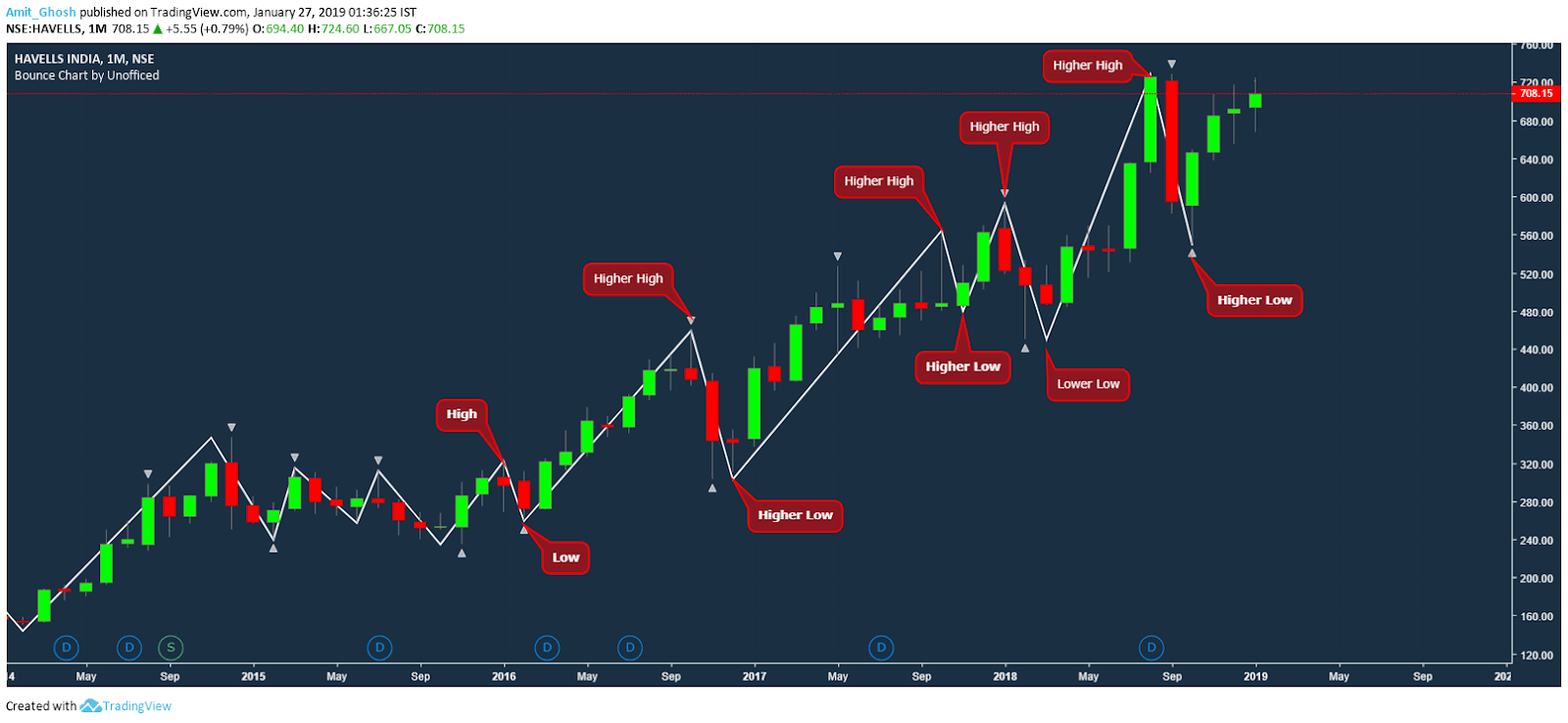

False Breakdowns in Uptrend

In this trade, We can clearly see that Havells is in a strong uptrend. It made neat Higher Highs but suddenly, one low is broken. But it continued to resume the trend effortlessly after this event.

This is called False Breakdowns.

As per our system, we should have stopped out here. The breakdown would cause huge past profit erosion as well as we are unable to make money on the up move followed by this event. How to avoid this kind of scenario?

This type of scenario is only caused by fundamental events. In this case, it is results. Sometimes results create unnecessary volatility. Now there are two ways to deal with these kinds of scenarios –

- By closing the trade before the results are out and taking the trade back after consulting the lower time frame after the results.

- Closing the uptrend only when a downtrend is created.

So, if we go by option 2, It is a SAR (Stop And Reverse) system. Either we are long in the trade or we are short in the trade. This method had its pros and cons. Although it completely eliminates the noise of a sideways trend, it also attracts higher risk and time cost as we are inside the trade even when it is consolidating in a sideways trend.