Catching the Falling Knife

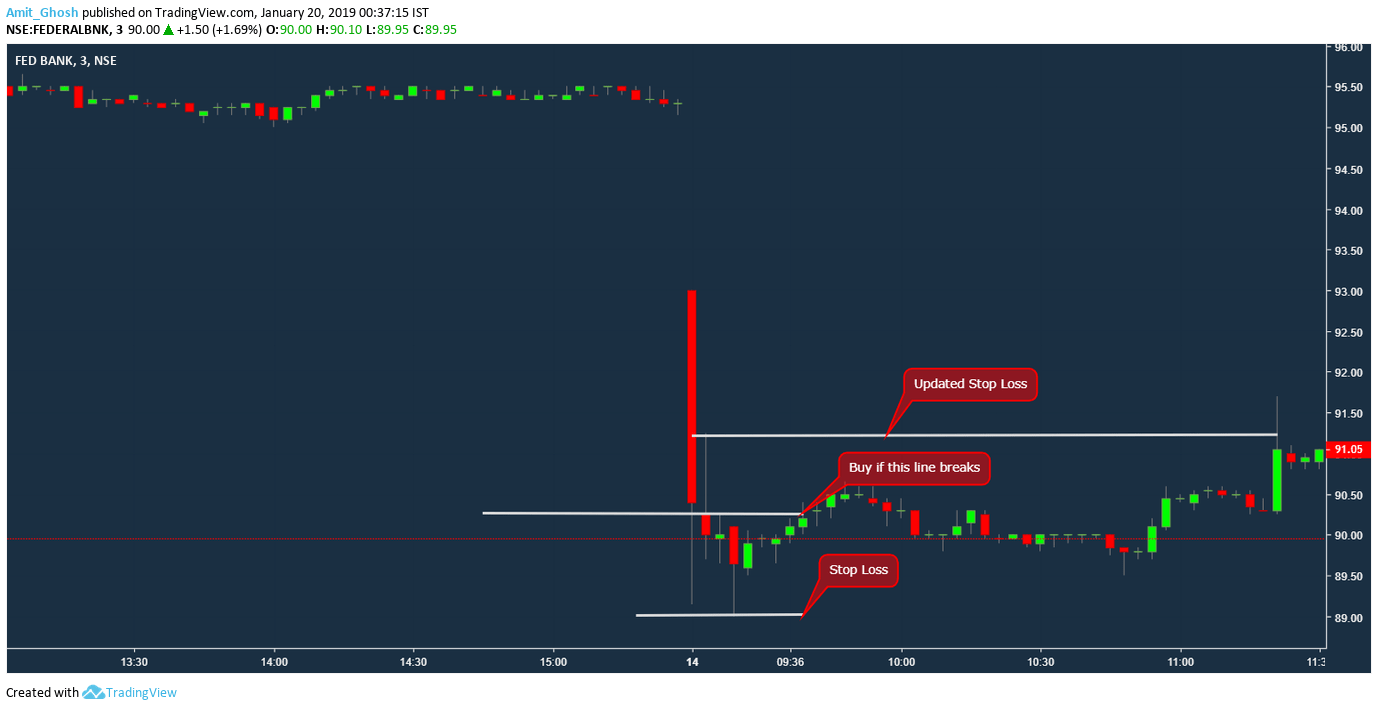

Let’s discuss a case of Fedbank which happened recently. This trade idea was posted the moment Fedbank declared results and it shot down.

We have no idea how the results were. But the bet is even if it keeps falling, it will make a small retracement (similar to the ball’s bounce). Now there are two ways to monetize it –

Buying it with a small stop loss to catch the small retracement. Also, We need to book the profit quick as if there is any sign of falling again.

Selling it with small stop loss once the small retracement is done.

So, to find when exactly to buy it which is the first case (The white lines are called trend lines and we shall discuss later on about how to find those lines), we are looking at 3 minutes time frame (the results were just declared and the movement was too volatile and hence the lower time frame) and as well as looking at daily time frame.

The stop loss line is the support line in the daily time frame. Now, as it is a support in the daily time frame, there is a high chance the support will be maintained.

In this case, I have exited the trade with some gain as it hit my trailing stop loss. Majority of Traders and Investors use Swing Highs as a trailing stop loss.

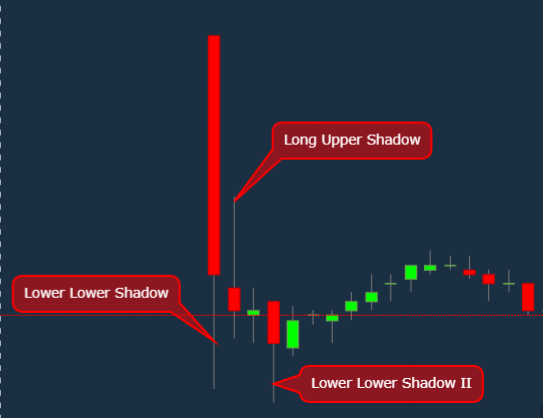

Here we used the high of the candle which has long upper shadow to trail our stop loss i.e. we moved our stop loss to the high of this candle once the high is broken because –

Last time the long shadow is created because bears overpowered bulls. Now, it is broken means bulls managed to beat the bears. Now, if it gets broken, it will only mean bears got their control back!

In that case, not only the buy trade should be closed; one should also sell it immediately with a tight stop loss for a small gain (small because we are seeing lower time frame which is full of noises!) . Anyways, our trailing stop loss was hit and we made a small gain.