Basics of Charts

A Japanese candlestick gives you more information than a simple line graph.

Where Line graph just gives closing prices, the Japanese candlestick will also give you the opening price, the closing price, the highest price and the lowest price during a certain period of time.

Let’s explore among all the different chart types –

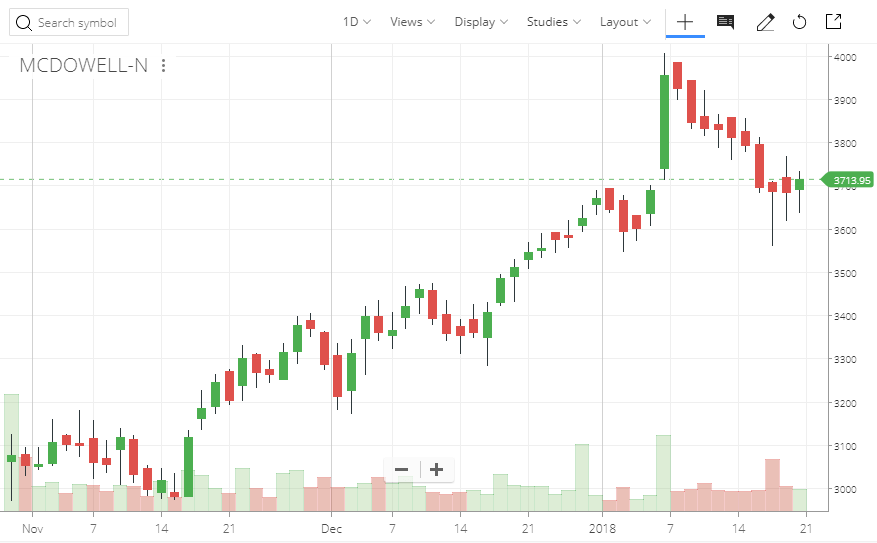

This is a normal candlestick chart.

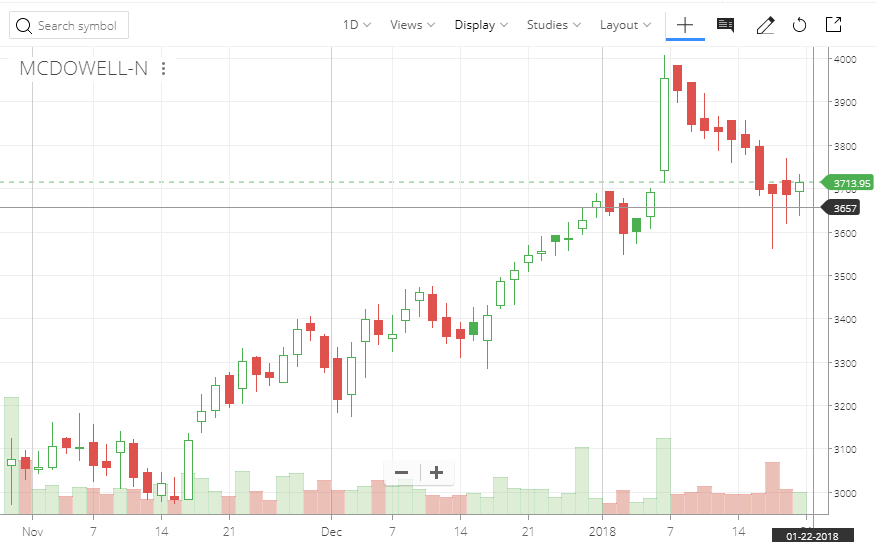

This is a hollow candle chart.

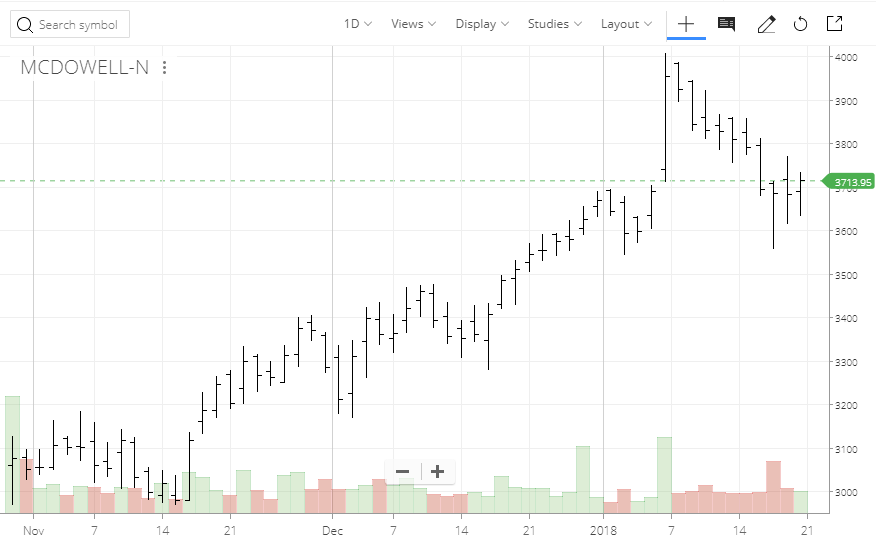

This is a bar chart.

A normal candlestick chart is a popular tool used in technical analysis that visually represents the open, high, low, and close (OHLC) prices of an asset over a given time period.

A hollow candle chart is similar to a normal candlestick chart, but the candle body is hollow, indicating that the closing price is higher than the opening price.

A bar chart is another popular type of chart used in technical analysis that displays the price range of an asset over a given time period using vertical bars. The top of the bar represents the highest price, the bottom represents the lowest price, and a horizontal line on the left and right side represents the opening and closing prices, respectively.

Like most traders, we prefer normal candlestick charts which came around 1868. Patterns emerged, Market prediction got serious eyes into it and after the Japanese stock market opened at the 1870s, it became significantly important.

This needs four data – Open, High, Low, and Close for each time period you want to display the chart. Let’s suppose we are charting for a daily timeframe!

If the prices go up that day (closing price is more than opening price) then the candle is colored green and in case of the price going lower that day, the candle is colored red.

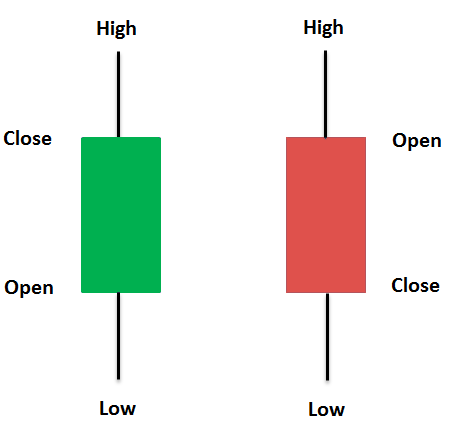

It encaskets a more visual and interpretable version than the normal table of prices or other charts like a bar chart that doesn’t color the candles. This is a detailed example of a bull candle (green one) and a bear candle (the red one).

The filled portions (colored with green or red) are called ‘body’ and the wicks are called ‘shadow’.

Hi Folks, If you’re unable to understand any stuff here or have ideas to share. Feel free to ask/share here or in the community 🙂