What is Liquid Bees in Indian Stock Market

Most of the investors have surplus cash in their trading account and they cannot buy stocks due to lack of good investment opportunity. And, the money being in the trading account, will earn no interest! Now, You can transfer the money to the savings account but there are time and transactional cost involved.

That is where Liquid Bees come –

- Liquid Bees give daily returns as a form of a dividend which is tax-free because of Dividend Distribution Tax rule.

- There is capital protection. Hence, the risk is very low!

- The fund is very liquid. One can redeem Liquid Bees instantaneously when he/she needs money.

Liquid bees is an open-ended ETF that invests in a portfolio of Collateralised Lending & Borrowing Obligation (CBLO)/Repo & Reverse Repo with daily dividend and compulsory reinvestment of dividend. Compulsory reinvestment means your earned dividend will be acting as an investment in the next day.

Open-ended funds means it can issue and redeem shares at any time and one buys the shares from the fund directly and from that fund itself rather than existing shareholders.

ETFs (Exchange Traded Funds) are a good financial instrument to invest on that can expose to an index or a basket of securities or physical gold or other commodities and it trades on the exchange like a single stock. One can easily buy and sell the ETFs like any other stocks realtime, and in market hours.

Who owns Liquid bees?

Bees products were initially sold by Benchmark Asset Management Company which was bought by Goldman Sachs. Then Reliance Capital Asset Management (RCAM) bought it from Goldman Sachs in 2015.

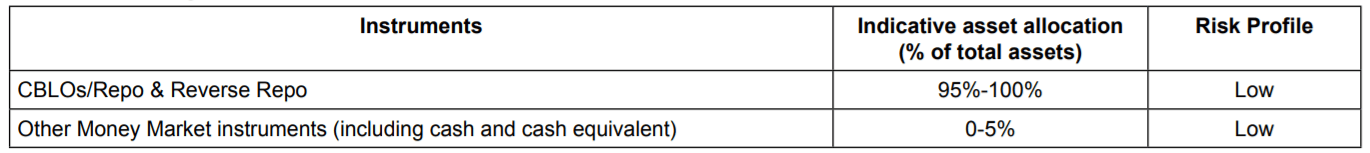

The allocation of money in Liquid Bees –

The allocation changes time to time as per SEBI guidelines which is rare considering it didn’t happen ever since inception. The correct timely data will be on the Reliance Mutual Fund website.

What is CBLO?

- The full form is collateralized borrowing and lending obligation. It is a financial instrument that represents an obligation between a borrower and a lender as to the terms and conditions of a loan.

- In this case, it is an RBI-approved Money Market Instrument backed by Gilts (bonds that are issued by Govt of India) as collaterals. It creates an obligation on the borrower to repay the money along with interest on a predetermined future date.

What is Repo and Reverse Repo?

- ‘Repo’ means the sale of Government Securities with simultaneous agreement to repurchase them at a later date.

- ‘Reverse Repo’ means the purchase of Government Securities with simultaneous agreement to resell them at a later date.

So, CBLOs/Repo & Reverse Repo in the Liquid bees allocation table are debt instruments and being backed with collateral as security it has low-risk exposure considering Government doesn’t decide to bail out which is highly unlikely. Due to the nature of low risk, the yield in the Liquid Bees is also lower.