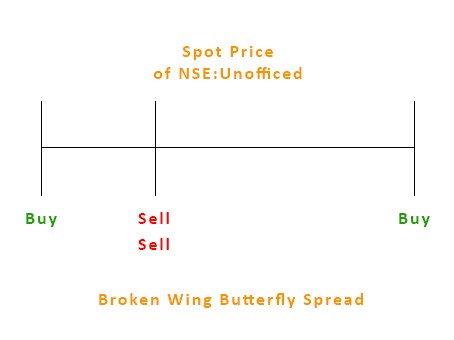

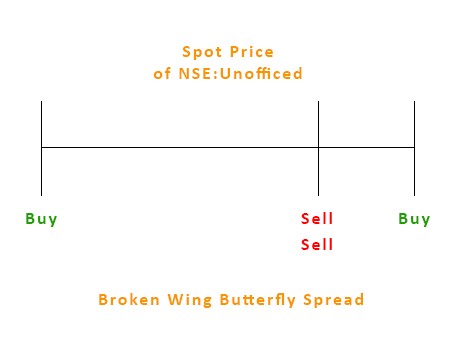

Broken Wing Butterfly Spread

Unlike our Butterfly Spread is non-directional; what about a slight direction in that setup.

In the Butterfly Spread, it was equidistant strike prices where we were buying the options. Instead of that let’s make the distance unbalanced. It will give a directional bias.

|

|

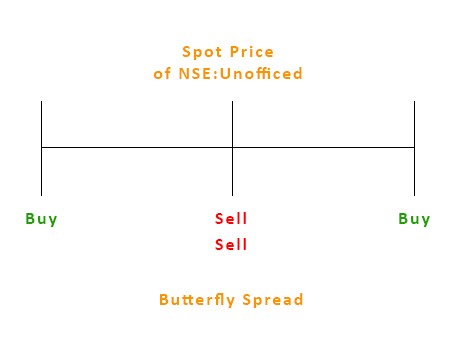

Let’s recall our old setups discussed in Butterfly Spreads –

|

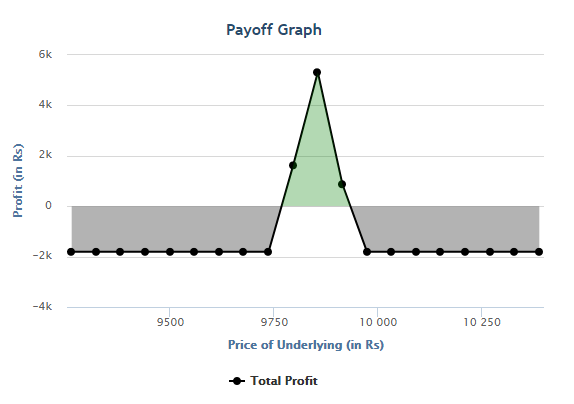

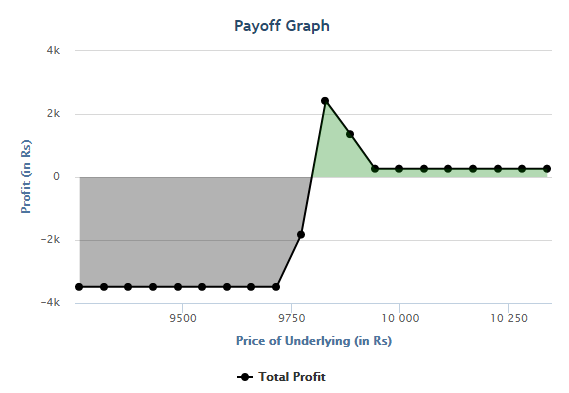

Put Butterfly Spread |

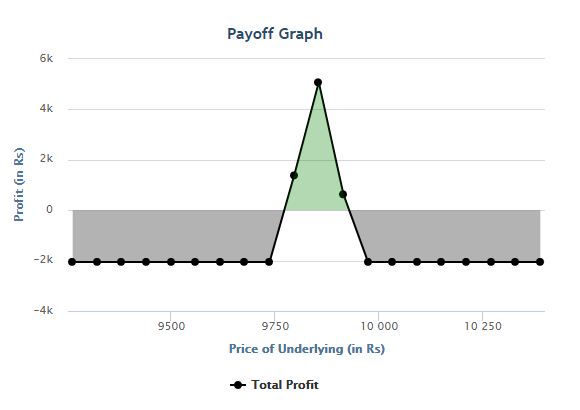

Call Butterfly Spread |

|

|

Broken Wing Put Butterfly Spread

Now let’s break the wings of Put Butterfly Spread –

|

Put Butterfly Spread – Closer OTM Strike |

Put Butterfly Spread – Closer ITM Strike |

|

|

So, In case of Put Broken Wing Butterfly Spreads –

- We reduce the lower strike price closer to ATM to give more leg room towards the downside.

- We reduce the higher strike price higher to ATM to give more leg room towards the upside.

Broken Wing Call Butterfly Spread

Now let’s break the wings of Call Butterfly Spread –

|

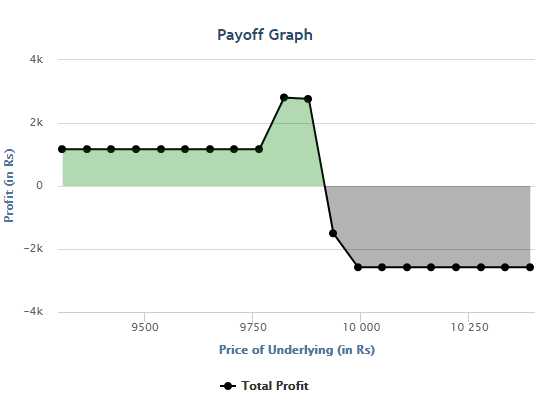

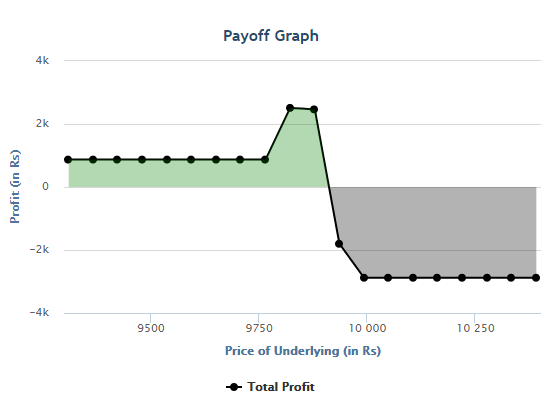

Call Butterfly Spread – Closer ITM Strike |

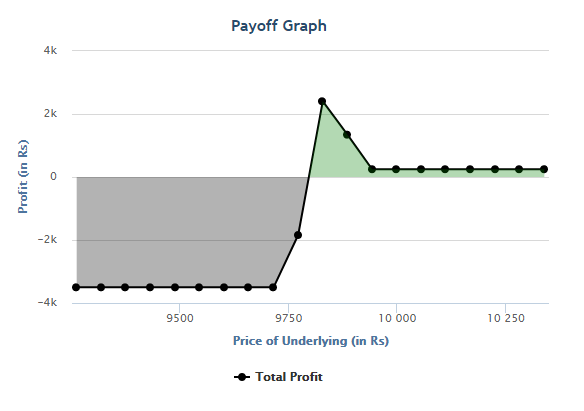

Call Butterfly Spread – Closer OTM Strike |

|

|

So, In case of Call Broken Wing Butterfly Spreads –

- We reduce the lower strike price closer to ATM to give more leg room towards the upside.

- We reduce the higher strike price higher to ATM to give more leg room towards the downside.

Hence,

A Broken Wing Butterfly is a long butterfly spread with long strikes that are not equidistant from the short strike. This leads to one side having greater risk than the other, which makes the trade slightly more directional than a standard long butterfly spread.

Directional Assumption: Neutral / Slightly Directional

Max Profit: Width of narrower spread + Credit Received -OR- Width of narrower spread – Debit Paid