The MACD Crossover Strategy

The MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two moving averages of a stock’s price. To generate buy and sell signals:

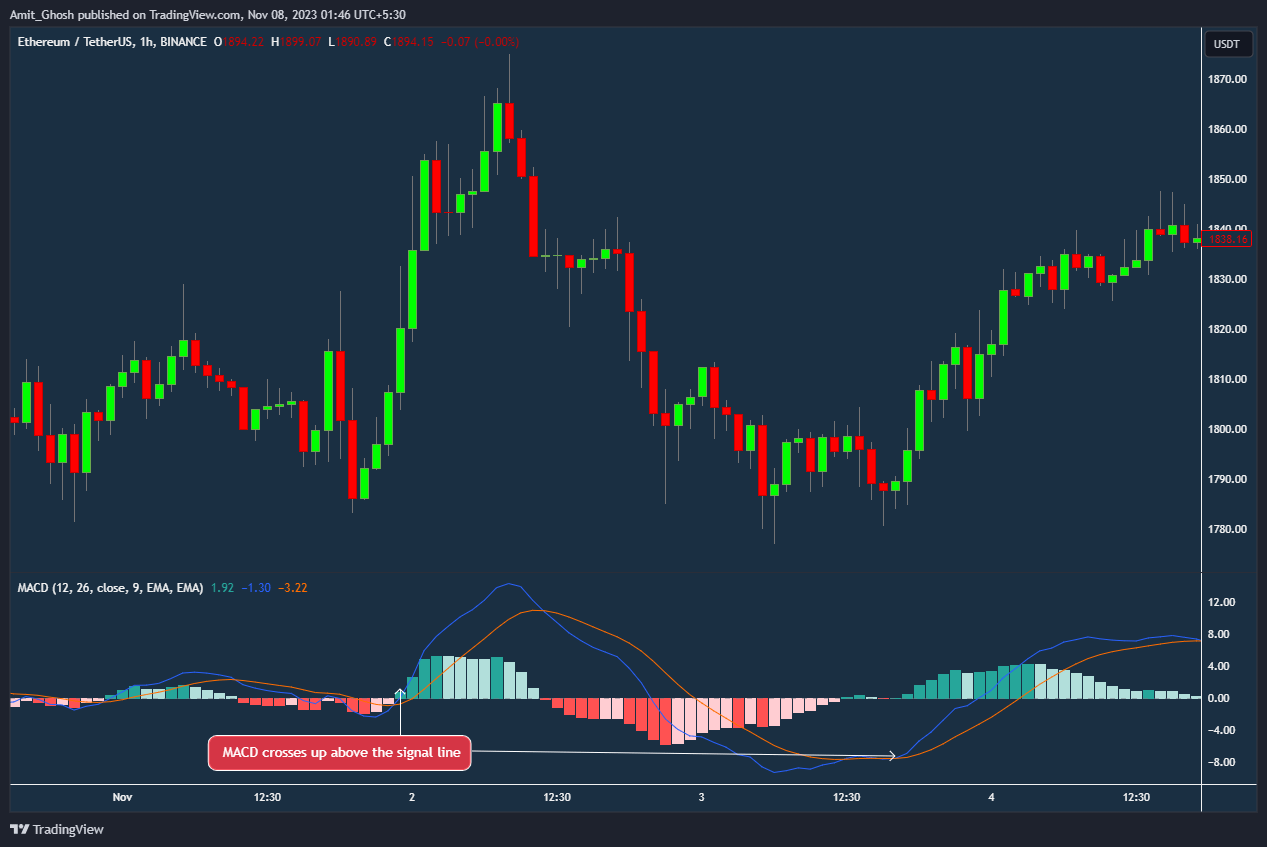

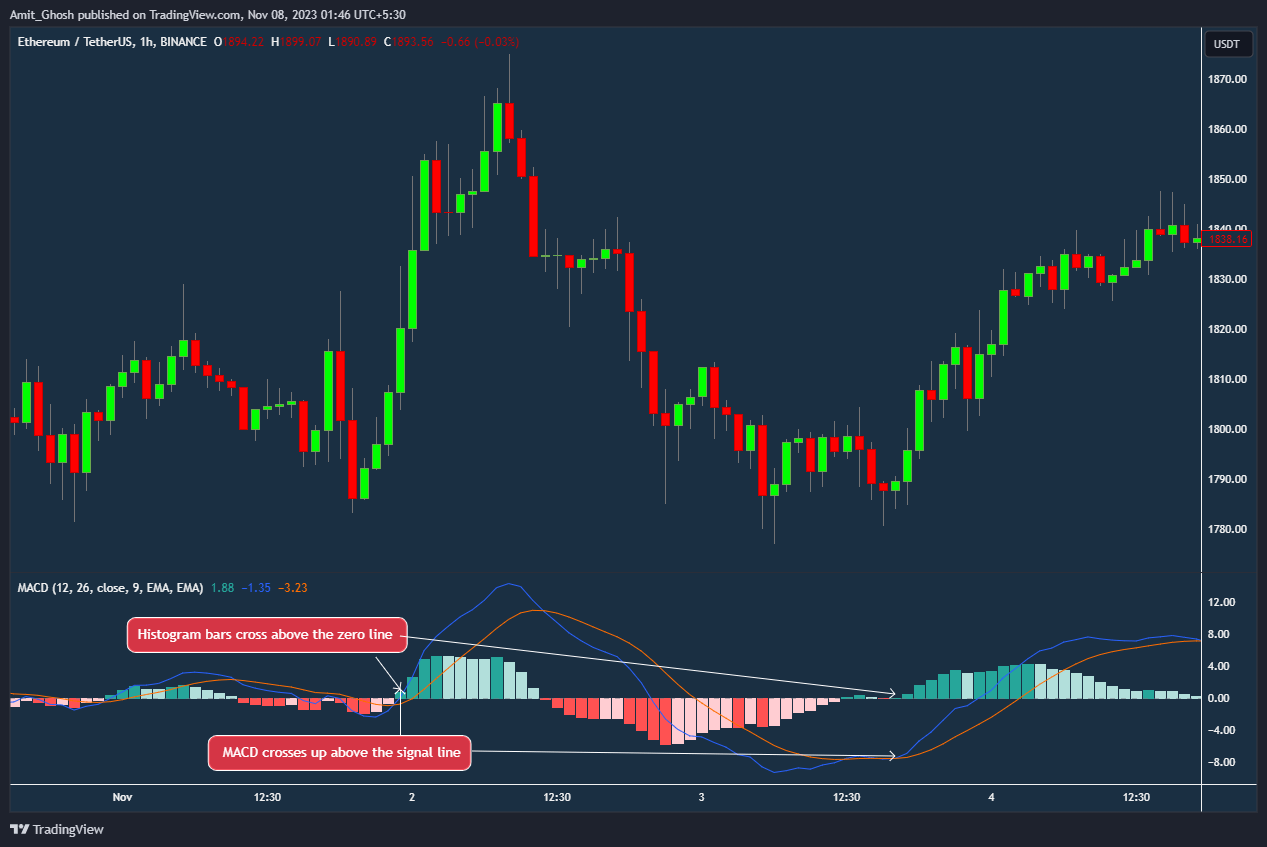

Buy Signal: A common buy signal is generated when the MACD line (the difference between the 12-day and the 26-day exponential moving averages) crosses above the signal line (9-day EMA of the MACD line). This crossover indicates an upward momentum, suggesting it might be a good time to buy.

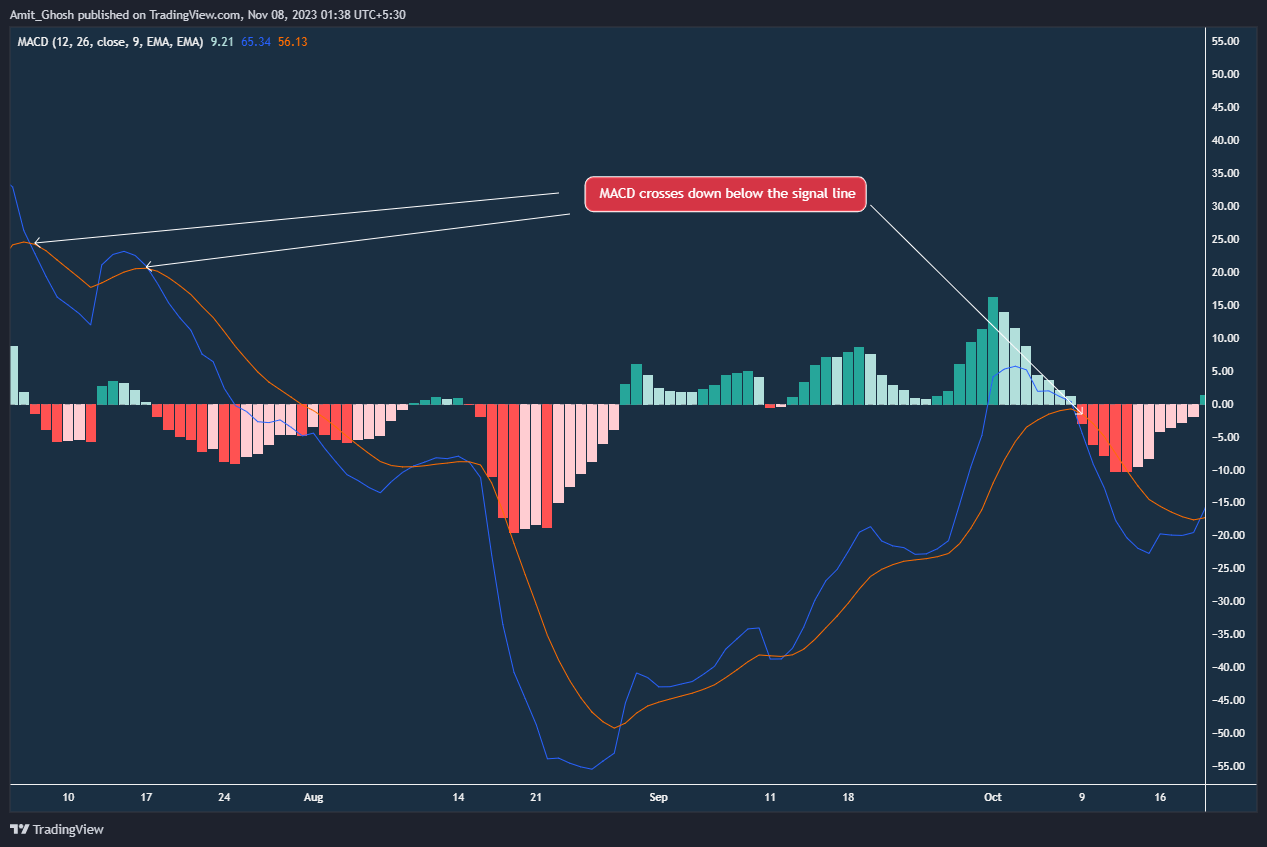

Sell Signal: Conversely, a sell signal is indicated when the MACD line crosses below the signal line. This crossover suggests a downward momentum, implying it might be time to sell.

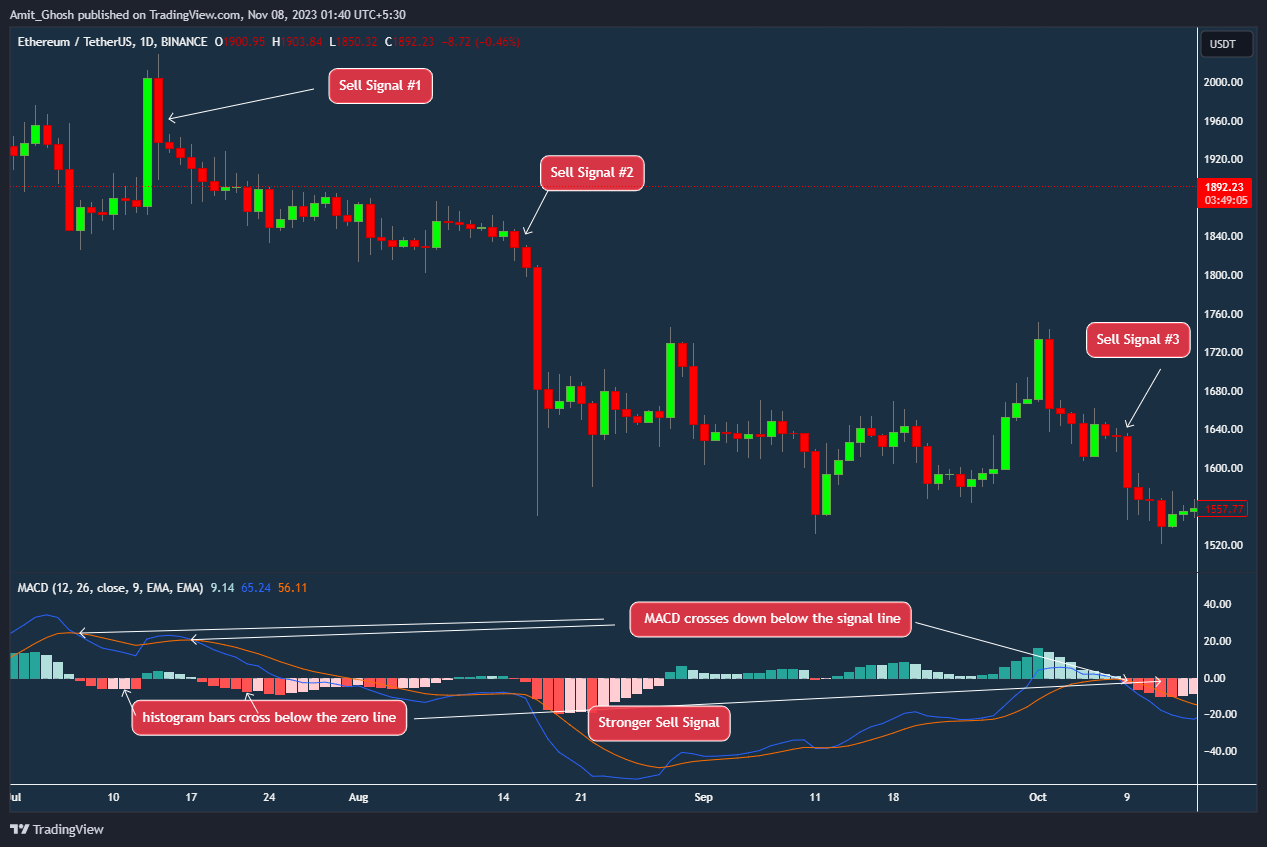

Case for Sell Signal

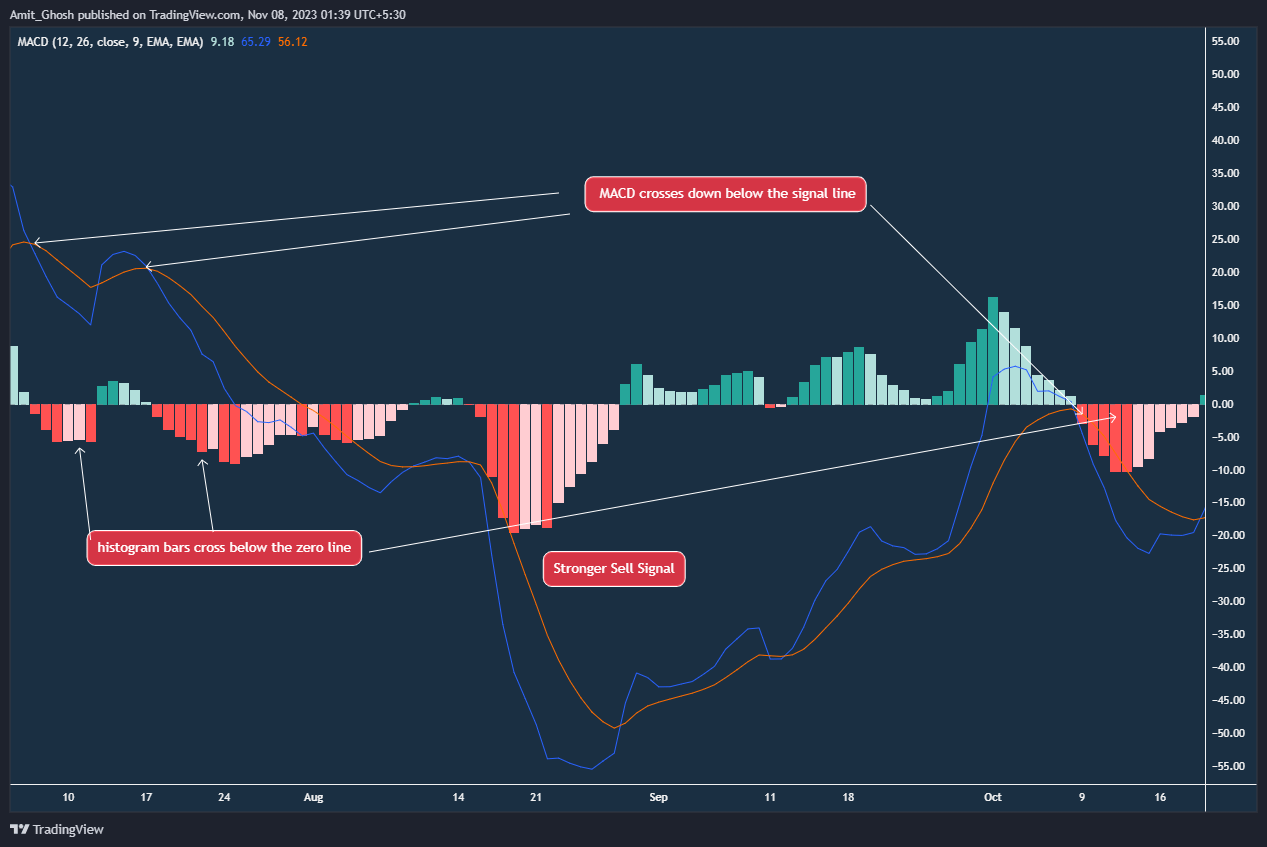

When trading with the MACD indicator, you could take an aggressive sell signal when the MACD crosses down below the signal line.

The image below shows the MACD providing three strong sell signals:

- MACD has crossed down below the Signal line

- The histogram is below the zero line

Summarizing –

A signal to sell is when the MACD has crossed below the signal line. The signal is stronger if the histogram bars are also below the zero line. If the MACD crosses down below the Signal line, but the histogram has not confirmed it by producing bars below the zero line, this is still considered a sell signal, but not as strong.

Case for Buy Signal

However, the buy signal would be stronger if the histogram bars cross above the zero line as well.