It has been only two years since I started to trade on Indian Markets. It has been quite a journey since then. Previously, I used to do equity trading, the intraday on equity, then options, futures, and more complexity.

By Theta, This forum refers to BANKNIFTY options only. Well, the good part is, half of the forum started with me too. Now. BankNIFTY options is never a single strategy.

Since then, I have found out three profitable versions of trading BankNIFTY.

1. Taking a range based bet on Thursday night and throwing it on Friday. It’s positional.

We see technicals to predict the range. But technicals will always give you multiple support and resistance.

As you can see support and resistance lines from technicals. But how to choose things properly is based on fundamentals. We scan out for all major events which may impact. (Like Results of Axis Bank) and choose the strike price to fit our breakeven.

Breakeven means the range where our bet is. Its defined by Upper Breakeven and Lower Breakeven.

2. Intraday Option Selling on Thursday with insane leverage.

Upstox and few other brokers take very few margins for selling of BankNIFTY Options on Thursday. So option sellers get the power of option buyer and on top of it, we get theta by our side which is very high on the day of expiry.

With great leverage comes the great chance of blowing account.

Suppose if BN is trading at 25000 and You sell 10 lots of 24500 PE at 5. It is most unlikely to move down unless there is a fundamental event. So 40*10*5 = 2000 is free money.

But if BN falls 500 points which is not unusual either and you got frozen. Generally, we cut the trade or do hedge like 25000 CE to decrease the damage. But, well, most of the trades get frozen.

So, when BankNIFTY falls 500 points, the option becomes delta one.

Delta is one of four major risk measures used by option traders. Delta measures the degree to which an option is exposed to shifts in the price of the underlying asset (i.e. stock) or commodity (i.e. futures contract). Values range from 1.0 to –1.0.

- Put options have a negative sign.

- Call options have a position sign.

When BN touches 24500 and keeps falling the delta of 24500 PE becomes -1. It means it is equivalent to hold 10 lots of BN future sell. The risk increases to skyscraper and losses expand to four digits to five digits in literally seconds.

One of a good way of strategy is to sell +-500 points OTMs and hitting stop loss if that OTM becomes ITM which means BN moves 500 points to that side.

3. Intraday Option selling aiming the vega. (Vega Stripping)

If we have Risk: Reward = 1:1. What is the win ratio you need to become a profitable trader here?

From a single point, it looks simple. You’re betting 10 INR to make 10 INR. So if you lose 10 INR, you need to win 10 INR to breakeven (no profit no loss). If you win 50% you will make breakeven. Simple Probability.

If you win more than 50%, you win and are labeled as a profitable trader. But it is wrong.

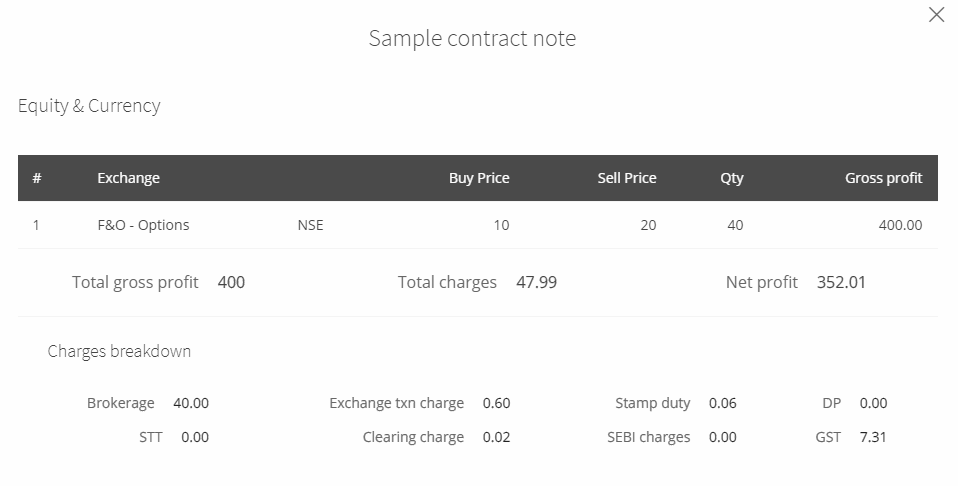

Head to https://zerodha.com/brokerage-calculator

Now, look here –

So the thing is, You make loss or profit. You are losing around 50 INR in each trade.

If we have Risk: Reward = 1:1.

Now, what is your win ratio to become a profitable trader?

Is it >50%?

1. My strategy has a 10 point stop loss and 10 points take profit.

2. No matter we make loss or profit, we are stripped of 50/40 = 1.25 points.

This is a reduction model where your profitability decreases rapidly giving you the illusion that you will be profitable at winning more than 50% which is not.

Without any extra charges not included case, it should be 100. But we are degrading by 2.5 points each time. The account will go zero if you do 40 trades with 50% win ratio.

To make you profitable with more than 50% win ratio, you need 10:12.5 risk: reward. 12.5 = 10 + 1.25 + 1.25

10:12.5 = 1:1.25

As you can see earlier we thought we could do profitable trading with more than 50% win ratio in 1:1 Risk: Reward is now 1:1.25. It’s hugely different and that’s what makes trading so hard – the Wrong perception of Mathematics.

Now, what is the real win ratio for risk: reward 1:1?

You were winning 8.75 (10-1.25) with betting a loss of 11.25 (10+1.25)

The actual risk: reward is 8.75: 11.25!

You need to win more than 77.7% trades to be profitable with 1:1 risk: reward

Now you can see that if you add “extra charges” your profitability win ratio goes from “more than 50%” to “more than 77%”

When new traders come into a market they think it is easy to win more than 50% trades and make money? Well, it’s a trap!

So, the end story is we modified from 10 points TP 10 point SL to 12 points TP 10 point SL

Just a difference of 2 points creates the strategy so hard that in former (10 TP 10 SL) you need 77% win ratio and in later (12 TP 10 SL) you need 50% win ratio.

So what happens in Vega Stripping? Its support and resistance with few formations of patterns in the smaller time frame. Just a noisy version of our old version of positional trading which spans for a week and here it spans for few mins.

The option prices change is pure substantial and too many fundamental catalysts is affecting all the time. So these trades vary person to person.

The primary discussion which happened here is

1. What is theta is unofficed?

2. What strategies do people play here mostly?

3. Why XE has 12 TP 10 SL instead of normal 10 TP 10 SL? (Reductive Risk: Reward)

In the theta course offered here, We primarily deal with the positional setup because that is passive income and you can just give 20 mins each week to prepare the setup instead of gluing yourself to the screen. Right?

One Comment