.7-303.1-167.9) = 68.8 points. As the lot size of NIFTY comes to 75, the max profit will come to 68.8*75 = 5160

How to Calculate Breakeven(s):

- Upside: Higher Long Option Strike – Debit Paid

- Downside: Lower Long Option Strike + Debit Paid

[15] Note that Lot sizes change from time to time.