Hello,

It is said if you arm yourself with specific knowledge, accountability and leverage; You will end up rich one day. Let’s talk about insurance – Most people know about insurance industry terms such as premiums and claims. Look at the risk insurance companies are taking.

Will you give someone 1Cr cover if they give you 490 per month? Translating to trader’s language, he is selling an option with an unlimited loss to gain 490 INR. But they are so much profitable that they hired Akshay Kumar to pose!

So, We decided to sell BankNIFTY Weekly options. Previously it was used to fill the blank margin to mint overnight benefit of time decay in Hydrapoint but the profitability was too good to be ignored. Hence, a standalone system is created –

- Options are sold on directional view with stop loss.

- Options are sold to bet on a range with different risk management which I call Martingale system.

- Options are sold on Thursday on when the contracts expire with 5x more leverage thanks to the brokers.

- Options are aggressively laddered up and down to increase the risk and reward both.

- Options are sold based on vega to mint on high VIX events.

In short, it became too complex. Choosing the correct trade and Executing the trade are two different things! Trade spotting was always fine. What created a problem is trade execution.

- Zerodha API cost 2K INR per month for automated trading.

- Upstox API cost 500 INR per month for automated trading.

- Angel Broking Sub Broker Terminal requires me to validate each trade from the customer once before it is being placed.

But if a client gives 24K in just API cost. How he is supposed to make for himself unless he has a huge capital. The solution that came out was filled with latency. That is a story of another day.

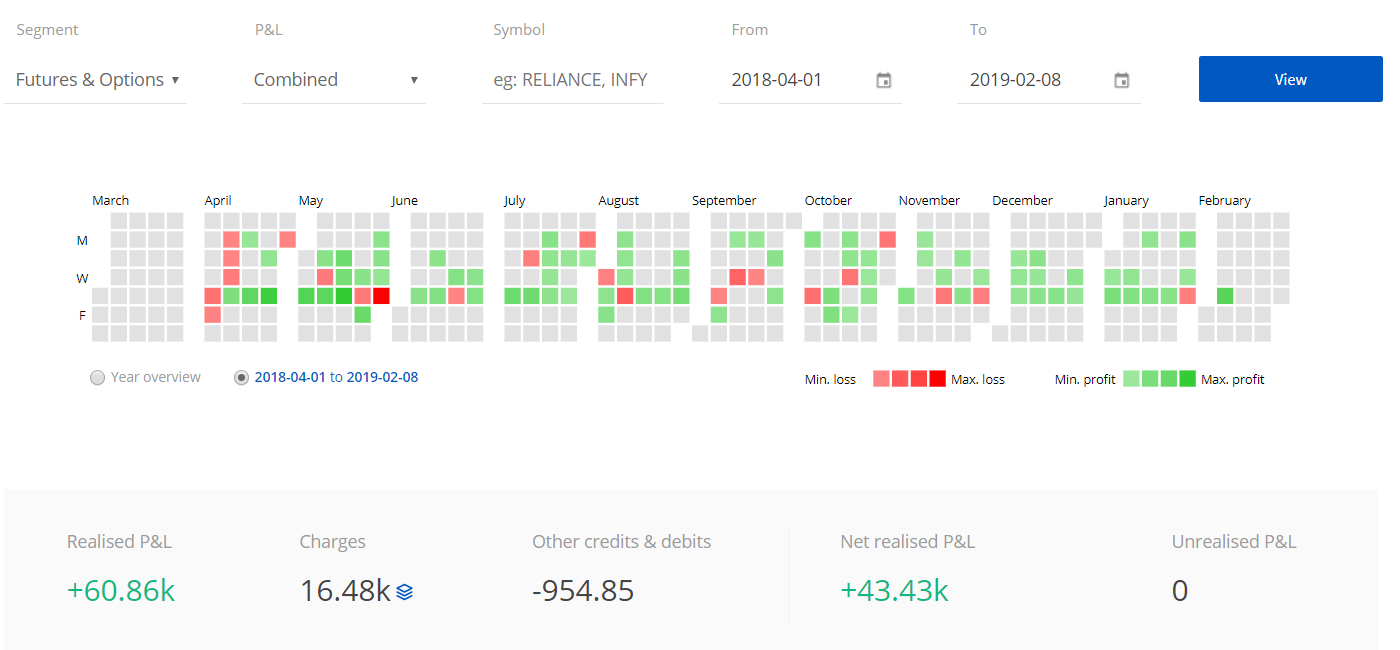

In short, this is the outcome. The profit is not re-invested as a margin to embark a new trade. In that sense, even after deducting 30% profit share of mine 30401.83 INR is the gross profit so far on 150K which is like 20.26%.

But, this result is not at ALL satisfactory.

Three major events happened this year!

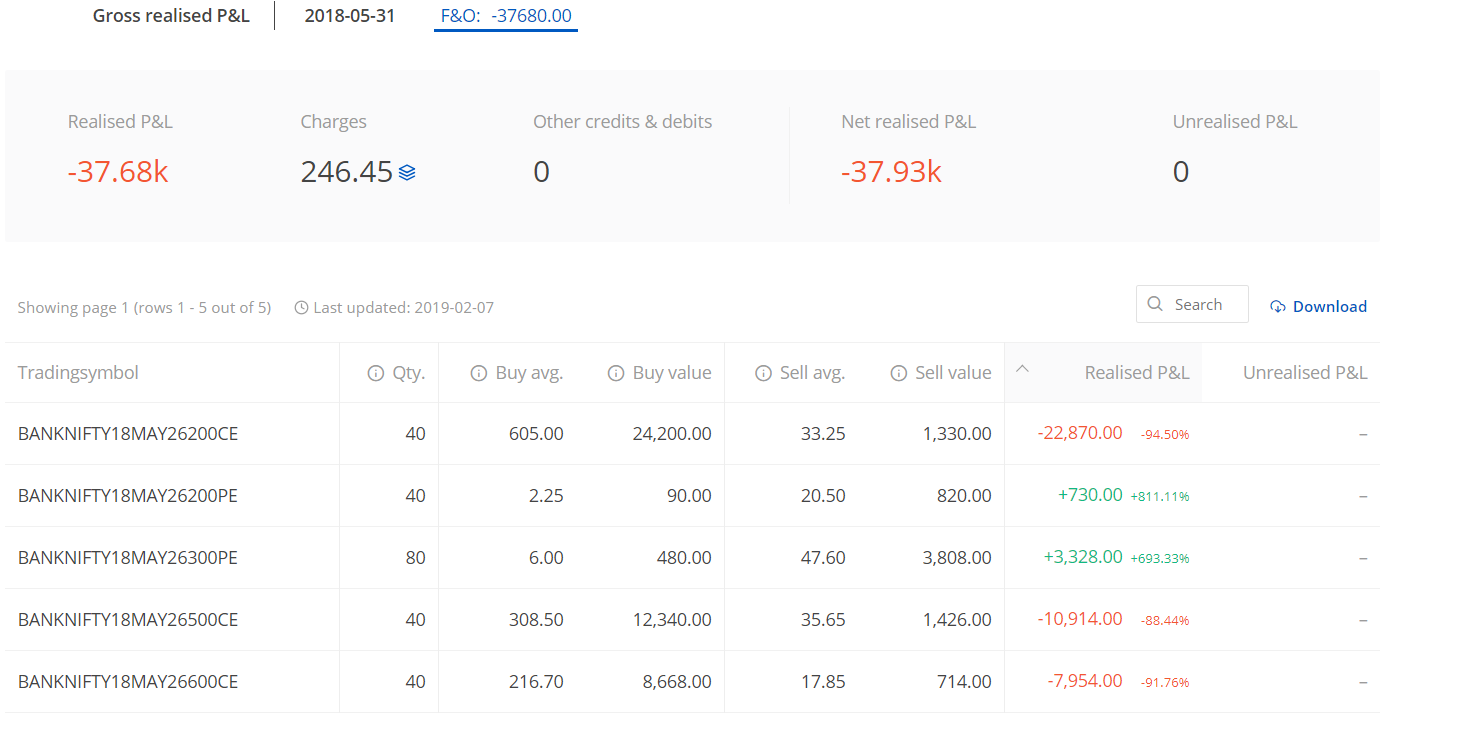

31st May Theta Loss

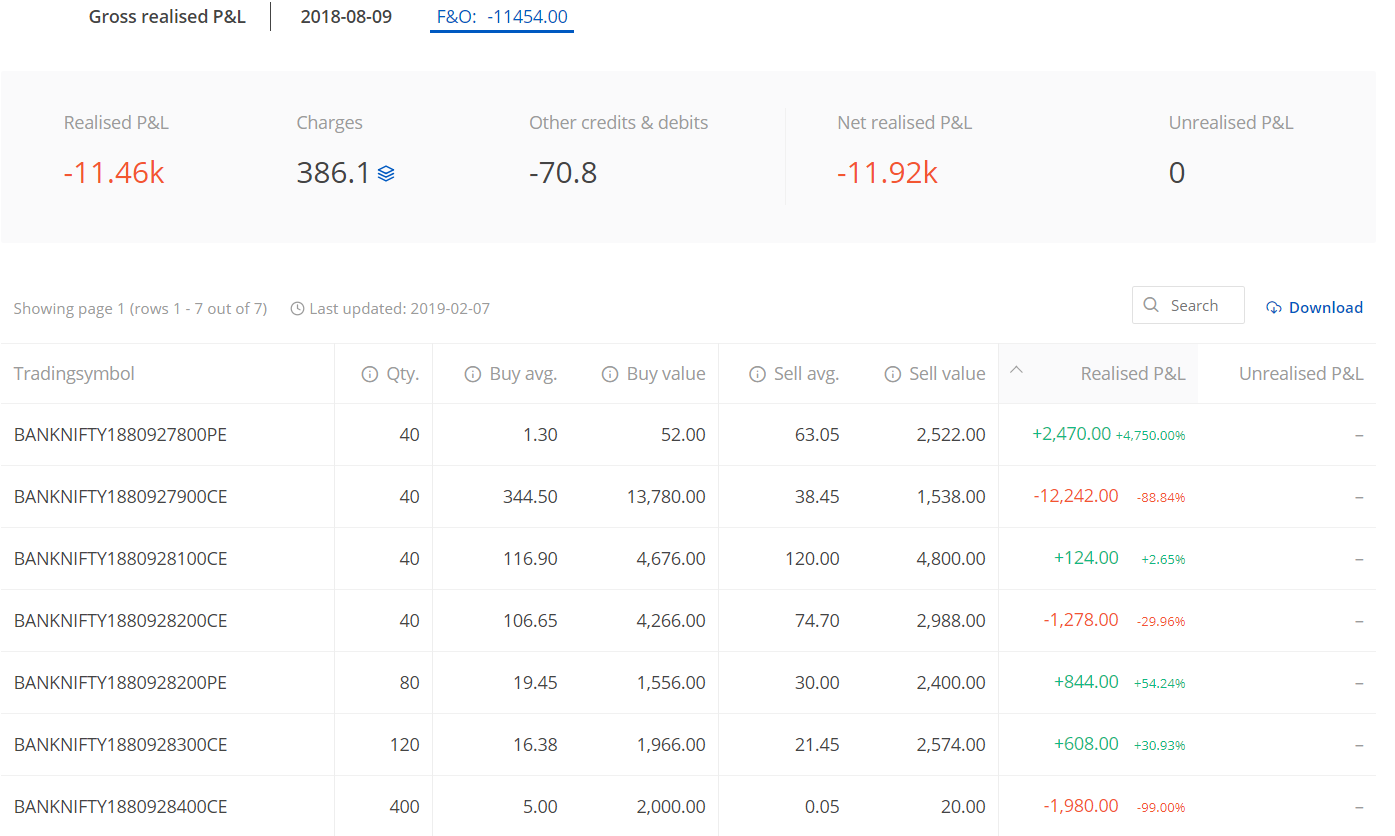

9th August Theta Loss

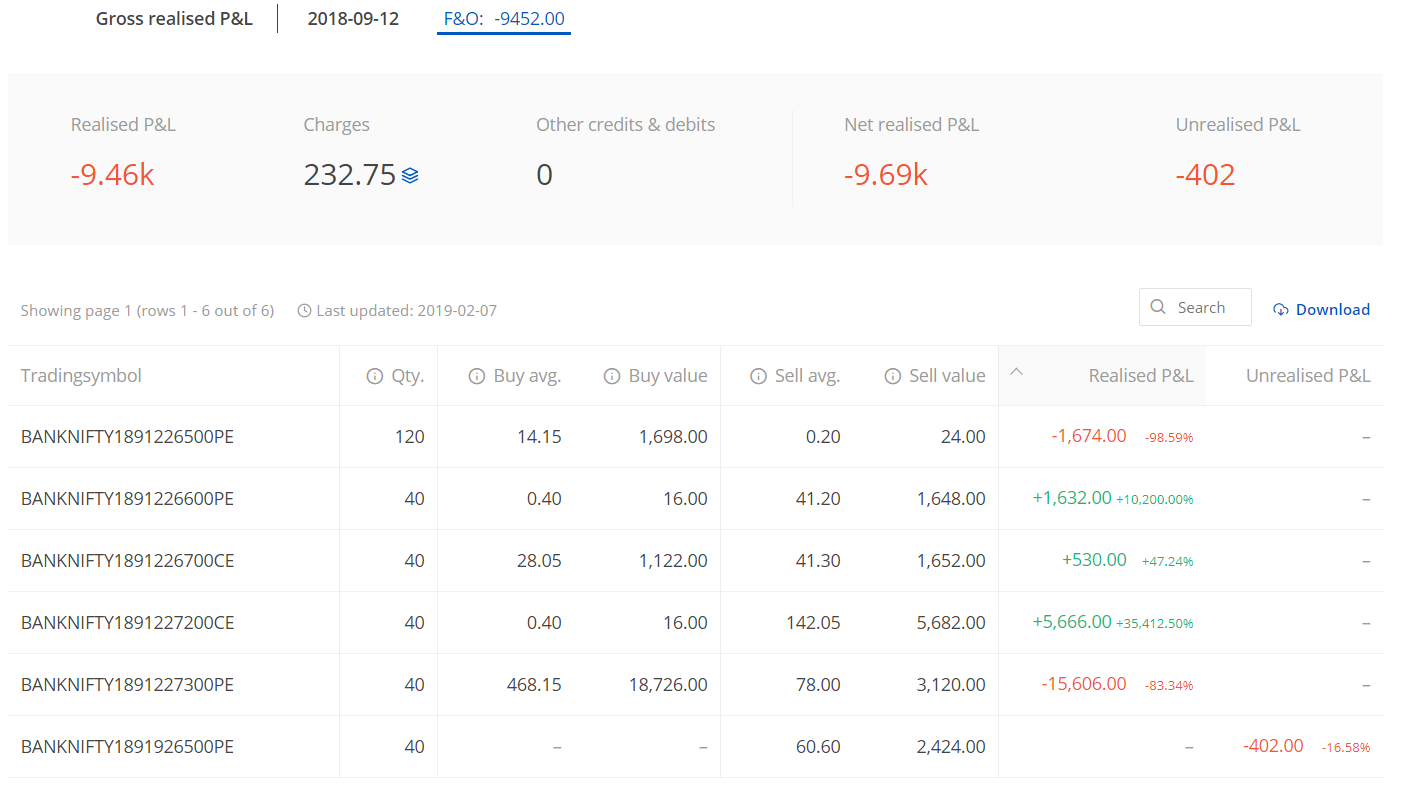

12th September Theta Loss

What is clearly evitable is three days eroded 37.93+11.92+9.69 = 59.54K. But clients mapped in Upstox doesn’t have any significant losses on these days. What happened here is BankNIFTY gave an outbreak in the very last minute.

When this happens, due to huge active members in Zerodha, things started to go worse –

- You can not buy OTM CE,PE (Well, sometimes apart from ATM everything gets blocked) to hedge wrong trade.

- The movement of PE, CE legs go so rapid that stop losses won’t work.

- Then comes the freezing moment. You close the trade, it shows in the system and order stays stuck on order book. You put another order to close it. Sometimes the previous order gets automatically cancelled, sometimes both get executed making a reverse order altogether.

- Now different account will generate different problem due to this, The complexity increases so much that it requires manual intervention which is time-consuming and hence turns out to be expensive.

Now, what happens when an account holder of 150K margin loses 37.93K on a single day. It is problem for a trader too as We are getting left with 110K margin the next day. Now, Different account has a significantly different margin from each other increasing the complexity. Recovering 37.93K with 110K effectively takes huge time and One can not afford to draw more drawdown as well! Now, with God’s grace, all things got recovered.

Now imagine – What if the loss wouldn’t happen in the first place? The returns will be astronomical.

If one files a case against broker using NSE Arbitration Panel, there is a high chance of winning but again, the time involved there and the headache mess is not worth the money. One should embrace accountability, and take business risks under their own name. Otherwise, Society doesn’t reward you with responsibility, equity and leverage!

The Intraday Systems

So, We’ve completely changed the intraday system. In fact, separated it! Previously there used to be the same trade in all accounts. Now it is a different set of trades generated at a different time of expiry day. Accounts are chosen with a randomizer. All have their own set of risk management predefined and diversified.

The Lavania Model

This is the current sheet right now –

https://docs.google.com/spreadsheets/d/1iDQa9Xcny7e-5C35A9eZy_-5Vh-Anrj60rYOZIqX-vQ/edit?usp=sharing

But gauging investor sentiment, a new system is developed –

https://docs.google.com/spreadsheets/u/1/d/1BZjjFKUlDmC-OrVrq5ZM4quUTb0cukq7ax8FHa1tuVI/edit#gid=0

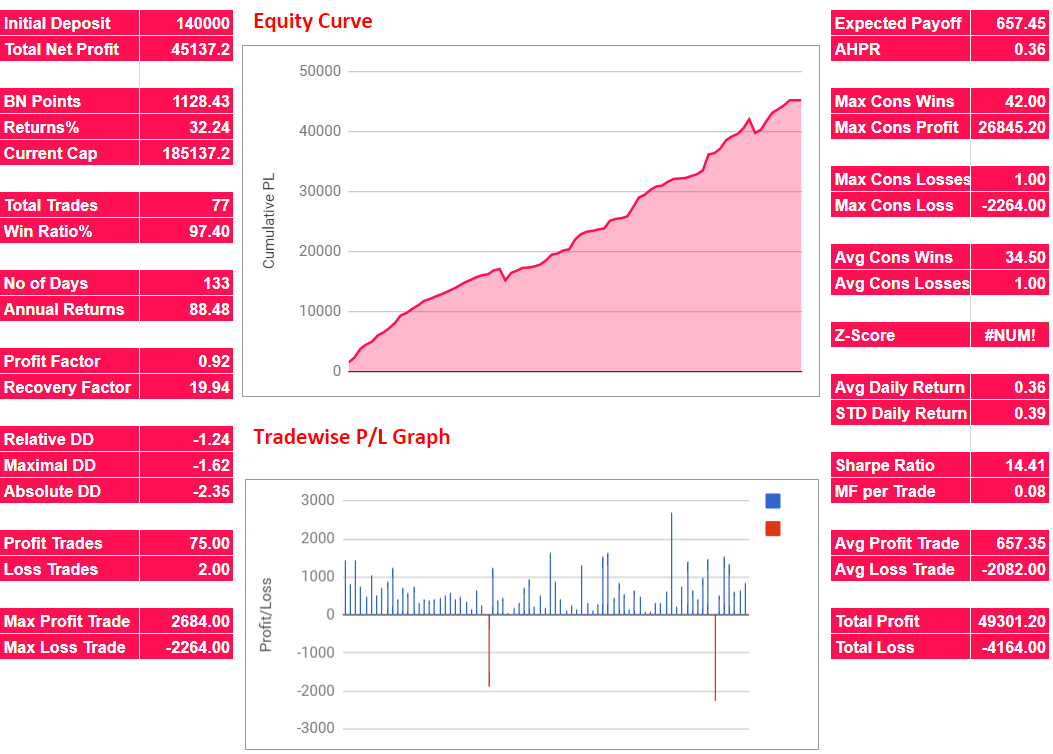

- The Number of trades is significantly low.

- Maximum loss per week is capped at 4K per 200K.

- The win ratio is terribly high.

There are only 2 loss trades out of 77 trades and there has been no loss since 19 weeks.

But, there is no chance of making any significant high profit in this system due to the construction of the system doesn’t allow to do so. But it is consistent, steady!

Our Current Theta system is slightly aggressive than Lavania model, We also developed a totally different system for different margins. 65k, 100K, 150k, 200K, 300K. (Lavania model can work on any margin due to its construction towards market neutrality and conservative risk management.).

Right now, things work like a lego model. If someone has 500K. He will be automatically allocated to 200K and 300K with a totally different risk management system. We’ve completely stopped taking random accounts. All accounts under SB has better control over execution. Let’s focus on growing vertically than horizontally.

- Trump China Issue.

- HDFC FII Limit News.

- IIFL Scam.

- INR Devaluation.

2018 was a year of volatility and We did great so far selling insurance in this fearful market. Also, from Monday, NIFTY is joining weekly series. We can expand the AUM to double without disturbing the risk metrics.

Still, there are seven more expiries to go until April 1!

– Amit

PS: Thanks for being in Unofficed.