Andrew´s Pitchfork Indicator

- What the Andrews Pitchfork is

- How to put the Andrews Pitchfork on your chart

- How to trade using Andrews Pitchfork

Andrews Pitchfork

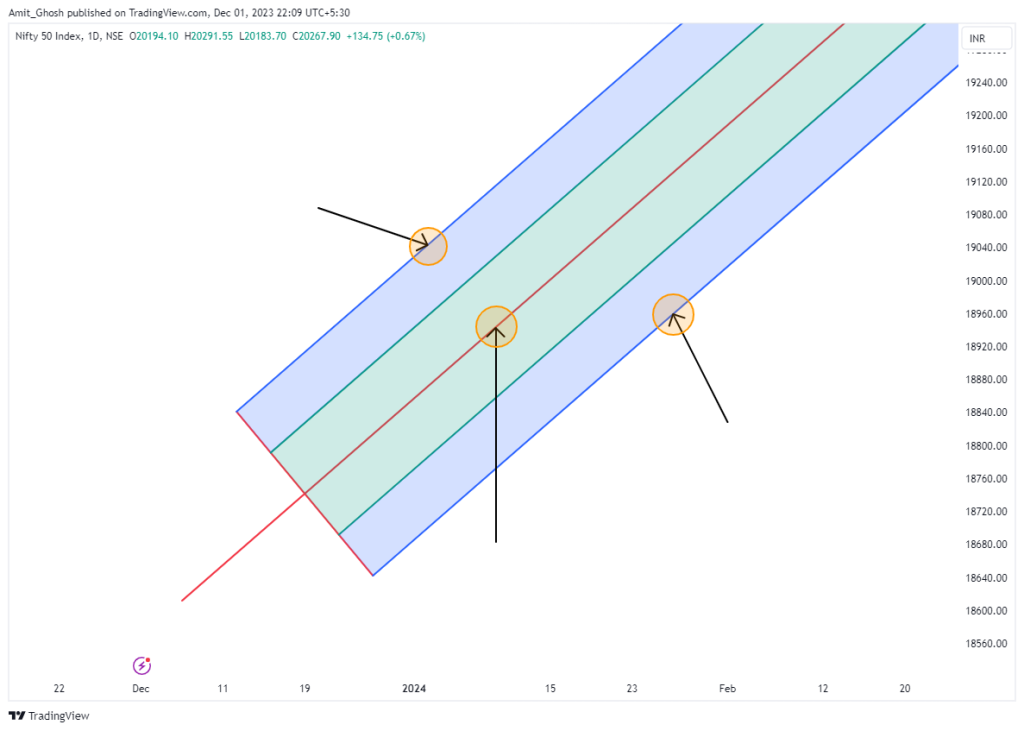

Andrews Pitchfork is a tool that is used for predicting market reversals as well as entries into established trends. When the market is in an up or down trend, it can help identify clear channels that price often moves in. This can alert the trader to clear entry levels ahead of time, before the market even retraces.

Traders will also often use it to help predict when an asset’s direction is about to change, therefore allowing them to take advantage of market reversals.

Constructing Andrew's Pitchfork on a chart

- For an uptrend, the pitchfork is constructed from a low and high and then a low in that order.

- For a down trend, the pitchfork is constructed from a high, a low and then a high in that order.

You first want to look for three consecutive highs or lows on the chart. Look for major highs and lows, the ones that catch your eye easily. We will call these turning points. Highlight these turning points on your chart as they are important in the construction of the pitchfork.

You can see that once the three lines are drawn on your chart, it resembles a farmer’s pitchfork, hence the name.

Drawing Andrews Pitchfork can be difficult at times due to the fact that it can become subjective when identifying which highs and lows to use in the construction.

However, once drawn, the pitchfork is simple to use.

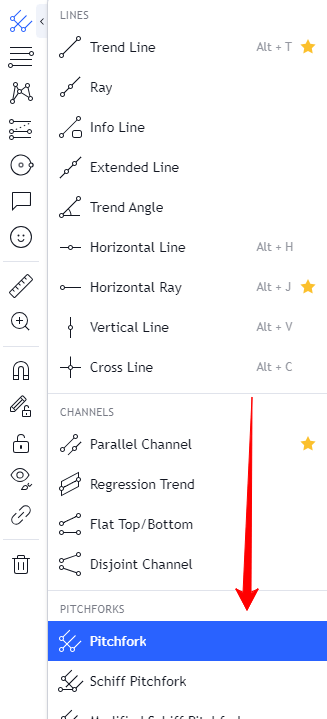

Most trading platforms make it even simpler for the trader as they include an indicator that plots the lines on your chart without needing to calculate anything.

For example, using Tradingview, we can draw Andrews Pitchfork by identifying three swing points in the market.

How to trade using Andrews Pitchfork

- When looking to initiate a long position, you want to look at the lower lines of the channel with the idea of trading the retracement.

- When looking to initiate a short position, you want to look at the upper lines of the channel with the idea of trading the retracement.

Short Case:

- Key high price

- Key low price

- Key high price

This is you can see the indicator draws another two lines which is between the extreme boundary and the medians and is marked by the green zone.

Entry Signal – > Possible short entry

You can see how it bounces off from the lower boundary. So, You can also use the indicator as small scalps of mean reversion trades which are part of retracement.

Long Case:

- Key low price

- Key high price

- Key low price

Conclusion

- The Andrews Pitchfork helps identify channels to predict price reversals.

- It is plotted around three consecutive key highs or lows.

- It features three parallel lines that indicate support and resistance levels.

- As price moves, it tends to gravitate towards the central line in the pitchfork and bounce off the outer lines.

- When looking to go long on an asset, find a key low, followed by a key high, and then another key low in consecutive order.

- When looking to go short on an asset, find a key high in price, followed by a key low and another key high.

- Andrews Pitchfork is best used in a trending market and on higher time frames.