Before knowing how to trade options first you need to know about the terminologies used in stock market options:

CE = Call Options

PE = Put Options

Call ~ Long ~ Buy signifies upside.

Put ~ Short ~ Sell signifies downside.

Nifty Mar 9000 CE = Nifty Staying above 9000.

Nifty Mar 9000 PE = Nifty Staying below 9000.

- Buying Nifty Mar 9000 CE means you are betting that Nifty will stay above 9000 at the end of the trading session of last Thursday of March ~ 30th March.

- Selling Nifty Mar 9000 CE means you are betting that Nifty will stay below 9000 at the end of the trading session of last Thursday of March ~ 30th March.

Similarly,

- Buying Nifty Mar 9000 PE means you are betting that Nifty will stay below 9000 at the end of the trading session of last Thursday of March ~ 30th March.

- Selling Nifty Mar 9000 PE means you are betting that Nifty will stay above 9000 at the end of the trading session of last Thursday of March ~ 30th March.

So, fundamentally speaking –

Buy Nifty Mar 9000 CE = Sell Nifty Mar 9000 PE

Sell Nifty Mar 9000 CE = Buy Nifty Mar 9000 PE

Options are amazing if you know how to trade options! Instead of betting that NIFTY will go up tomorrow and do something; you can bet NIFTY will stay between this range and that range till this August.

Predicting NIFTY will stay in x and y range in tomorrow is comparatively easy than predicting it will stay in that range at the time of expiry right because there will be a dozen of movements before that.

So if someone else bet on the same thing you do after few days; his chance of winning is always higher than yours and hence to re-balance this options’ value decreases with respect to time towards their expiry. This is called Theta.

Breakeven Points

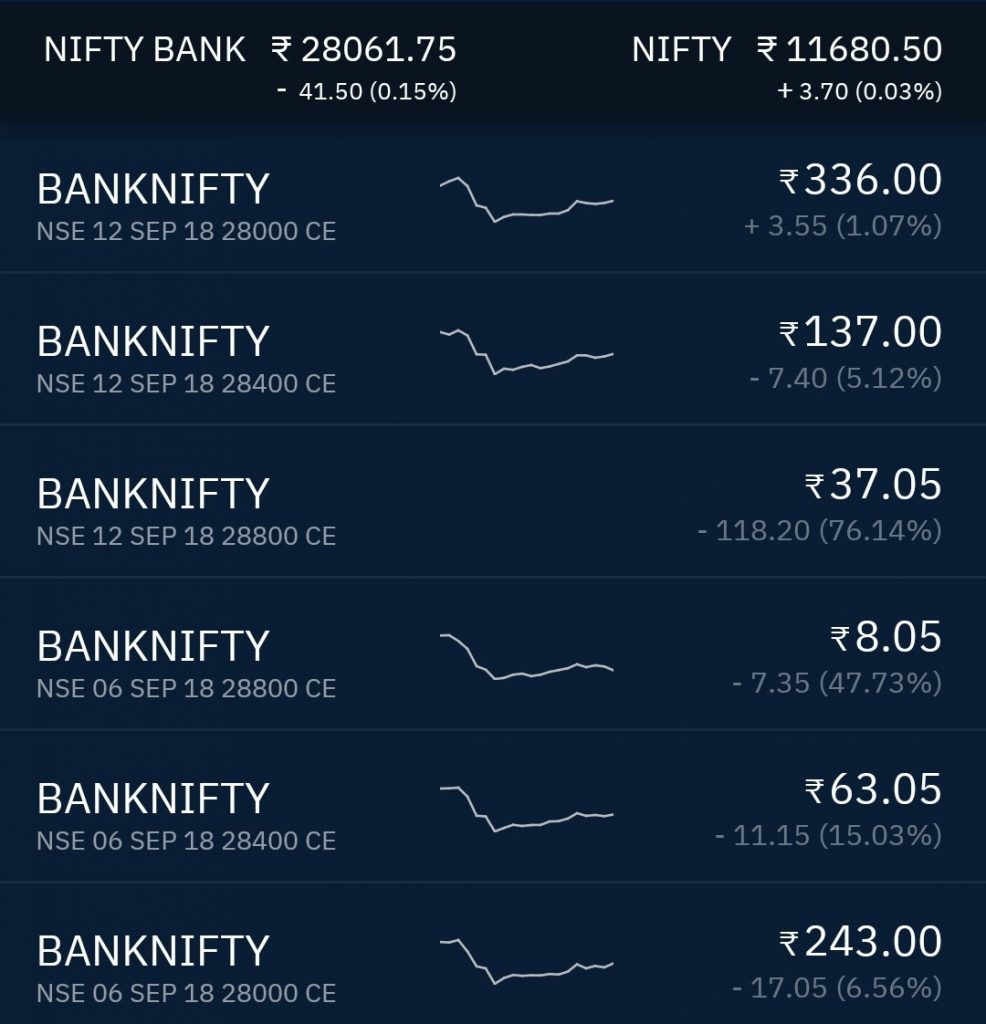

This video will show how to add bank nifty weekly options in Upstox. Let’s say, We sell 28400 CE expiring on 6th Sep. So, on Thursday of 6th Sep,

If BN closes at 28400, the price of “BN 6th Sep 28400 CE” will be priced 0.

The price of “BN 6th Sep 28400 CE” –

- If BN closes at 28399, it will be priced 0.

- If BN closes at 28398, it will be priced 0.

- If BN closes below 28400, it will be priced 0.

- If BN closes at 28401, it will be priced 1.

- If BN closes at 28402, it will be priced 2.

- If BN closes at (28400+x), it will be priced x.

So, the higher the price of the option, the better it is for the seller. If a seller sells “BN 6th Sep 28400 CE” at 100. He will not make a loss unless BankNIFTY expires above (28400+100) = 28500.

So if someone sells a call options, there will be a point beyond which if the underlying scrip (BankNIFTY here) expires, he will make a loss. It is called Upper Breakeven Point.

If there is some put option seller, he will have a Lower Break-even Point similarly.

Also, note – the price of 28000 CE expiring on 12th Sep is higher than the price of 28000 CE expiring on 6th Sep.

The higher the time to expiry, the higher the uncertainty. The higher the uncertainty, the higher the premium of the options.

Taking the example of Bank nifty 6th Sept 28400 CE at 63.05, options have five components –

- Expiry Date – 6th Sept

- Instrument Name – Bank nifty

- Strike Price – 28400

- Direction Bet – Call/Put (Up/Down)

- Cost – 63.05

Also, if BankNIFTY goes above 28800. It means it will go above 28400 for certain and by 400 points. So, the price of 28400 CE expiring on 6th Sep is higher than the price of 28800 CE expiring on 6th Sep. So you can just set an alert in Upstox till the BEP breaches –

Ways to make money in the Stock Market:

- Betting on the upside.

- Betting on the downside.

- Betting on a range.

The above case is about betting on Bank NIFTY closing below or at 28400 before 6th September. If you win the bet, You make money. If you don’t win the bet, then your loss is proportional to the gravity of your loss. It can be calculated as discussed above.

Now the first magical fact is betting on the range

Range Betting

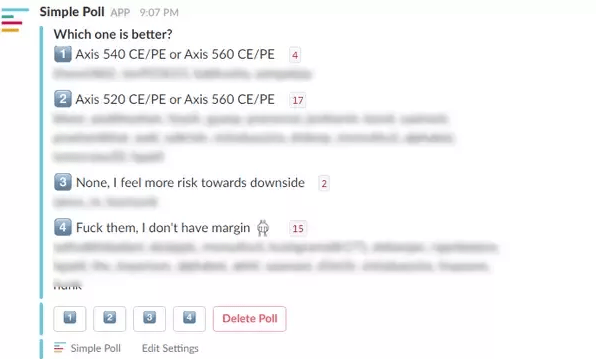

I will give you a couple of live setups on how to trade options for this month with proper rationale which I have also shared on our slack group –

Sun TV Theta Decay Options Strategy

Sell Suntv Aug 760 PE at 13.5

Supports of Suntv is at 800,780,760.

It’s a high beta stock so beware. If NIFTY crashes it will crash in line with NIFTY. But as long as it stays above (760-11 = 749) you are in profit.

Margin needed – 73,550 INR

Premium received – 13,550 INR

So total effective amount needed to short this option – 73,550 -13,550 = 60,000 INR

Now the second magical fact is you get that amount you can net as maximum profit in the single option sells before hand and can be used as your margin hence decreasing your effective amount needed to short.

If all goes right then 13,550 INR profit on 60,000 INR employed in this current month.

The third magical fact is due to theta; the value of the option will decrease and hence you can exit the trade or use your profit as your effective stop loss afterward.

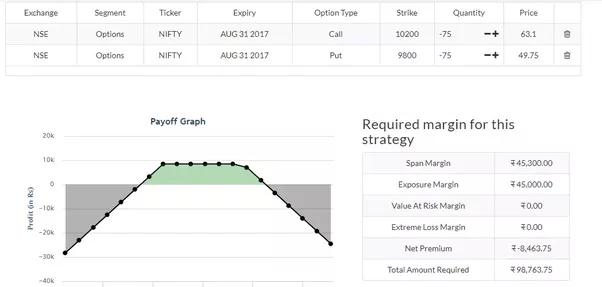

NIFTY Options Strangle Strategy

Here goes another setup –

Sell NIFTY August 9800PE at 57.20

Sell NIFTY August 10200CE at 50.25

Here is another good setup –

Initial credit = 50.25+57.20 = 107.45

Downside breakeven is = 9800-107.45 = 9692.55

Upside breakeven is = 10200+107.45 = 10307.45

So as long as NIFTY stays inside 9692.55 and 10307.45 you are in profit.

Isn’t it good and less horrible than taking a directional bet? It will start generating money spot on as long as NIFTY is staying in that range which is a huge range.

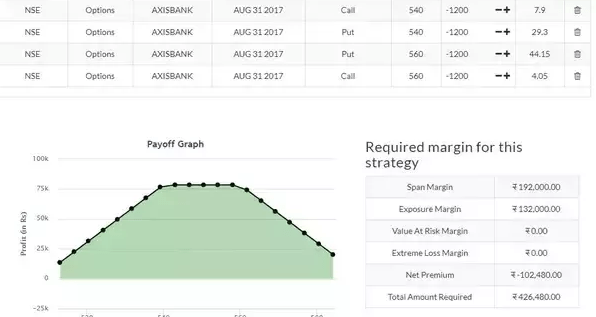

AxisBank Options Straddle Strategy

We are just assuming that they are sold right? Let’s say I am bullish on Axis bank. Instead of buying futures we can sell according to this following setup –

Even if Axisbank stays between 513 and 584 you will be in a profit of at least 10,000 INR. Our highest profit is 78,480 INR and that too will happen if Axis just stays between a range of 540–560. That’s a 20 point range!

Guess our employed capital? 426,480.00 -102,480.00 = 324,000.

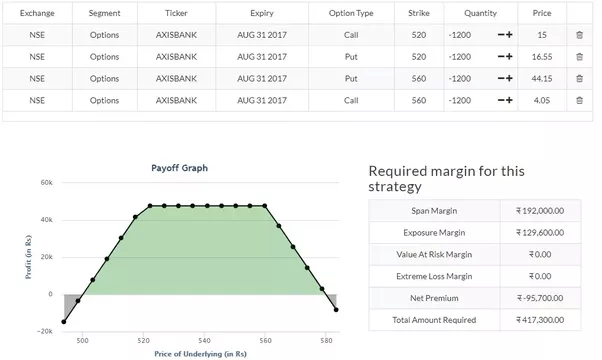

AxisBank Options Straddle Strategy Extended

Similarly, if you say I don’t like the range of 513 and 584; I need more leg room towards downside; that can be arranged too.

Your highest profit here is 47,700 INR and you attain this if Axis stays between 520 and 560; that’s a 40 point spread of maximum profit.

You will stay in profit as long as the Axis bank stays between 500 and 580 before this expiry. But the loss of profits in 500–520 and 560–580 range is drastic.

Guess our employed capital? 417,300.00-95,700.00 = 321,600.00. Lower than the previous setup!

As is says – Each trader has his own appetite. What’s yours? 🙂

In case you need help, here is people’s votes –

One Comment