Diagonal Spreads

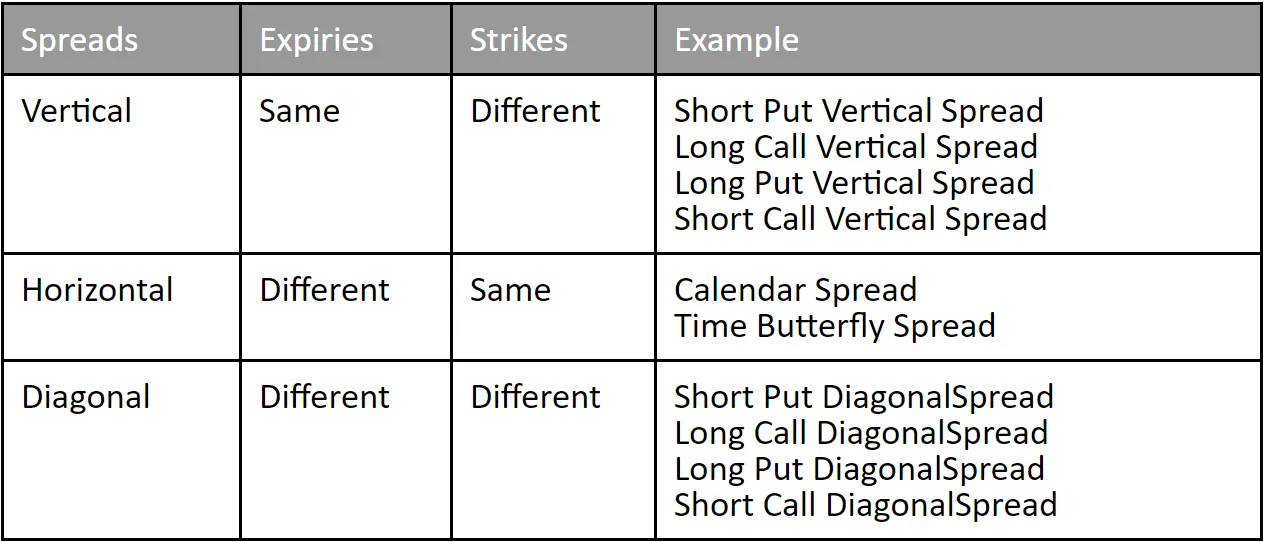

In Calendar Spread and Time Butterfly Spread, We have the same strike prices but When we implement a different combination of strike prices it is called a Diagonal Spread.[1]

Like, Options in calendar aka horizontal spread strategy has the same strike with different expirations, This uses various strikes over various expirations which leads to large numbers of variants. Anyways, We can declare Time Butterfly strategies as a type of horizontal spread in that sense.

The primary goal here is to create Diagonal Spreads with options having the same delta. In that case it will move almost similar to our normal calendar spreads in the payoff graph. Anyways, as different strike price and expiration increases the complexity of greeks, each diagonal spread has to be analyzed separately.

But, keeping an eye to our need for delta neutrality, We can discuss four important variants. Anyways, if the delta is positive or negative, the underlying movement will significantly affect the payoff as the calendar spreads because of its affiliation with vega.