Backtest Entropy Alpha Bollinger Band Strategy Using Python with Equities Data

Let’s jump directly to the discussion from where we had left in the last part. So far We have checked out the trade performance and, analyzed that details with various popular trading metrics to get an overview of strength of our strategy.

In this part, We will apply the same in Equities data.

The Core Differences

- In Equity, We do not have different

instrument_tokenfor different expiry. So, We can backtest the entire dataset! - The code of getting the

priceof the stock andhighof the stock has to be changed and modified to get the equity data instead of derivatives data.

#Price At The Particular Time

import datetime

# Your code here

# Create a function to get the price and high of a stock at a specific time

def get_stock_data(symbol, time):

# Define the start and end date

start_date = pd.Timestamp(time)

end_date = start_date + datetime.timedelta(minutes=5)

# Convert start and end date to string format

from_date = start_date.strftime('%Y-%m-%d %H:%M:%S')

# Fetch historical data for the stock

data = kite.historical_data(instrument_token=get_insToken(symbol,"NSE"),

from_date=from_date,

to_date=from_date,

interval='minute')

# Return the price and high of the stock at that time

return data[0]['open']

# Add new columns to the DataFrame

df['price'] = ''

# Iterate over each row of the DataFrame

for index, row in df.iterrows():

# Get the stock symbol and triggered time

symbol = row['Stocks (new stocks are highlighted)']

time = row['Triggered at']

# Get the price and high of the stock at the triggered time

price= get_stock_data(symbol, time)

# Update the price and high columns

df.at[index, 'price'] = price

Rewriting the code to get the high of the equity price when we entered the trade –

def get_high_of_day(kite, df):

high_list = []

for i, row in df.iterrows():

# Get historical data for the trigger date of the stock

symbol = row['Stocks (new stocks are highlighted)']

data = kite.historical_data(instrument_token=get_insToken(symbol,"NSE"),

from_date=row['Trigger Date'],

to_date=row['Trigger Date'],

interval='day')

# Get the high of the day

high = data[0]['high']

high_list.append(high)

df['high'] = high_list

return df

df=get_high_of_day(kite, df)

df

Rewriting the code to simulate the trades in equity pricing system –

The Quant and Position Sizing

500000. It means if the stock price is 1381, it will short rounddown(500000/1381) = 362 quantity.

import datetime

def find_day_high_time(kite, df):

square_off_time_list=[]

square_off_price_list=[]

is_target_list = []

for i, row in df.iterrows():

# Get historical data for the trigger date of the stock

symbol = row['stocks']

data = kite.historical_data(instrument_token=get_insToken(symbol,"NSE"),

from_date=row['Triggered at'],

to_date=row['Triggered at'] + datetime.timedelta(days=1),

interval='minute')

is_target = False

for i in range(0,len(data)):

if(row["high"]==data[i]["high"]):

is_target =True

print("Target Triggered")

#df.at[i, "is_target"] = True

square_off_time_list.append(data[i]["date"])

square_off_price_list.append(data[i]["high"])

break

if not (is_target):

print("Target did not Trigger")

square_off_time_var = datetime.datetime.strptime(str(row['Trigger Date'])+ " 14:50:00+05:30", '%Y-%m-%d %H:%M:%S%z')

data1 = kite.historical_data(instrument_token=get_insToken(symbol,"NSE"),

from_date=square_off_time_var,

to_date=square_off_time_var,

interval='minute')

#print(data1)

square_off_time_list.append(square_off_time_var)

square_off_price_list.append(data1[0]["open"])

is_target_list.append(is_target)

df['square_off_time'] = square_off_time_list

df['square_off_price'] = square_off_price_list

df['is_target'] = is_target_list

return df

df=find_day_high_time(kite, df)

df

import math

quant_size = 500000

df["lotsize"] = df["price"].apply(lambda x: math.floor(quant_size/x))

df

The Final Trade Log

The above changes done in our old patch of code leads to this Final Trade Log –

Triggered at stocks entry_price high square_off_time square_off_price is_target lotsize pl_points pl

779 2022-09-13 10:01:00 HEROMOTOCO 2888.1 2903.00 2022-09-13 14:50:00 2865.00 False 173 -23.1 -3996.3

778 2022-09-13 10:01:00 DRREDDY 4284.85 4306.95 2022-09-13 14:50:00 4250.00 False 116 -34.85 -4042.6

775 2022-09-13 10:03:00 DIXON 4623.25 4670.00 2022-09-13 14:50:00 4605.05 False 108 -18.2 -1965.6

770 2022-09-13 10:06:00 ITC 331.7 335.00 2022-09-13 12:56:00 335.00 True 1507 3.3 4973.1

771 2022-09-13 10:06:00 SBICARD 957.4 961.00 2022-09-13 10:22:00 961.00 True 522 3.6 1879.2

... ... ... ... ... ... ... ... ... ... ...

5 2023-04-20 10:02:00 ICICIBANK 894.95 899.30 2023-04-20 14:50:00 893.85 False 558 -1.1 -613.8

4 2023-04-20 12:49:00 CUB 132.3 133.90 2023-04-20 15:16:00 133.90 True 3779 1.6 6046.4

3 2023-04-20 14:16:00 BAJAJ-AUTO 4311.1 4330.50 2023-04-20 14:50:00 4313.00 False 115 1.9 218.5

1 2023-04-21 09:58:00 ASIANPAINT 2853 2887.00 2023-04-21 14:23:00 2887.00 True 175 34.0 5950.0

0 2023-04-21 10:07:00 APOLLOTYRE 335.4 337.40 2023-04-21 14:50:00 333.95 False 1490 -1.45 -2160.5

477 rows × 10 columns

We have nearly 477 trades compared to 60 trades of last time giving a broader dataset spanning over half a year.

Calculate Trading Metrics

We can use the same patch of code used in the previous chapter to analyze the Trading Metrics. The column names of the database are also same. Anyways, The Output shows all the available info you need to know to evaluate a strategy –

Net P&L: 691606.25

Number of total trades: 477

Number of times target is hit: 187

Number of times stop loss is hit: 290

Win Ratio: 0.61

Avg PL: 1449.91

Max PL: 26645.0

Min PL: -21498.75

Gross P&L: 691606.25

Average Gain: 6019.51

Average Loss: -4897.87

Profit Factor: 0.58

Expected Payoff: 1449.91

Maximum Drawdown: 120861.8

Sharpe Ratio: 0.21

Gross Profit: 1661385.15

Gross Loss: -969778.9

Recovery Factor: 1.71

Maximum consecutive wins: 9

Maximum consecutive losses: 0

Maximal consecutive profit: 43535.70

Maximal consecutive loss: 30436.85

Average holding time: 0 days 05:08:35.345911949

Average holding time for profit trades: 0 days 05:34:04.130434782

Average holding time for loss trades: 0 days 04:35:01.212121212

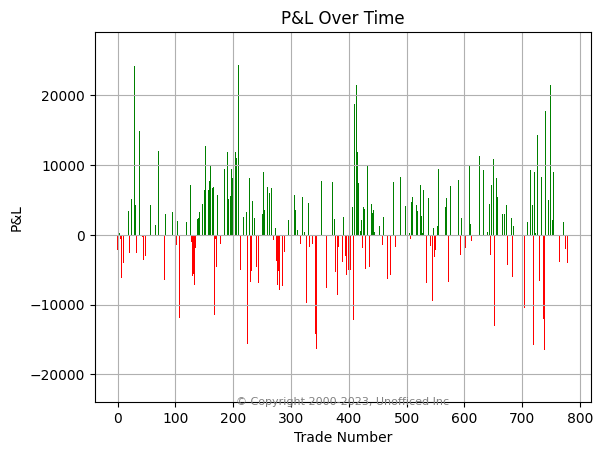

Calculate the Profit/Loss over the Time

We can use the same code with matplotlib library to plot the graph. The graph looks like –

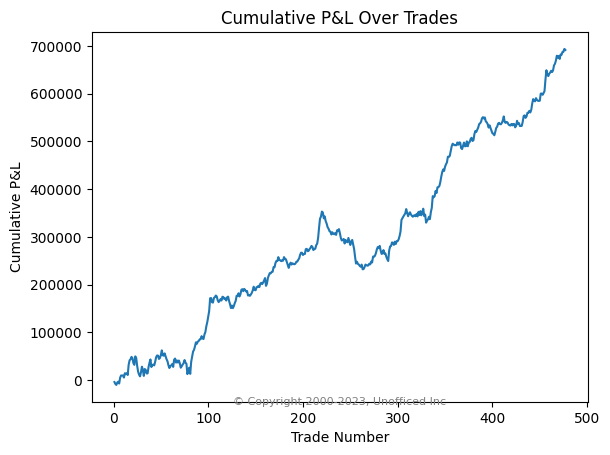

Plot the Cumulative Profit/Loss Over Time

We can use the same code from the last chapter to generate the graph –

That concludes this discussion.