The story of economic moat and cyclicity

We were discussing on Economic Moat on the slack when the discussion came up.

In business, I look for economic castles protected by unbreachable moats. A truly great business must have an enduring “moat” that protects excellent returns on invested capital. The dynamics of capitalism guarantee that competitors will repeat assault any business “castle” that is earning high returns.

Warren Buffet mentioned this in one of his Annual Berkshire Meetings.

Reliance

Think of it

1. It has a moat!

2. It has more than one moats!

3. It has huge cash flow which is used to create more moat!

Now the dynamics of capitalism works in a reverse way here. Because of the news moat creation is backed by cash flow from other profitable ventures, the price is darn competitive. It itself assaulting the peers!

Dhirubhai Ambani’s polyester company Vimla was same. Low margin cost and high quality give the high-quality product in the lowest price tag.

![]()

Buffet invested in airlines. Entire airline stocks of the entire world shot up.

Then I read an article on Safal Niveshak. I did a short based on the fundamentals that Indian Airlines won’t be profitable like the US and other markets because of bad government policies as well as monopolistic nature of Oil prices.

I will suggest everyone read the whole article once.

It was written way earlier even before than Buffet’s investment. Indigo was not prominent back then.

Its one of the first articles in that blog, so it is lying unnoticed.

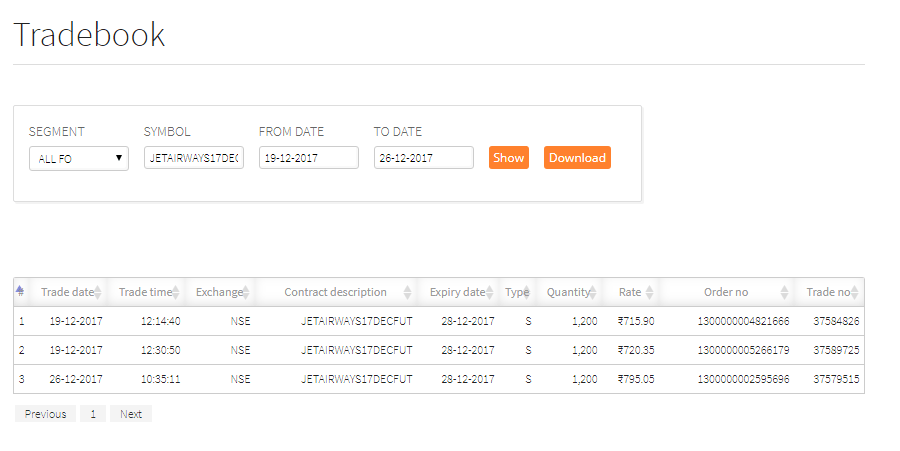

So, I had entered with three lots.

That month was pretty bad because I suffered a loss of 1.54L in a span of 2-3 days. The rise was ballistic.

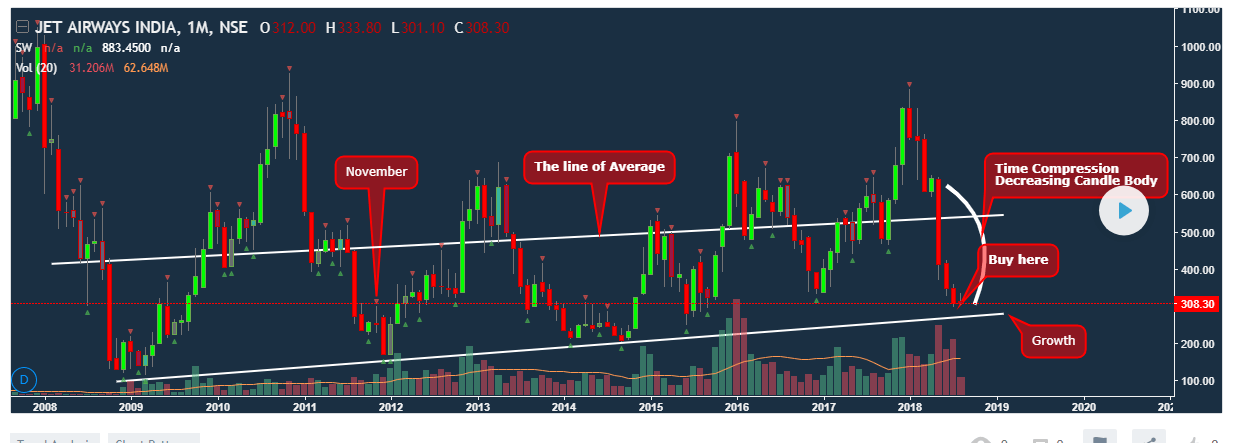

“Jet Airways – Buffet Euphoria and Story of a bear”

The euphoria was fuelled by Indian bull run and ended a bad death. Long-term investors didn’t get any money out of it. Traders made some, lose some.

Now, what is the point of discussion is –

When the Euphoria ended finally with a long consolidation at 300 levels. The market being inefficient didn’t discount the stock properly because of *investor sentiment*.

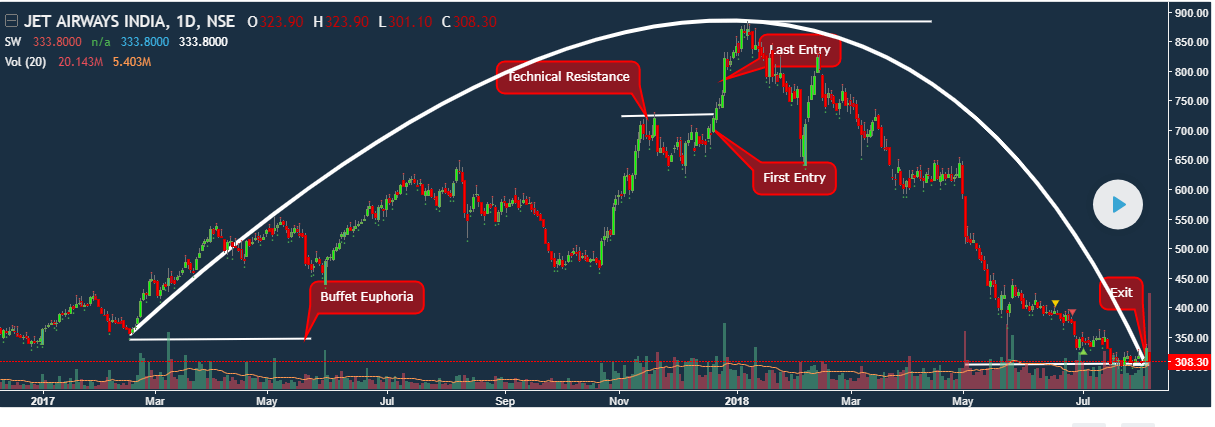

Here goes a snapshot of peers from Markets Mojo. The entire sector is red.

- Too much debt.

- Damaged with monopolistic oil pricing

- Damaged with over taxation

- Govt Policies are against the profitability of the business

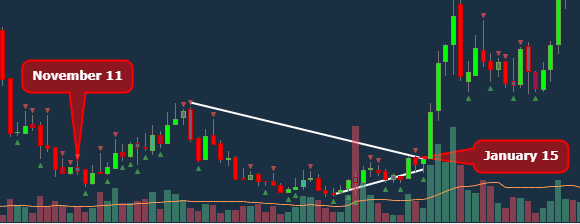

The article was posted on Nov 15, 2011.

So What happened to the person who invested in that day. I have marked it properly as you can see here.

He is in the same place. But the business is not. Domestic airlines are growing steadily. There is a slight increase in profitability of the sheets which is natural.

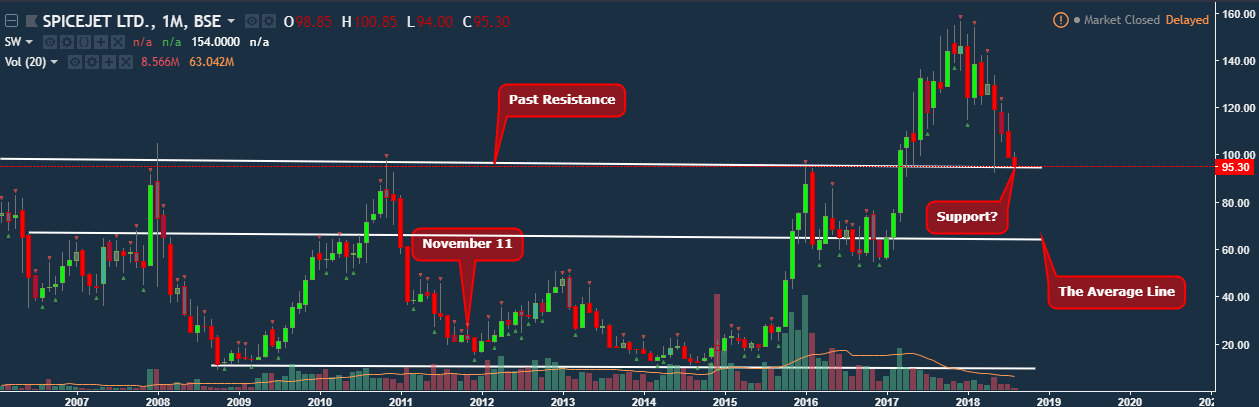

Spicejet did well. It was a crashed business but did comparatively well and gave a 400% return on investor’s money in the span of 8 years.

Well, at some point, it was 800%.

Does that mean the article writer failed to evaluate the business?

Evaluation of a business is not an easy task. The dynamics change continuously.

It also didn’t go anywhere for 4 years. There must be some fundamental shift happened in the month of January 15 that created 800% returns on 3 years. So, the article wasn’t updated and hence, all right!

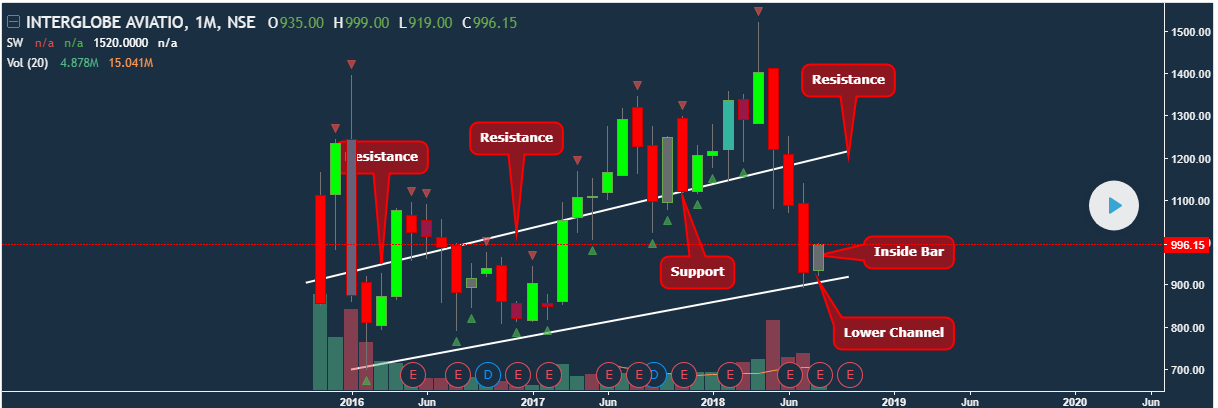

Indigo has IPO recently and it is also moving at the same pace.

Verdict = This business of airlines follows a cyclic pattern in the Indian Stock Market

The cyclic management theory

- Great Management + Great Business = Multibagger

Reliance

- Great Management + Bad Business = Cyclical

Tata Motors

Tata Steel

Indigo?

Jet Airways?

Spicejet?

- Bad Management + Great Business = Average Return

Indian Government is considered as a bad manager itself (at least in most of the cases). Almost PSU Banks will fall inside this.

- Bad Management + Bad Business = Multibagger (Loss)

Check your portfolio. There should be plenty of them!

I hope you guys got the trade!

![]()

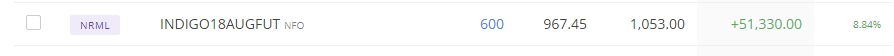

I have entered Jet Airways and Indigo as of now as –

- Jet Airways stopped falling.

- Indigo started reversing.

But, Spicejet is still falling! So, let’s avoid that bit. Jet Airways is currently closed as you can see here because of some rumors were going on and I didn’t want a gap down risk over the weekend. I will catch it up on Monday.

We should buy these two at the current price and wait till it touches the pivot line. By pivot line, I am referring to the line which acts as a support and resistance since months

If you have read this answer on time, You’re sitting over 50K profit.

[…] Metal, Energy, Airline, Good companies with Bad Management falls under cyclic […]

[…] Metal, Energy, Airline, Good companies with Bad Management falls under cyclic […]

[…] Ever heard, When Anne Hathway movie was getting released, Berkshire Hathway shares shot up because the algorithms were buying based on sentiment analysis shift over the term – Hathway? Yes, that happens here too, here goes another story if you’re interested – The story of economic moat and cyclicity! […]