Refer: Blue candle shows the day of October 30, 2017. Red arrow shows the day of the expiry i.e. November 2, 2017.

The image basically tells all the story except why the losses were not minimized on November 1 when the resistance was broken which is completely my fault as my illness didn’t allow me to join The Market that day.

On October 30, trades were taken assuming 25200 support won’t be broken.

Sell BankNIFTY 2nd November 25000 CE at 150.

Sell BankNIFTY 2nd November 25200 CE at 100.

Refer: https://unofficed.slackarchive.io/dr_theta/page-30

But it broke and broke badly. It took support at 25500. On the day of 2nd November, there is no resistance as it was an all-time high.

As well as the rise was too sudden and high that there was no support as well in the near strike price. Obviously, 25000 is a support but the price of 25000 PE is too low to take. So a blind guess of support was to take close to last day’s candle or levels like 25500.

Considering it may go up more immediate concern was to guess a point of BankNIFTY closure and realizing the loss to free up the margin to take better trade which has more probability of profit.

Firstly, it was asked to put a limit to close BankNIFTY 2nd November 25000 CE at 400 and to sell BankNIFTY 2nd November 25500 PE at 70 and 25500CE at 65.

Q. Why to exit at 400?

A. The value of 25000 CE is at 484. If Banknifty expires at current levels of 25540. 25000 CE will be expired at 540 making you an additional loss of 64 points. Instead of that if you short 25500 CE at 55.85 it is quite evident you will not only save that additional 64; you will also make money on 25500 CE.

But 400 wasn’t coming.

Refer: https://unofficed.slackarchive.io/dr_theta/page-30

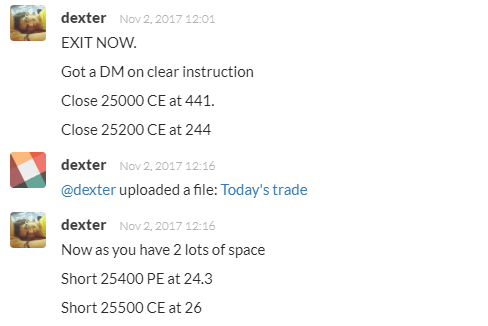

So we exited and moved forward with trades with a better probability of profit.

Close 25000 CE at 441.

Close 25200 CE at 244.

Short 25400 PE at 24.3.

Short 25500 CE at 26.

Close 25500 PE at 50.

25000 CE made a loss of 441 – 150 = 291 points.

25200 CE made a loss of 244 – 100 = 144 points.

25500 PE made a profit of 70 – 50 = 20 points.

25500 CE made a profit of 65 + 26 = 91 points.

25400 PE made a profit of 24.3 points.

Net Profit/Loss

= -291 – 144 + 20 + 91 + 24.3

= -299.7 points ~ -299.7*40

= -11988 INR.

Net capital deployed = 130000 INR.

The week was bad but loss and win is part of the battle and aim is to win the battle.