Scalping with Bollinger Bands

This serves as a simple illustration of the comprehensive application of Bollinger Bands. We don’t expect you to fully grasp it at this point, as we will delve into the intricacies in upcoming sessions. However, take note of the inherent potential for simplicity within this trading setup.

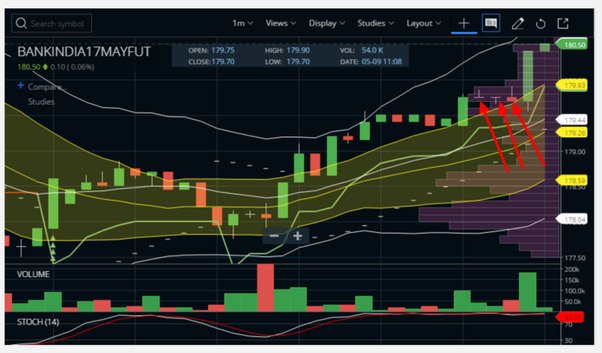

Currently, we have successfully achieved our initial two targets. Our third position remains active, guided by a trailing stop loss set at the median Bollinger Band.

In this context, “scalping” refers to a trading strategy where traders aim to profit from small price movements in the market by making a large number of trades within a short timeframe. Scalpers typically seek to capture minimal price differentials multiple times a day, capitalizing on brief price fluctuations to generate profits.

To effectively navigate this scenario, it’s essential to employ a combination of different timeframes, Volume Price Analysis (VPA), and support setup. Currently, the breach of that specific line has the potential to trigger a significant price spike.

When it crossed the lower boundary of the price action range, it experienced a sharp downside movement. This type of price action often forms around the median Bollinger Band when a trade reverses. This is precisely why we select the median Bollinger Band as the Trailing Stop Loss.

Until a new Price Action range is established, it acts as a barrier influenced by Volume Price Analysis (VPA), and this can result in a trade reversal. This is also why we use the median Bollinger Band as the Target Price.

However, it’s worth noting that our trailing stop loss was activated. Despite all positions ending in profit, we plan to reopen the last position if the price breaches the upper boundary of the price action range.

In advanced Bollinger Bands trading, this is akin to a Stop and Reverse (SAR) setup, where a stop loss transitions into a trailing stop loss. In the current scenario, the script is expected to experience a brief downward movement until it breaks through the upper barrier. Therefore, it makes sense to capitalize on this opportunity, given our prior profitable trades.

In essence, we are now profiting from both upward and downward trends at a microscopic level. In summary, when a trailing stop loss is triggered, it signifies a SAR trade – a strategy that involves seizing opportunities on both sides of the market.

At this moment, the high of the current candle serves as our Stop-Loss level. However, we observe a Doji candlestick pattern forming. This signals an opportunity to close the trade. Consequently, we are exiting the trade with a slight profit, surpassing the breakeven point.

We’ve experienced six stop-loss hits in total up to this point. To better understand these trades, please refer to the provided image.

Now, we encounter a doji candlestick pattern. The appearance of a doji suggests it’s time to close the trade. A doji signals market indecision, indicating that price action might lead to a substantial move, but it doesn’t provide a clear indication of the direction that move will take.

Doji Example

Now, let’s dive into how to utilize the Doji setup effectively. In cases where the Doji lacks any tails and persists for 4-5 consecutive bars, we implement a specific strategy. During this scenario, we place both buy and sell orders at the High (H) and Low (L) of the candle that forms the spike following the Doji.

This approach is based on the premise that the breakout of the spike-confirming candle signifies the direction of the impending move. Therefore, we ride the market in the direction it chooses.

Having initiated our trade at the median Bollinger band, we now have two potential exit options:

- Exiting at the upper band of the 1 SD Bollinger.

- Exiting at the upper band of the 2 SD Bollinger.

To accommodate our exit strategy, we enter the trade with two lots. As demonstrated, the first target has been achieved. We then adjust our trailing stop loss to the level of the first target while pursuing the second target.

Our original stop loss is positioned at the lower spike of the preceding candle, which corresponds to the level at which we initiated the trade based on the Doji Price Action levels. As demonstrated in this scenario, our second trade has also achieved its intended target.

However, when employing the Bollinger Ride Strategy (BRS), there is an option to keep the final lot active while implementing a trailing stop loss based on price action, instead of terminating the trade immediately upon reaching the upper band.

This approach enables traders to continue riding the trend and potentially maximize profits as long as market conditions remain favorable, demonstrating the flexibility and adaptability of the strategy to different trading situations.

Therefore, when our trailing stop loss was hit, we promptly initiated a short position, in line with our Stop and Reverse (SAR) setup, with the stop loss set at the price action level. Please refer to the image below for clarification:

Our stop loss is hit and we’re finally out of the trade.

Doji Example #2

Now you will see the Doji case again and also you know what trade we are going to place here –

Let’s delve into the details to provide a clear explanation and minimize any potential confusion. You can reference the image above to follow along with the specific actions taken in each candle:

-

Doji Formation: The initial step in this sequence is the formation of a Doji candle.

-

Closing the First Trade: After the Doji formation, we decided to close out our first trade with a profit of 0.25 points (pft).

-

Buy Order: Following the closure of the first trade, we placed a buy order.

-

Incorporating VPA (Volume Profile Analysis): At this juncture, we incorporate Volume Profile Analysis (VPA) into our trading strategy. Instead of setting our stop loss at 179.5, as dictated by the traditional method, we opt to place our stop loss at 180. This decision is influenced by insights from VPA, which suggests a more prudent placement for our stop loss.

By combining our trading approach with VPA, we aim to make more informed decisions and optimize our trading strategy for potential gains.

We’ve adopted a nuanced approach to refine our stop loss strategy. Here’s a breakdown of the steps taken:

-

Calculation of Mean: Initially, we calculated the mean of three potential stop loss levels, arriving at an average value of approximately 180. In this process, we considered levels such as 180.14, 179.86, and others.

-

Addressing Imperfections: Recognizing that the value of 180 might not represent a perfect barrier, we made the decision to fine-tune our approach. Rather than using a level that ended in .00, we opted for a stop loss at 179.95 or 180.05. This adjustment accounts for the significance of psychological barriers in trading.

-

Updated Stop Loss: Our final stop loss level was set at 180.05. This specific value was chosen to reflect the reality that many traders tend to buy or sell at round price points like 180.05.

This refined stop loss approach enhances the accuracy of our trading strategy by considering psychological factors and market behavior in our decision-making process.

Hence, Low of this candle.

Now our stop loss is at 180.35. So 180.35 triggers a price action.

Now our stop loss is at 180.45. Low of the candle formed at 11:23.

We closed at 181.05.

Price Action

In this scenario, we’re relying on price action and psychological barriers to fine-tune our trading decisions. Here’s how our strategy unfolds:

-

Psychological Barrier at .05: We recognize that .05 price levels often act as psychological barriers in trading. Traders tend to buy or sell at whole numbers or increments like 182.05, while fewer transactions occur at values like 182.1.

-

Doji Candle Formation: At 11:29, we observe the formation of a doji candlestick pattern. A doji suggests indecision in the market, signifying that neither buyers nor sellers have a strong upper hand at that moment.

-

Pending Buy Order: Based on our analysis, we place a pending buy order at 182.1, anticipating that it may be more likely to trigger trades than an order placed at 182.05.

-

Profit from the Upper Bollinger Band: As the price briefly touches 182.05, we manage to secure a profit of 0.30 points. This move is driven by the price action and the fact that the stock price has breached the upper band of the 2-standard deviation Bollinger Bands.

-

Anticipating Downside: Looking forward, we anticipate that the price action may trigger a decline, possibly to 181.5.

Here’s an overview of how we handle what we term as a “failed case” of a 3BB breakout, and how we use martingale in this context:

-

Failed 3BB Breakout: In this situation, the 3BB (Three Bollinger Bands) breakout strategy did not yield the expected results, and we categorize it as a “failed case.” We’ll explore the details and reasons for these failures later in our discussion.

-

Two Exit Points: Despite the initial failure, we recognize that there are still opportunities to navigate this trade. Our strategy provides us with two potential exit points, and we’ll explore these options in more detail.

-

Martingale in F-3BB Case: Martingale is a strategy that involves increasing the position size after a losing trade to recover losses and potentially make a profit. In the context of a “failed 3BB breakout” (F-3BB case), we employ martingale to adjust our position size.

-

Entering with Two Lots: As a result of the martingale approach, we decide to re-enter the trade with two lots. This decision is based on our analysis of the potential exit points available to us.

We’ve achieved our first target, which was to reach the lower band of the 1 SD Bollinger. This resulted in a profit for one of our lots.

Currently, we have two lots remaining in the trade, and our next objective is to reach the lower band of the 2 SD Bollinger. To protect our gains and manage risk, we’ve implemented a trailing stop loss, which is currently set at the lower band of the 1 SD Bollinger.

This approach allows us to capture profits along the way while still having the potential to benefit from further price movement toward our target at the lower band of the 2 SD Bollinger. Trailing stop losses are valuable tools for traders to lock in gains and minimize potential losses as a trade progresses.

Well, we see a gap down here. We change our trailing stop loss hence to 181.

Well, we see a gap down here. We change our trailing stop loss hence to 181.

We’ve adjusted our trailing stop loss to 181.05. This decision was based on the observation that the high of the current candle falls within the range between the 1 SD Bollinger and the 2 SD Bollinger. When I mention “closure,” I mean that the high, open, close, and low prices of this candle all lie within that particular price range.

In the meantime, our SAR (Stop and Reverse) indicator has been triggered.

Despite this, we’re keeping our stop loss at 179.95, which was determined earlier. However, it’s important to note the significant price action movement that occurred during this period.

Price action can be quite dynamic, and traders need to be adaptable in managing their trades. Our trailing stop loss provides a level of protection, but sudden price movements can influence our decision-making process.

We have three targets here and hence three lots.

- Median Bollinger of 1 SD.

- Upper Band of 1 SD Bollinger.

- Upper Band of 2 SD Bollinger.

It hits the first target as well as the second target. But while approaching the third target it made a Doji followed by a green candle which gives confidence on an uptrend.

But we can see another Doji is happening. So we change our stop loss from “Upper Band of 1 SD Bollinger “ to the low of the green candle formed after the first doji.

We hit our stop loss and it opened a sell trade. But our first Doji’s trade got overlapped by the second Doji.

However, we can also immediately exit a trade seeing the Doji but lots of external things to be considered like Volume Profile Barrier, Bollinger, and other technical indicators.

Here is the Doji Trigger –

Now we have entered with three lots again.

- Median Band.

- Lower Band of 1 SD Bollinger Band.

- Lower Band of 2 SD Bollinger Band.

I conclude this narrative at this point. To achieve the level of precision seen here, one would need a more in-depth understanding of price action, candlestick patterns, and Volume Profile analysis. These advanced techniques allow for a detailed analysis of market movements, enabling traders to make informed decisions on a candle-by-candle basis.

Trading in the financial markets requires a combination of technical knowledge, strategy development, and a deep understanding of market dynamics. It’s an ever-evolving journey where traders continuously refine their skills and adapt to changing market conditions.

This case study provides a glimpse into the complexity and depth of analysis that can be involved in trading. As you continue your journey in the world of trading, remember that learning and experience are your best allies. With time and dedication, you can develop the expertise needed to navigate the financial markets successfully.