Stochastic Indicator

- What the stochastic indicator is and what it is used for,

- What the overbought and oversold zones are,

- How to confirm potential reversal points using the oversold and overbought zones.

- How to confirm potential entries.

- How to change settings and what to expect from different settings.

The Stochastic Indicator

- If the indicator is overbought, the market could be due for a correction or reversal to the downside,

- and if oversold, the market could be due for a correction or reversal to the upside.

What the overbought and oversold zones are,

- An overbought zone,

- A neutral zone and,

- An oversold zone.

Trade Signals using the Stochastic Oscillator

When looking to use the stochastic oscillator for trading signals, it is advised that you wait for the moving average lines to cross over each other after they have moved into the overbought or oversold zones.

For example,

If the lines move below 20 and then rise and cross back above 20, this would be a bullish signal and a long trade could be considered.

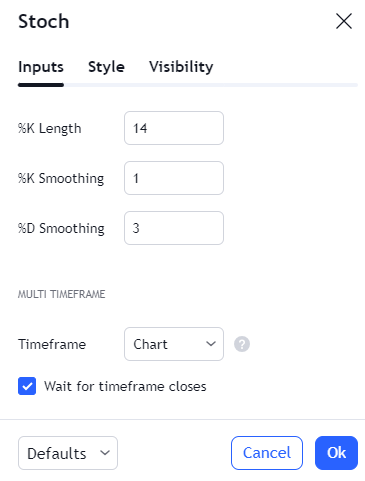

Stochastic Oscillator Parameters:

As a trader, you can decide to change the stochastic oscillator’s parameters to suit your trading style.

However, it is important to note that it is vital to test whatever settings you decide to use.

The standard settings used that indicate an overbought zone are between 80 and 100, while the oversold zone is found between 0 and 20.

By lowering the overbought zones level to 70 or raising the oversold zone to 30, you would find the indicator giving overbought or oversold signals much faster. This would allow you to get into the trade sooner, but the downside is that it would also increase the number of false signals given, leading to more losing trades.

%K Line:

- Definition: %K represents the position of the closing price within the price range over a specific number of past bars, which is the look-back period.

- Formula: The formula for %K involves taking the Simple Moving Average (SMA) of 100 times (Current Close – Lowest Low) divided by (Highest High – Lowest Low). This calculation is then smoothed, typically with a factor called smoothK.

- Lowest Low: This is the lowest price point in the set number of recent bars within the look-back period, determined by the periodK input.

- Highest High: This is the highest price point within the same set of bars in the look-back period, also defined by the periodK input.

- Default Period for %K: The typical time frame used for calculating %K is 14 bars.

%D Line:

- Definition: %D is a smoothed average of the %K line.

- Purpose: The smoothing is to minimize false signals or whipsaws while still aligning with the larger market trend.

- Formula: %D is calculated by taking the Simple Moving Average (SMA) of %K over a specific period, usually referred to as periodD.

- Default Period for %D: The most common time frame for calculating %D is 3 bars.

Additional Smoothing:

For %K: There’s often an additional smoothing period applied to %K, generally set to 3 bars by default. This further smooths out the calculation to reduce volatility and potential false signals.

Now, Raising the indicator’s setting to speed up the lines will cause them to enter the overbought or oversold zones much faster. This will generate more trading signals, however there will be more false signals generated, which can lead to regular losses.

This can make any kind of profitable trading difficult to sustain.

On the other hand, if you were to decrease these settings, it would have the opposite effect, causing the lines to move less frequently between the overbought and oversold zones. You will have to wait longer for the stochastic to generate an entry signal if the sensitivity of the indicator has been decreased. The downside to this is it can lead to missed trading opportunities.

When changing any parameters of the stochastic oscillator, it is important that you test whether these changes actually improve or worsen your trading results.

As usual, the target level has been written arbitrarily here.

Conclusion

- The stochastic oscillator is an indicator that helps predict reversals of the price of an asset.

- Traders use it to help them exit trades before a trend changes direction or enter before a new trend begins.

- It is made up of two moving average lines that travel in between an overbought, neutral and oversold zone.

- Traders can change the settings to make the indicator more or less sensitive to price movement.

- However, it is vital to test whether the changes are improving or worsening your trading results.