Hedging strategies: TLDR: If you’re one of those guys who search images on top 10 facts on rich people rather than top 10 ways to become rich; this answer will bore you to the core!

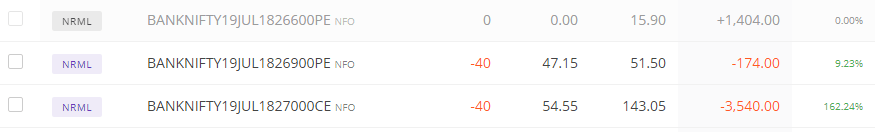

Let me give you an example directly as my call options (27000 CE) are at risk tomorrow!

Prologue:

Well, I run a tiny company Theta where mostly I sell BankNIFTY strangle. So far, We’ve already booked hefty profit due to the proper use of BankNIFTY swings.

There were three decisions –

- Betting on the fall – DCB Bank; We booked a good profit.

- Betting on the rise – Fed Bank; We booked a good profit.

What went wrong is the third decision for which I have to use Hedging strategies –

Didn’t estimated huge bull run! Shorted 27000 CE earlier. Watching the huge amount of open interest on the 27000 it is pretty easy bet.

Well, as usual, bought 26900 CE intraday understanding the flaw immediately. The worst part is – It didn’t execute in every account!

What to do?

Fundamental Check –

- SGXNIFTY shot 50 points up. So BankNIFTY is likely to shoot up 150 points.

- HDFC ADR is mild. Then who will shoot up? PSBs? Kotak and RBL have results. Kotak did bad today; it can rise like fire tomorrow on good results anticipation pulling BankNIFTY up!

- Federal Bank already shot up. Looking at the momentum will sell put options when it retraces.

- Crude is stable.

- Metals screwed. Will be hell for NIFTY Metals.

- Mindtree and Ultra cem results. It can pull NIFTY IT to fire.In short, bullish is the mum word mostly. But it will open gap up almost giving no chance of dealing haha.

Also, despite booking good profits, unrealized will be glowing like a bad nightmare depressing the entire mood.

Technical Check –

Let’s focus on the price.

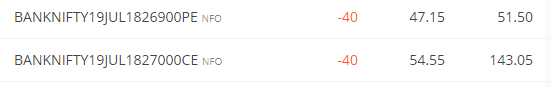

Question – When we will make more loss than what is showing?

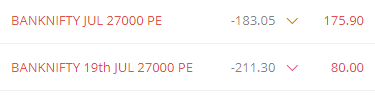

When BankNIFTY breaches = 27000 + 143.05+51.50 = 27194.55

Question – When we will make loss?

When BankNIFTY breaches = 27000 + 47.15+54.5 = 27101.65; Well we already have past profit. But let’s not make yourself comfortable.

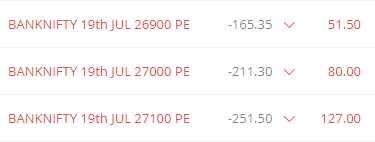

How to hedge -Laddering the PE up?

Selling PE?

Think again!

Are you willing to sacrifice 70 points (26900-50-27000+80) downside breakeven for 30 points upside breakeven?

One bad results and BankNIFTY can dip badly making a multi-bagger loss!

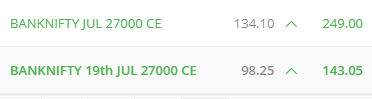

How to use Hedging strategies -Getting monthly CE to buy?

Look at the increase in premium. It is evident; if the market rises like today’s; then next week’s premium will rise faster!

But the story is not the same for put options.

Verdict: We close the put options as it will have no premium left. We will buy call options for this week. We will choose the strike price which is the same profit as the profit booked so far.

If our hedge goes wrong because the premium rise in CE is dart good. We will sell one more CEs of next week’s immediately as we have the margin for one lot of call options. Then sell another lot on Thursday.

One call options buy and two call options sell is a perfect example of call spread ratio.

Viola! Time to sleep peacefully.

27194.55 is the point where I should take a cold bath.