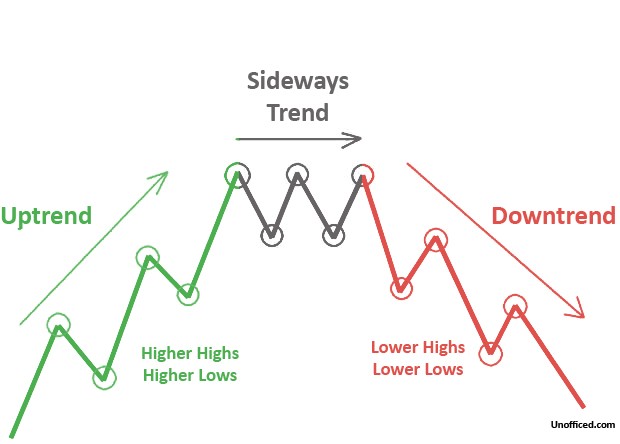

Trend Analysis – Sideways Trend

Here goes an image which explains everything in a nutshell! When a scrip trades in a range, is considered to be in sideways trend or no trend.

If a scrip is in uptrend or downtrend, it is said that the scrip is trending! Traders look for trending scrips to monetize. But, Scrip in a Sideways trend also can be monetized.

- Short the scrip if it is near the upper range of the Sideways trend.

- Long the scrip if it is near the lower range of the Sideways trend.

Also, options strategies can be constructed on the same range to take benefit of theta.

There are a few reasons that cause this trend. One of them is valuation catch up. Sometimes a scrip ladders up to a highly expensive price level which defies the fundamentals of the scrip. So the valuation has to catch up with time. It has already discounted all the forward events. Unless there is a change in the outcome which differs from the estimation (market discounts the estimation) the scrip stays range bound.

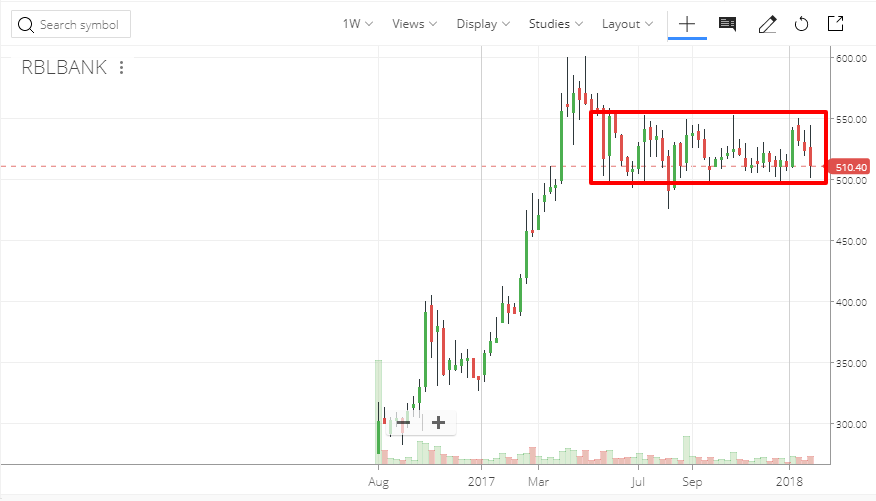

Here is Ratnakar Bank. It was in super momentum post its IPO and now consolidating and the valuation is catching up with time! A trader can buy at the current level with a small stop loss and a decent take profit.

Stocks exhibiting Sideways Trends are an amazing candidate for low-risk high reward strategy with a high win ratio. It will keep making many small profits until stop loss is hit. Although it did a fake breakdown it is within the range in closing basis. (At the time of day’s end, it closed within the range which shows the strength of the range).

Also, traders can look for iron condor in this range! The iron condor is an option strategy which has a limited loss and limited profit where the profit happens if the scrip stays between that range.

But when a scrip consolidates, the more it consolidates the more strong the breakout or breakdown happens! Because at the time of breakout or breakdown, the scrip again heads to discount fundamentals (earnings, news, ..etc) ahead of its timeline.