Big Lizard

If we sell straddle instead of strangle along with the OTM call buy, it is called Big Lizard. The term “Big” in “Big Lizard” comes from the fact that selling straddle yields “bigger” credit in premium than strangle.

The Big Lizard is a sophisticated options trading strategy that combines a short straddle with a long call.

It is designed to generate a net credit (income) and is typically employed when a trader expects minimal movement in the underlying asset but wants to hedge against the potential for a slight increase in price.

Live Example:

Here is a table for quick graphical representation –

| Jade Lizard | Sell Strangle + Buy OTM Call |

| Big Lizard | Sell Straddle + Buy OTM Call |

Here is an example –

- Short Straddle:

- Sell 1 ATM Call: 1x 45900 Strike Call Option sold for a premium of 349.45.

- Sell 1 ATM Put: 1x 45900 Strike Put Option sold for a premium of 366.9.

- Long Call:

- Buy 1 OTM Call: 1x 46400 Strike Call Option bought for a premium of 172.2.

Objective and Expectation

- Primary Goal: To collect premiums from selling the at-the-money (ATM) options, which are expected to expire worthless if the NIFTY BANK index price stays around the 45900 level.

- Secondary Goal: To limit the upside risk by purchasing an out-of-the-money (OTM) call option. This means if the index surges beyond the 46400 strike price, the gains from the long call will offset the losses from the short call.

Profit and Loss Dynamics

Maximum Profit: The net credit received from the sold options minus the premium paid for the long call. This occurs if the NIFTY BANK index expires at the 45900 strike price.

Maximum Loss (to the downside): Limited to the difference between the strike price of the short put and the stock price at expiration, plus the net credit received.

Maximum Loss (to the upside): Above the 46400 strike price, losses on the short call are offset by gains on the long call, minus the net credit received.

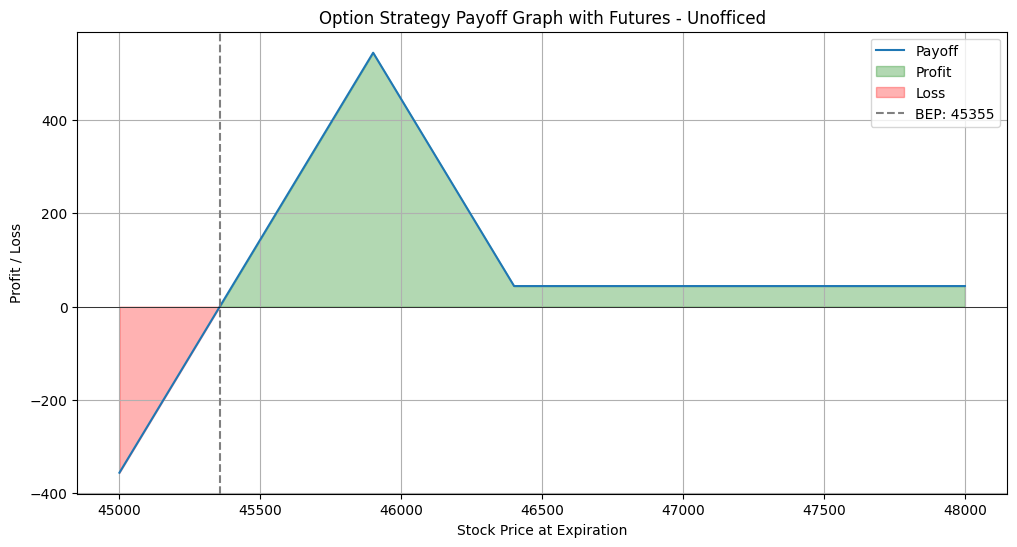

Our current payoff graph looks like –

There is no loss on the upside if the put premium of the straddle is more than the cost of the long call option plus the difference between the strike price of the long call and the strike price of the short call.

This is because any losses incurred due to the increase in the stock price beyond the short call strike price would be offset by the profits from the put premium and the long call option.

Breakeven Point

Breakeven: The strike price of the short options plus or minus the net credit received. It is calculated as:

Breakeven = Strike Price of Short Options ± Net Credit

With the provided premiums, the net credit is (349.45 + 366.9) – 172.2 = 544.15.

The breakeven points would be 45900 ± 544.15. If we select the put option strike price carefully, then there will be no upper breakeven.

As there is slight spike before it touches the lower breakeven, This also gives us a chance to exit the trade in good profit if we time it properly.

The payoff graph resembles that of a put ratio backspread, yet it offers improved trade management capabilities. For further details, you can visit the section on ratio spreads, specifically the put ratio front spread, at the Unofficed Volatility Spreads course: Put Ratio Front Spread.