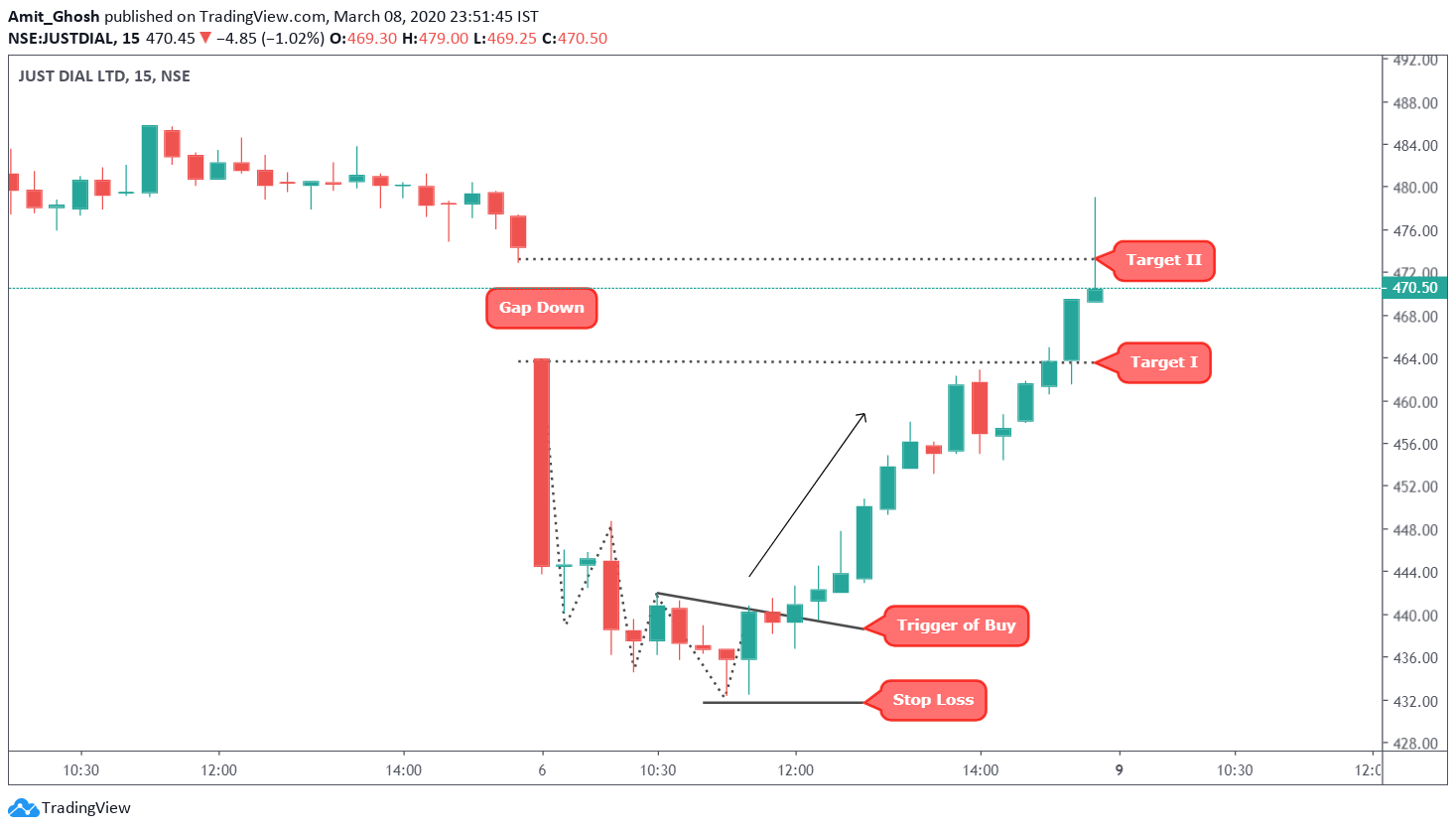

Bear Market Strategy: Bottom Fishing on Gap Down

Now, when a big gap down occurs to any stock along with the index (which happened last Friday because of CoronaVirus), the first thing that mostly occurs is more fall because of margin expansion triggering selloff from brokers.

After some point though, as you can see from the above chart, We can trade the stock with help of bounce theory because people having shorts cover their shorts creating a short covering.

- The initial gap works like resistance first.

- But if broken, the next resistance is where the gap fills.

It happens because of the long unwinding created by mostly intraday traders thanks to our inbuilt herd mentality. Also, because of that same reason, patterns emerge!

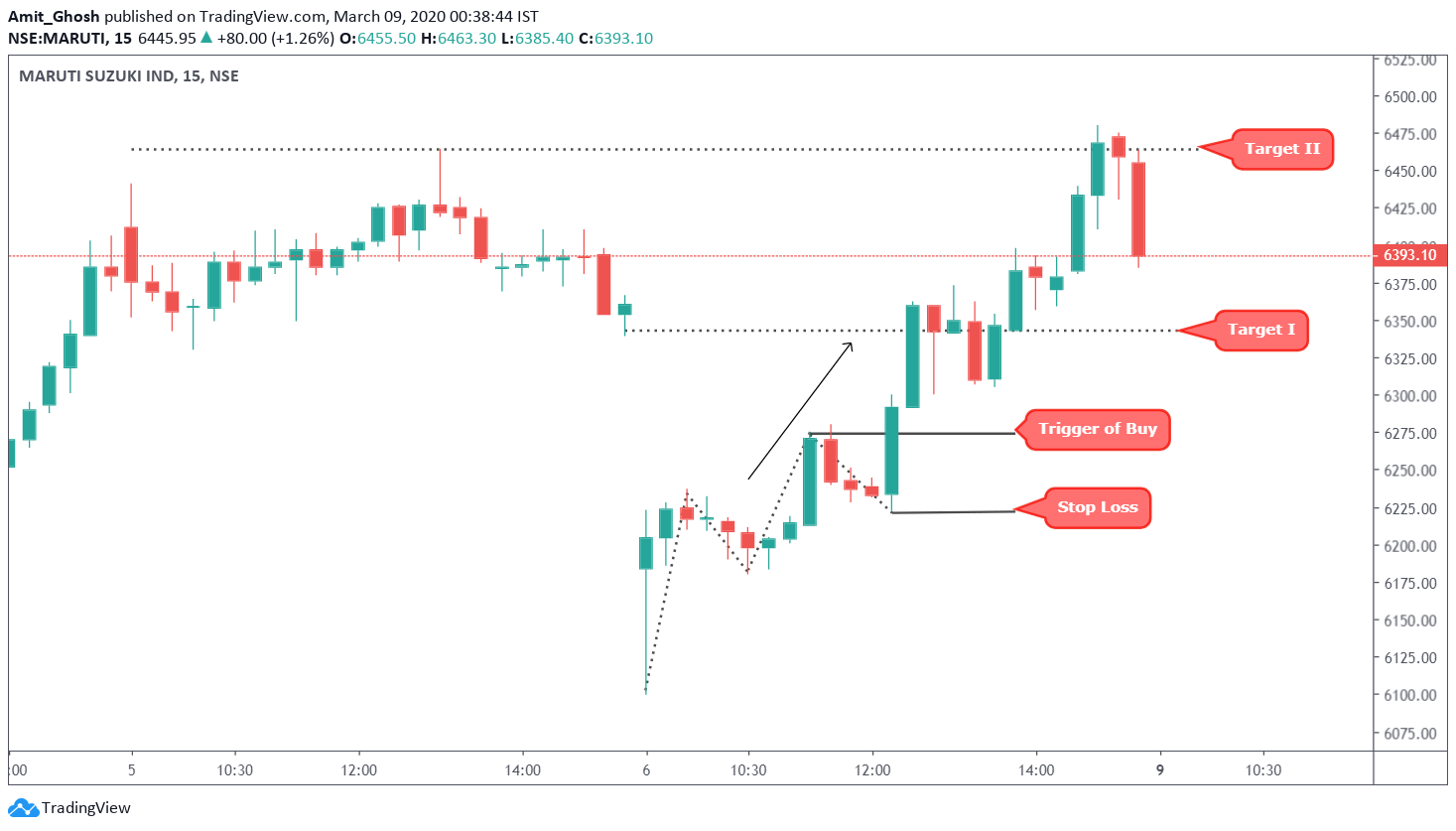

But, in the case of Maruti, We are not taking a contradictory bet. This is our basic uptrend trade. Although the targets are drawn using price action. The first target is where the gap fills. The second target is the highest point of the range of the previous day’s sideways trend!

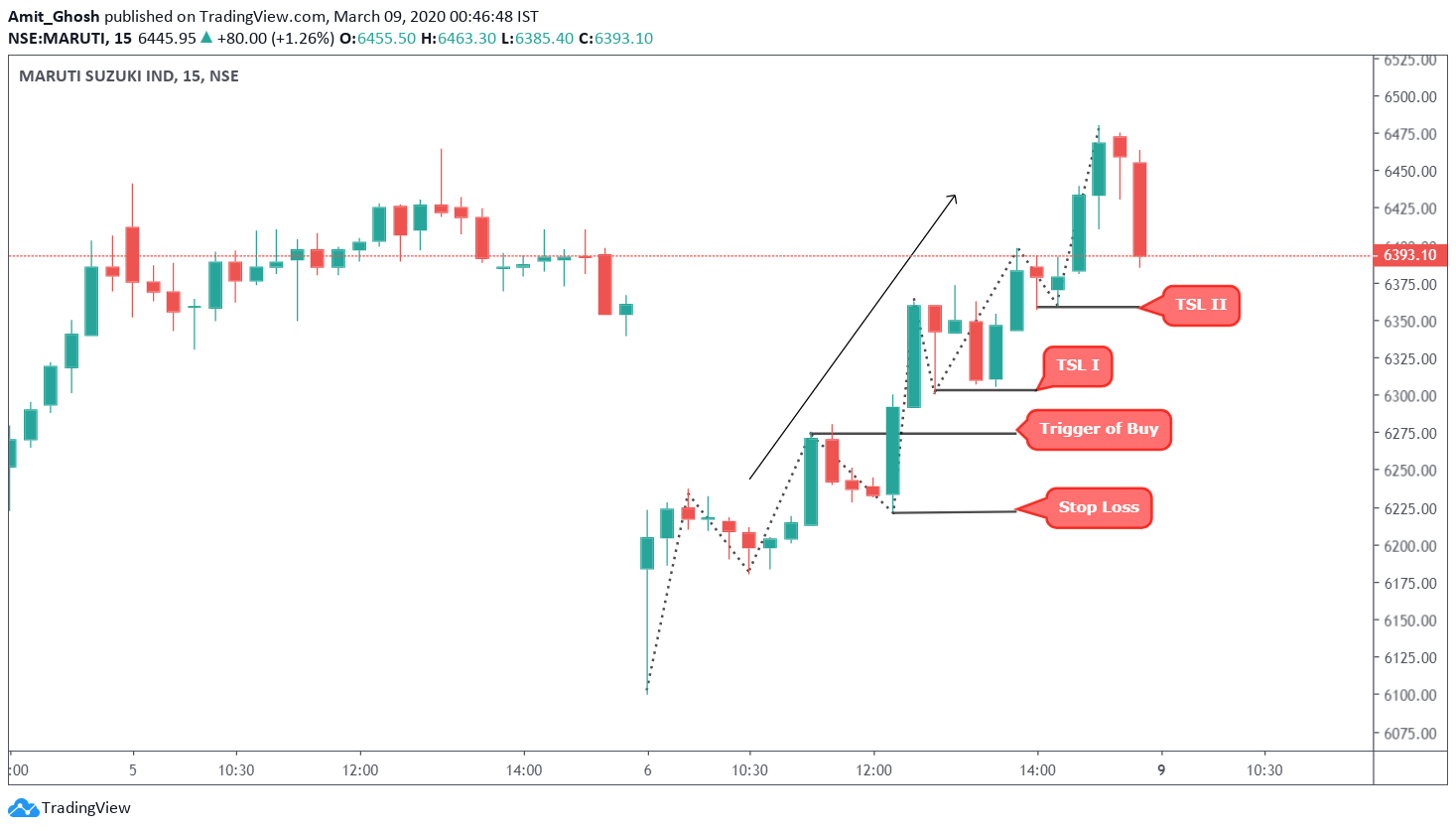

Alternatively, We can also draw the targets based on our trailing stop loss method that we have discussed earlier in Bounce as you can see in the above chart. In this method, The trailing stop loss didn’t hit. So, We have to close near 15:00 to avoid automatic square off from the broker and its subsequent charges!

Hi Amit, Didnt get yout buy trigger in the first chart of just dial. CAN YOU PLEASE HELP OR ELABORATE

THANKS IN ADVANCE

I think he means buy when the downtrend is broken (i.e when Lower High is breached) after a huge gap down.