The story of Suntv and Zee Entertainment

My childhood friend works in my IT company with me. His dad invests small amounts of surplus money in the stock market. But he generally calls me. Here go conversation couple days back-

– What should I buy? I’ve 5K with me. I don’t need this money right now.

– Buy Vedanta. It will give you a dividend. Metal Cycle will revert post trump tariff issue and technically it is a buy setup too!

– But, my friends are buying IT stocks. I was thinking of Infosys or Lupin.

– Just do as I say. I’ll tell when to exit.

In the end, He invested in Vedanta. It’s not a fictional story. I bought around couple crore worth of shares in the client accounts I manage. I posted a chart with technical entry and wrote the rationale in my trading diary.

The actual term is Sector Rotation.IT and Pharma stocks are going to the moon for the last couple months but where is the money coming from?

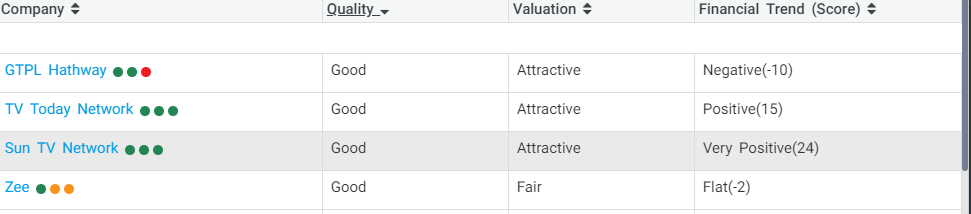

Sector rotation is about the movement of money from one industry sector to another. You can see all the private banks have been started bleeding i.e. HDFC Bank, Kotak Bank, IndusInd Bank. All the FMCG stocks are shooting up like anything. Similarly, the entire media sector comprising of Zee India, Suntv, TV18 is distressed now.

In fact, as per Dow theory, the entire media and metal stocks are in the bear market. Last year, entire IT and Pharma stocks were in distressed.

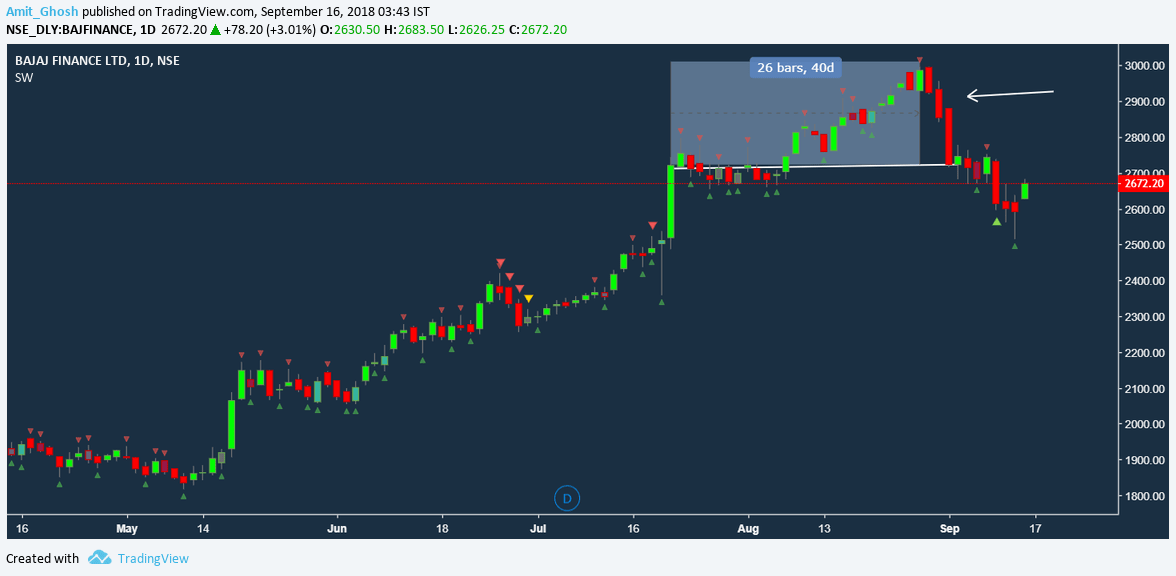

The trend is your friend.People who know basics of the market will put more money on the stock which already is overvalued making it bubble. Investors like Basant Maheswari rides the bubble. When bubbling bursts which it always does unless the stock maintains its astronomical results which is a tough job, you can see the effect in Bajaj Finance.

It took just 3 red candles to erode gains of the previous 40 days. It’s a mini stock market crash for that stock.

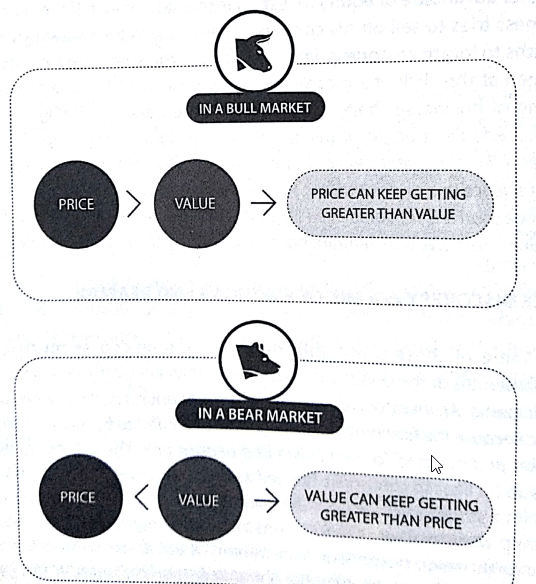

Now comes the amazing part. Price is what you pay and Value is what you pay. But we need to know about the term Contrarian Investing.

Contrarian Investing is an investment strategy that is characterized by purchasing and selling in contrast to the prevailing sentiment of the time. A contrarian believes that certain crowd behavior among investors can lead to exploitable mispricings in securities markets.

This leads the stocks which are already crashing will have negative sentiment from people like my friend’s dad. In plain simple sight, what goes down keeps going down. The common perception of Newton’s 1st law.

It leads to –

Now the question comes to this – Would you regret if you had bought Infosys at 500 (CMP 733) or Auro Pharma at 600 (CMP 800) last year?

The term bear market can also be stock specific. PC Jewellers crashed from 600 to 80 is a stock market crash for that stock! But looking at the recent fall, the sentiment will stay negative but again will always catch up.

Unlike Vakrangee they have real stores in Delhi which you can verify!

The entire sector’s valuation is cheaper than the price you’re paying for it.

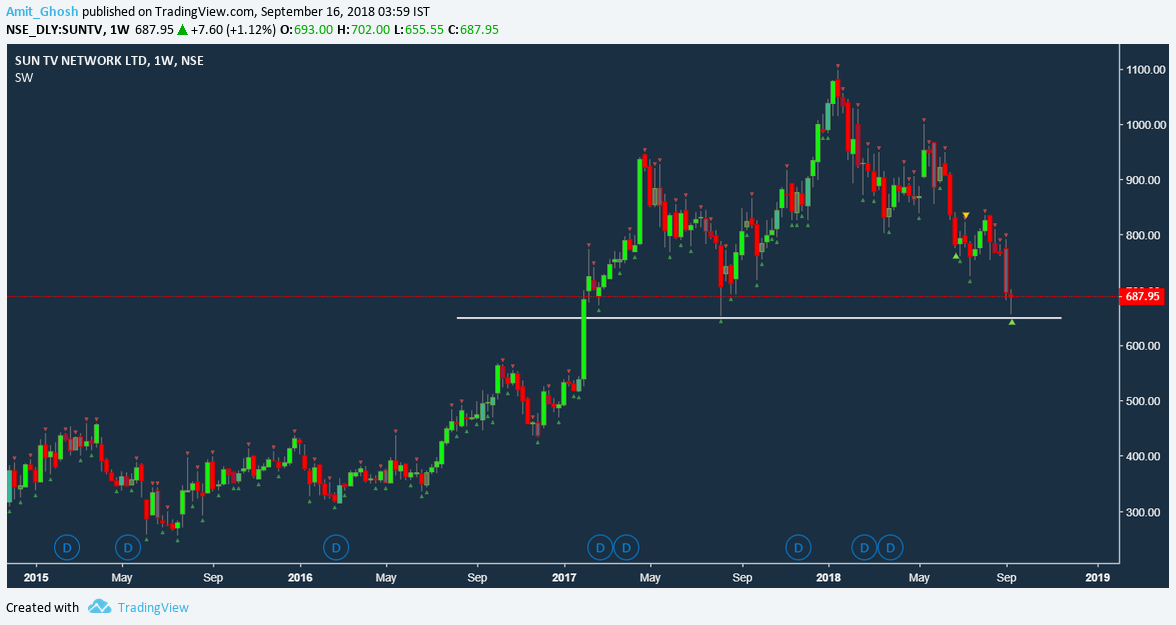

Just buy SunTV with a stop loss at 650 will be the current verdict. If it falls more below then it should be bought at 500 levels or 650 levels again when it comes back up.

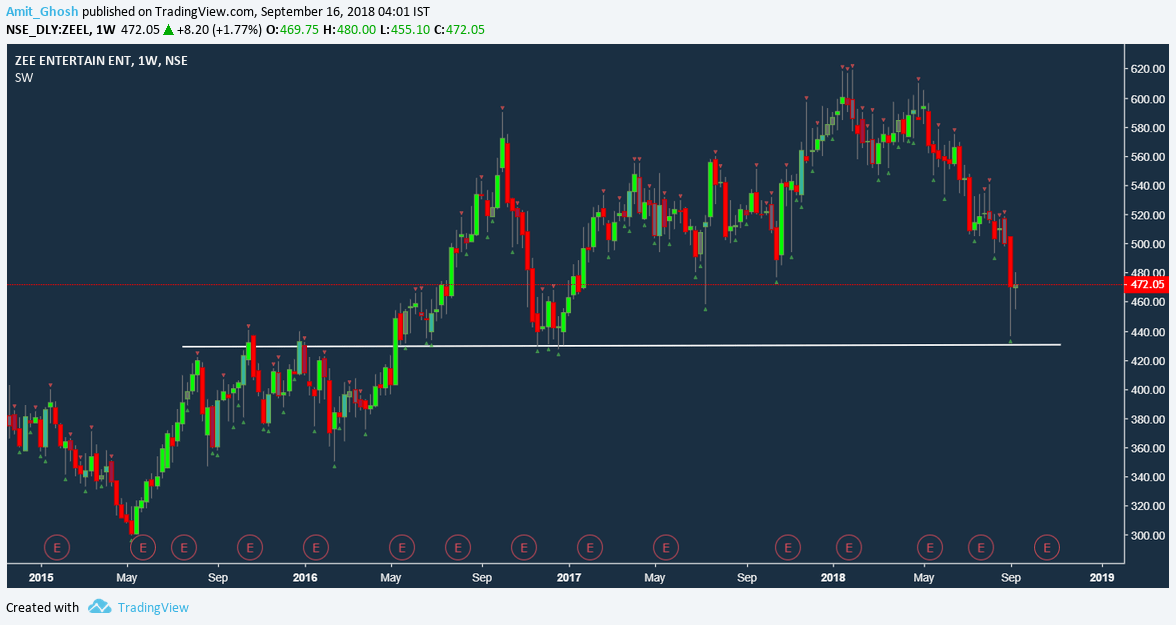

Also, you can buy Zee Entertainment with a stop loss at 400 will be the current verdict. If it falls more below then it should be bought at 360 levels or 650 levels again when it comes back up.

The stock fell because of negative sentiment in the entire media sector – Hence investor money flow is dried up! But if you buy now, your risk to reward is amazing!

You can just look at the above charts. They are moving in a synthetic way like Headless Zombies. So if one hits stop loss; so will the other one. If it does do that, don’t fight it, let it fall to the below said levels in that case or buy when the downtrend is dusted.

Awesome story. Would like to talk or chat with you. Kindly suggest.

Regards

Anand

8095827592