Entropy Core Strategies

BRS Bollinger Bands Trading Strategy

2 Topics

Entropy Advanced Strategies

Entropy Scanners

Backtest Entropy Alpha Strategy with Futures Data Part I

Backtest Entropy Alpha Strategy with Futures Data Part II

Backtest Entropy Alpha Strategy with Equities Data

Entropy FAQs

Entropy Trading Examples

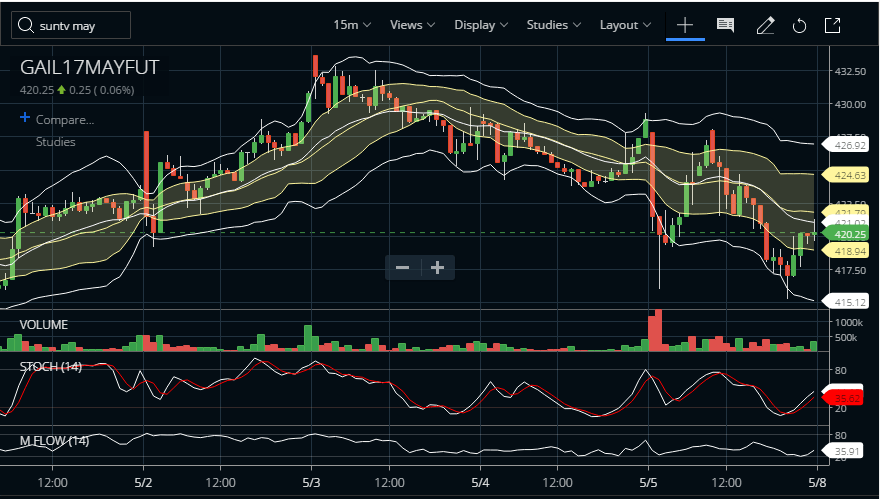

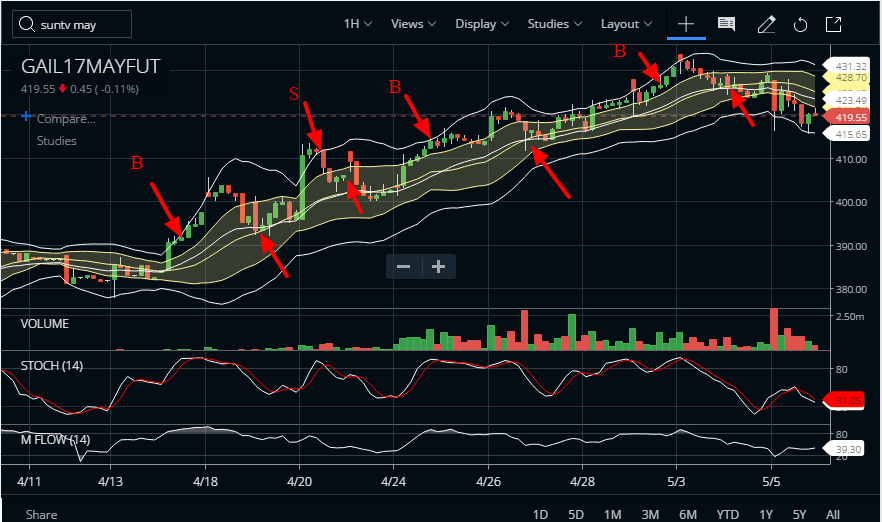

Gail Futures Trade Using Bollinger Bands

Just have a look with your common sense you can tell Gail is high beta and hence we can not find any much trading opportunity amidst the noise of lower timeframes

In case you are confused with the sell signal part –

To spot downtrend and trading opportunity for a sell signal,

- One red candle has its close outside 1 SD Bollinger.

- The next candle closes and opens below lower bands of 1 SD Bollinger.

- You enter at the “close” of the second red candle on the time of formation of the 3rd candle.

- You close when the candle touches the median of 1 SD Bollinger.

Here is another tricky condition to minimize loss (and well maximize profit):

- So far you have entered in the 3rd candle. If the candle ended as green after your entry. (You have entered the trade in the middle of 3rd candle formation right?)

- Here is what you do stay on the 4th candle – Immediately put 2 buy orders at the “high” of the last candle. Because it will not only exit you from the sell order; it will also open a buy position.

The art of balancing risk and reward in this intricate situation constitutes a strategy of its own, which I’ve aptly named the 3BB strategy. It derives its moniker from the distinctive “green-green-red” or “red-red-green” pattern formation.

Post a comment