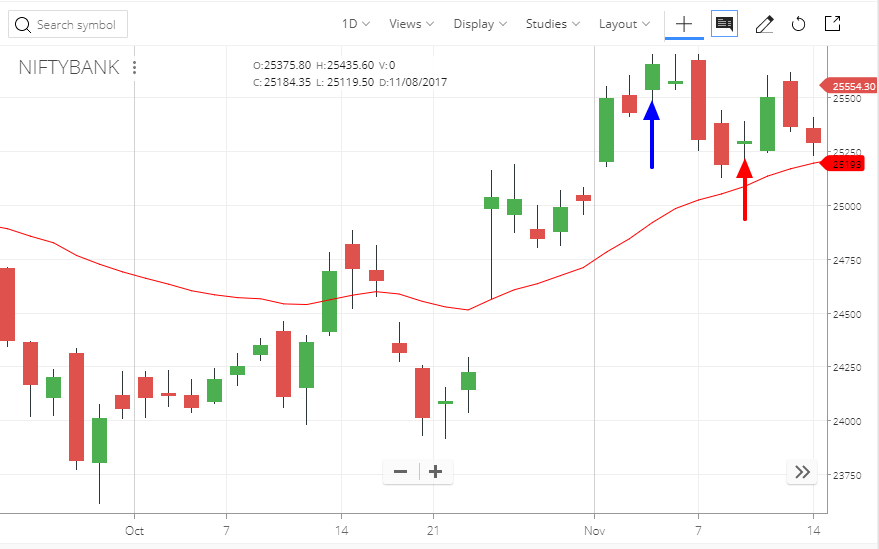

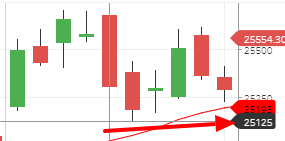

Refer: Blue candle shows the day of November 3, 2017. The red arrow shows the day of the expiry i.e. November 9, 2017. It was a range bound week.

Refer: https://unofficed.slackarchive.io/dr_theta/page-30&sa=D&ust=1523285255148000

There was no positive stimulus in the market. Last week BankNIFTY went up thanks to India’s rank upgrade on ‘best place to business’ list. It is at all time high and hence no resistance. So taken 26000 as a safe bet as resistance and sold 26000 CE at 47.4. No PE was taken as market generally tend to retrace after this long run.

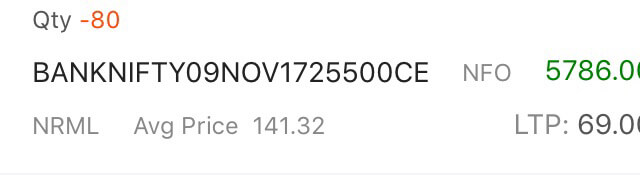

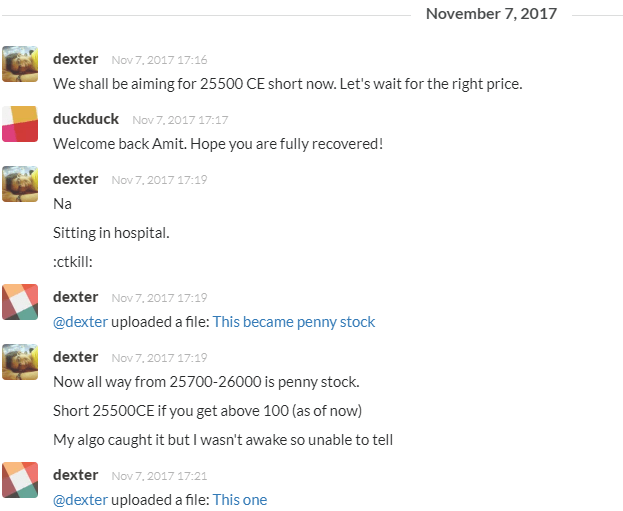

On November 7, BankNIFTY fell giving a clear idea of resistance at 25500 in the expiry. But though I took myself 25500 CE at 141.32 due to my illness I didn’t manage to update the rest of the people.

But next day it was available at the price of 100. It was discussed in the evening to get that options at the price as I was tending to expire at the market time due to fever.

Refer: https://unofficed.slackarchive.io/dr_theta/page-31&sa=D&ust=1523285255150000

All strike prices like 25600, 25700 and above CEs had very less value with it and wasn’t worth the risk.

On 8th November the low of the candle gave a definite stop loss and hence an assumptive resistance as the market opened gap up next day.

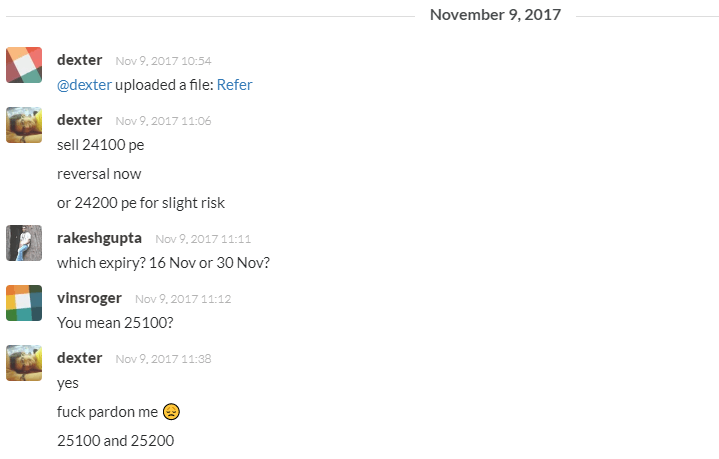

Right now we already had 26000 CE and 25500 CE in our account; so PEs were taken. Though my own positions differ from setup we are discussing here as due to higher margin my positions aim for a better breakeven.

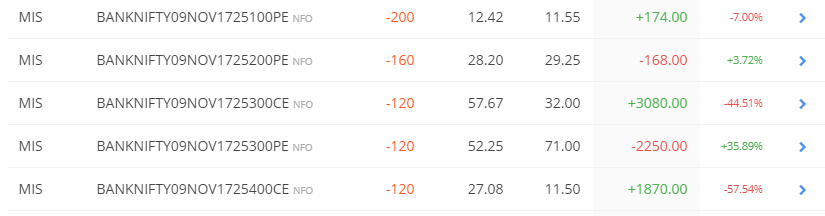

This picture was taken when the position was taken as per the setup shared here. So –

25100 PE was sold at 11.55

25200 PE was sold at 29.25

Net Profit/Loss

=(47.4 – 0.05) + (100 – 0.05) + 11.55 + 29.25

= 188.1 points ~ 188.1*40

= 7524 INR.

Net capital deployed = 130000 INR.