Hello,

After the last two months of heavy firefighting in high VIX, we had a bullish outlook in March. It got trumped when Martingale leg had to close on the high amount of loss as it breached Relative drawdown of 20% in a single gap down.

But this is an absolute drawdown of 20% this time. (Relative Drawdown is called Absolute Drawdown when it hits the capital.)

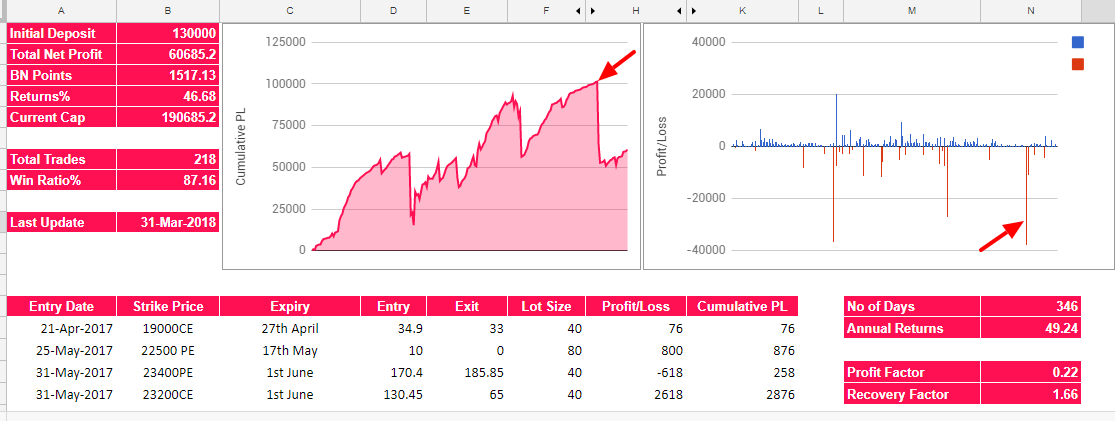

In our original strategy which was started with 1.3 L quant had erosion of profits only but those who joined later, experienced erosion of capital causing huge panic.

You can see both here – https://docs.google.com/spreadsheets/d/1iDQa9Xcny7e-5C35A9eZy_-5Vh-Anrj60rYOZIqX-vQ/edit?usp=sharing

The same trades will look like a disastrous strategy for a late investor.

The same trades will look like a disastrous strategy for a late investor.

When the maximal drawdown is hit in scenarios like this. We can not sustain on that same trade due to risk measurement. The trade will aim for more higher drawdown though previously we aggressively had recovered, that was the case when our capital was not hit by drawdown.

So trades had been cut. Risk Management is updated to a tune so that we do not see another drawdown more than 10%. (When you hit maximum drawdown promised, you need to recover with very low-risk trades.)

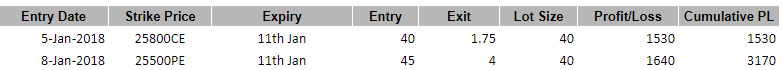

Overseeing all the disastrous trades, it is evident all three happened due to Gap up or Gap down scenarios. As well as, we can see huge profitability on Thursday trades.

Another main problem is with our broker’s API connectivity becoming laggard (Maybe because they were migrating from Kite2 to Kite3?) causing a huge slippage (which is solved now) and margin imbalance. (Different people are asked different margin for same trades which is still unsolved.)

Going forward –

- All accounts didn’t hit absolute drawdown. They will continue to recover aggressively and most of them have already recovered thanks to the calm expiry.

- Overnight positions will be limited to half (one lot) and directional. On Gap up or downs, we shall have enough margin to make it delta neutral in that case.

- To solve margin imbalance problem, on Thursday we will fire all trades starting from lowest risk to highest. So the account having margin problem will get low-risk trades first and high-risk trades get blocked.

- On Thursday, we won’t close OTM CE PE trades as though Zerodha charges 23.6 INR per closure charge, we will actually benefit out of it.

On Manual close, we used to close at 2-4. On 15:20 auto square off, trades will be closed on 1-2 giving us 80-120 INR more profit (also, making Zerodha rich in the process.)

Due to infrastructure, problem investor accounts’ returns are varying from -12k to +31k range. (There are few lucky people who missed the loss trade(s) thanks to broker’s timeout) You can tally your trade book with our trade sheet here. We aim to stabilize that by utilizing free margin in other profitable strategies like we already tried our hands in intraday stock short selling and NIFTY Martingales. Investors are asked to show the loss in Income Tax and so that it can be adjusted in subsequent years.

We have migrated all old customers to new pricing structure which is effectively the percentage of profits. You are advised not to trade on your account from this point.

There are certain compliance issues for few investors because of the percentage of profit model. You will be sent details in that case.

Also, we have started a new product based on expiry trades on Upstox (which is currently free and available on request) taking their leverage as our weapon. It has been disclosed formally to the public yet but many investors have already made a handsome profit out of it.

Outlook – We believe the market is on verge of breakout or breakdown. So, we shall aim for strike prices with high vega to slaughter them on theta on mean reversions.

Return – Our master account stands at 46.68% returns from inception and Alpha Theta stands at -19.02% since inception.

Due to an imbalance of returns, we are taking the trades with the highest loss as a benchmark. If your returns are less than this which is highly unlikely, We’ve already taken countermeasures to fill that gap with intraday trades.

-Amit

PS: Thanks for being in Unofficed!