Trend Analysis – Uptrend

Here goes the classic definition –

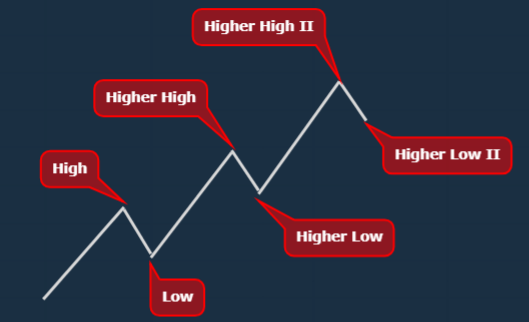

When a scrip makes higher highs and higher lows; that scrip is considered to be in an uptrend. We spot uptrend using the HHHL (Higher High Higher Low) Pattern.

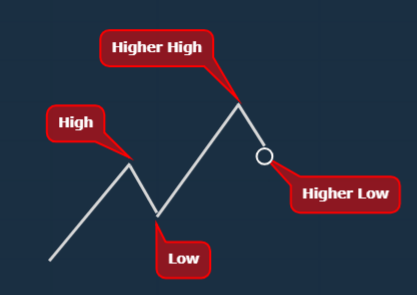

- Price makes an initial move.

- Then, it pulls back making a low. It is called retracement.

- Now, if it breaks the high it made previously; Higher High is achieved.

- Now to complete the whole setup, it can not retrace more than the previously made low!

Right?

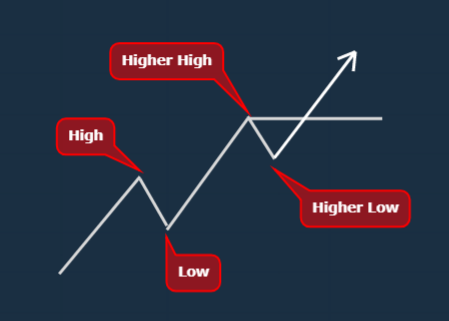

Now, when can we declare that HHHL Pattern has been confirmed? The moment it is confirmed we can declare that the scrip is in an uptrend.

|

The moment it breaks the Higher High, We can tell that our Higher Low is confirmed. Hence, Uptrend is confirmed! |

|

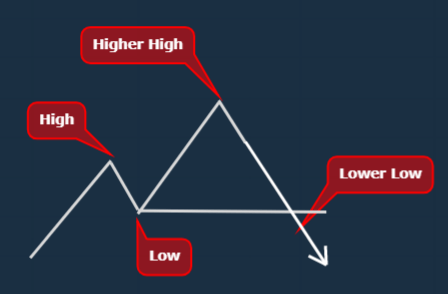

In case the scrip breaches previous Low without breaching Higher High; then it will automatically make Lower Low only. This invalidates our HHHL Pattern. |

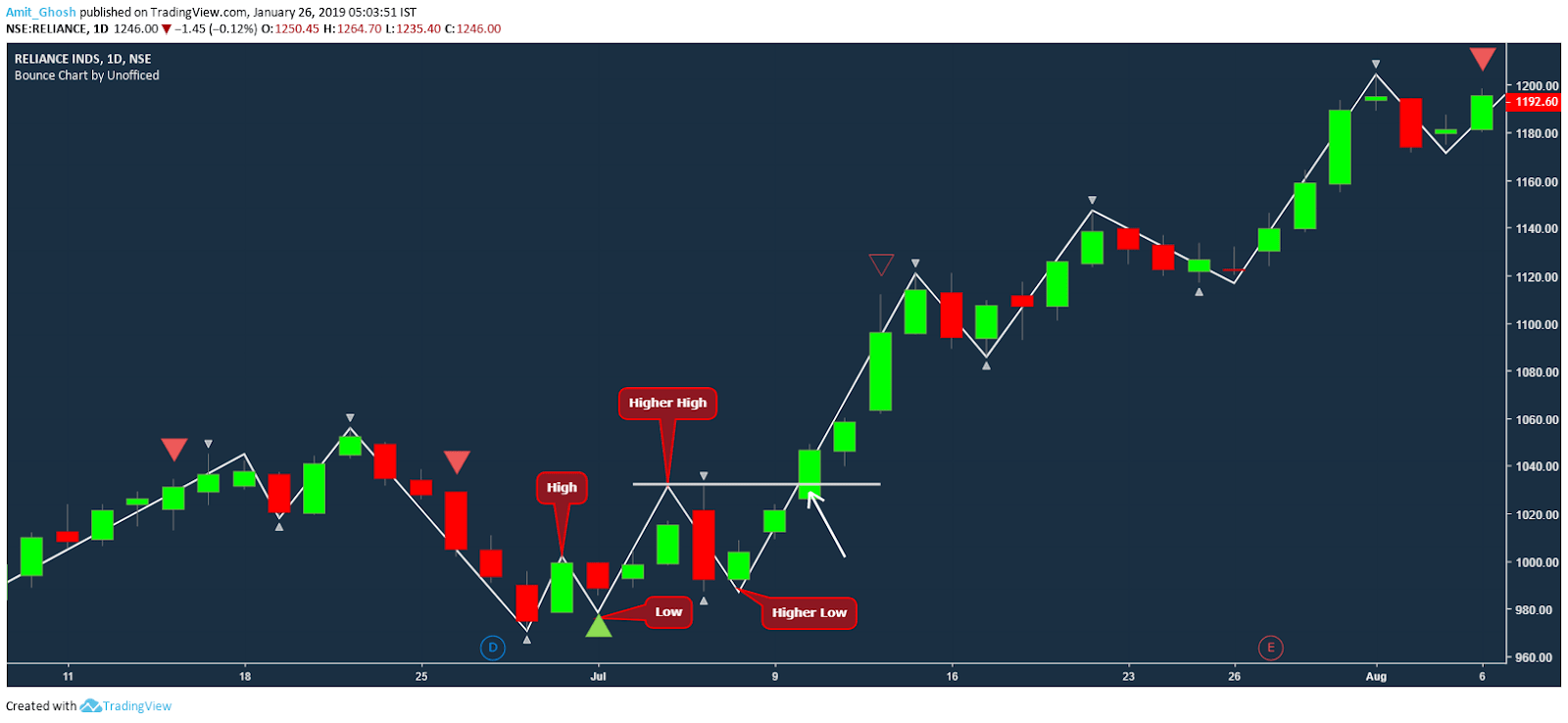

Let’s have a look at an example –

In the above chart, one can see the Uptrend has beautifully triggered.

So, What is the trade here?

Entry – We are entering the trade the moment the uptrend is triggered,

Stop Loss – We are putting the initial stop loss at the Higher Low created before the entry because if that breaks, it will not be uptrend anymore.

Target – Only Astrologers can tell where it will break the uptrend. If one exit early, one can miss a huge profit.

Managing the Trade – Every time a new Higher Low is created; We should move our stop loss to that new Higher Low to protect our profit!