Friday, March 27th, 8:58 PM

As per the concepts of Uptrend specified in the bounce theory, We’re in Uptrend in India VIX as you can see here –

https://www.tradingview.com/x/6yrvbNBF/

BankNIFTY broke the downtrend today but We need to take note that today we had an RBI event!

So if we give the legroom of this fundamental aspect, (Fundamental events sometimes trigger unnecessary and unrelated chaos) We will still consider it as a Downtrend.

Anyways, with rising cases of Corona Viruses and as World markets are currently going down, it is highly unlikely that the high of today’s will be broken on Monday.

So, Today, we have basically Swing high. (which in my personal opinion, is lower high of the downtrend).

https://www.tradingview.com/x/Z3dLyIKJ/

My current view is – It should trade between “Resistance I” to “Support”

My current fear is –

- Rising VIX – VIX is a metric of volatility. IndiaVIX is the metric of India’s volatility. It is technically in an uptrend. Volatility increases when irrationality kicks in. Irrationality kicks in when fear kicks in. Fear kicks in when the market goes down. It is as simple as that!

When VIX goes high, the prices of options also go high! So, it is also possible that CE prices shot up as the market fell. Now, it makes no sense to sell our usual strangle or straddle. - Wide Spread – The spread (High and low) of a week is huge which is leading to huge unrealized losses in the middle.

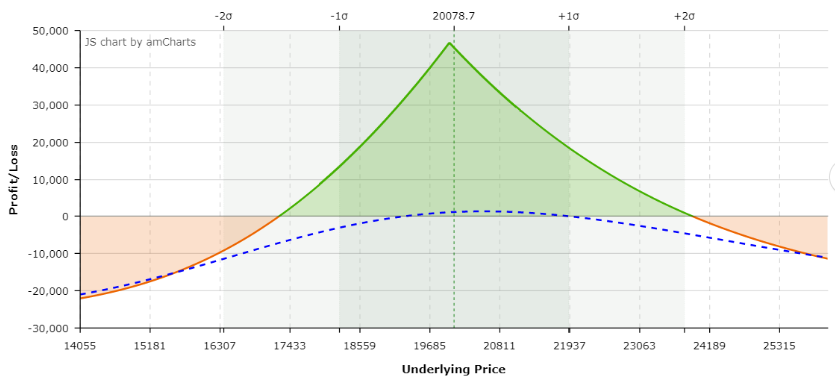

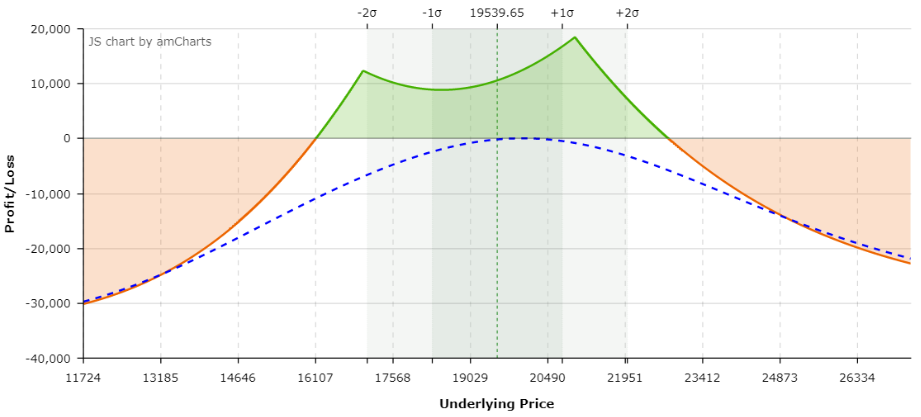

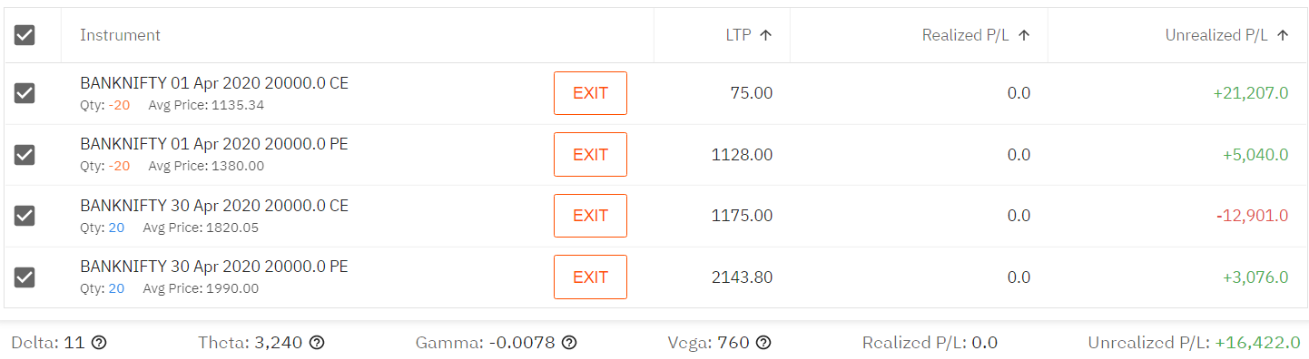

Setup 1:

- +1x 30APR2020 20000PE – ₹ 1884.75

- +1x 30APR2020 20000CE – ₹ 1903.9

- -1x 01APR2020 20000PE – ₹ 1330.9

- -1x 01APR2020 20000CE – ₹ 1786.15

Breakeven: 17247-23915 (Considering the IV stays same)

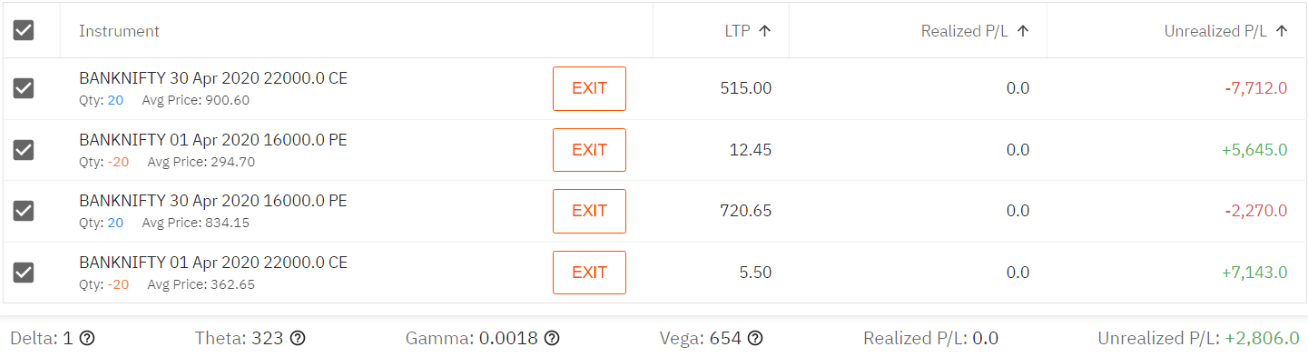

Setup 2:

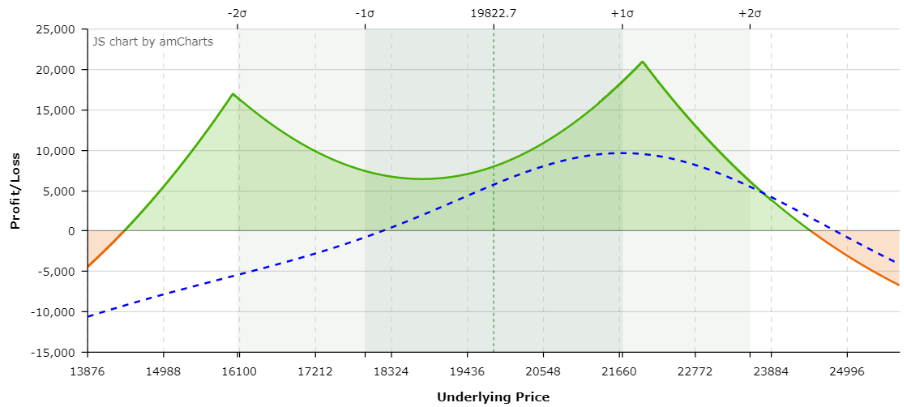

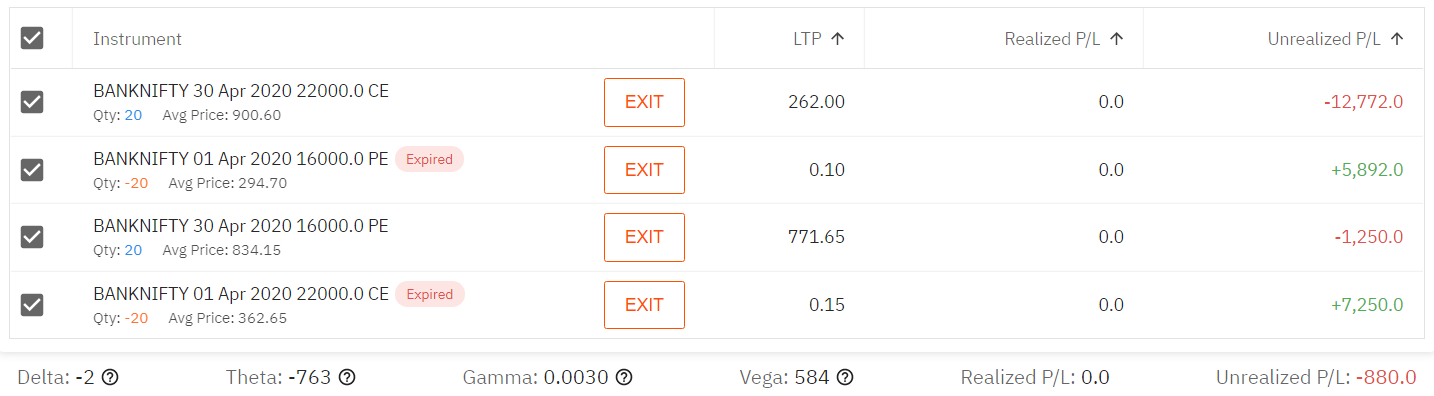

- +1x 30APR2020 16000PE – ₹ 834.15

- +1x 30APR2020 22000CE – ₹ 900.6

- -1x 01APR2020 16000PE – ₹ 294.7

- -1x 01APR2020 22000CE – ₹ 362.65

Breakeven: 14409-24458 (Considering the IV stays same)

Monday, March 30th,10:49 AM

Here comes the important part i.e., managing the trade. Although apart from the above two setups we have taken lots of other similar setups. But Let’s talk about what we did in a nutshell.

Basically, the market kept consolidating but the IV was not increasing either. So, we decided to contract our breakeven.

- +1x 30APR2020 17000PE – ₹ 1047

- +1x 30APR2020 21000CE – ₹ 1231.5

- -1x 01APR2020 17000PE – ₹ 278.3

- -1x 01APR2020 21000CE – ₹ 389

Breakevens: 16110-22771(Considering the IV stays same)

The drawback of these scenarios – The maximum loss potential kept increasing!

Wednesday, April 1st, 5:09 AM

We closed both the setups on Wednesday Morning in most of the places!

As you can see, it is a snapshot of the second setup unchanged. If it is changed as it was suggested, the profit will be more.

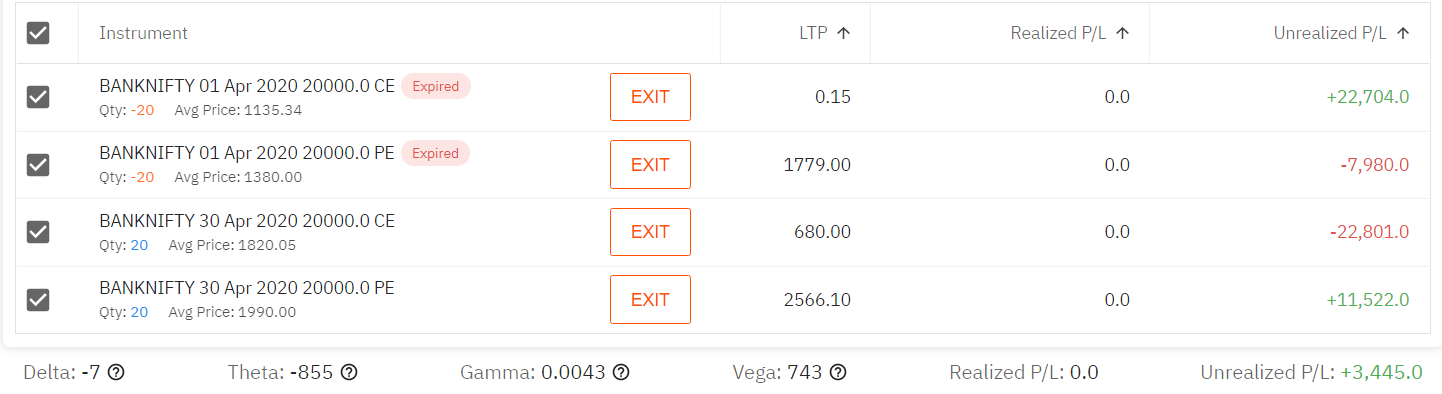

Thursday

But if it was not closed and kept open till Thursday, there would’ve been a significant loss of profits in both setups.

https://www.tradingview.com/x/K6Du3Q7B/

It is because in the last two days (as marked), there is significant erosion of volatility. Volatility, as discussed earlier, affects the strike prices with a far expiration date more than the nearer ones.

Volatility also affects the far OTM strike prices even more. So, if kept open, the second setup would also dive into a complete loss.

Hence, it is very important to manage the trades here as apart from breakeven, We have other metrics to worry about – Volatility!

Key Points

So, in case of volatility drop, it is more advisable to close Calendar Spreads on Tuesday (The most impact of Vega happens on Wednesday and Thursday.) and to deploy models that are profitable on high implied volatility.

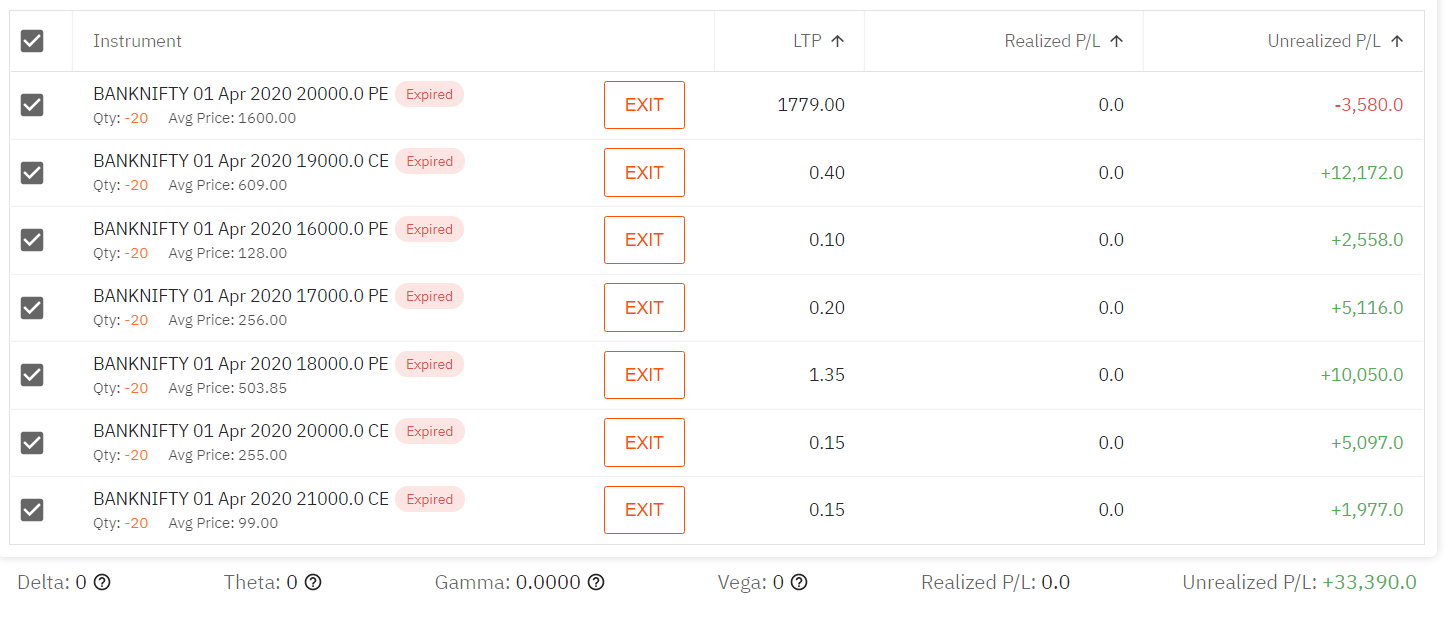

Short Strangles, Short Iron Condors, Short verticals, Covered calls, Naked Put, Credit Spreads – are such examples. Here are outcomes of two such models deployed on Wednesday –

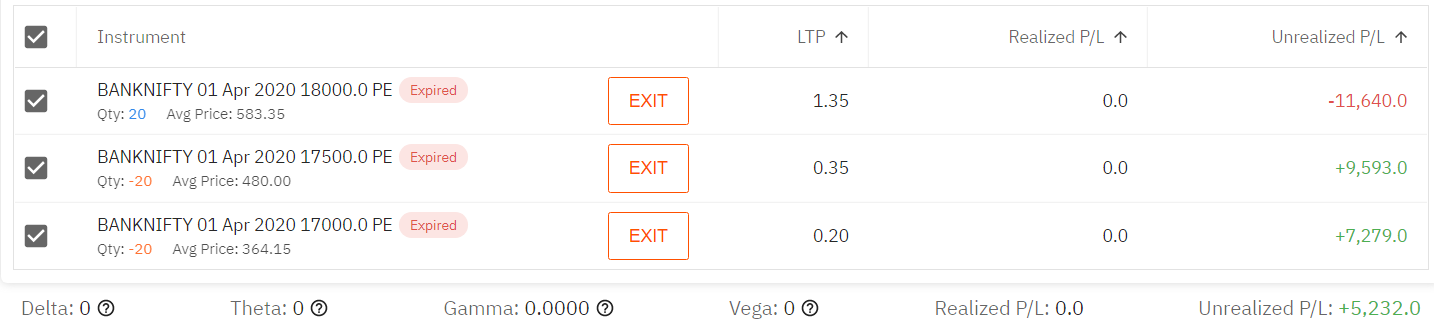

This is a put ratio spread.

This is a combination of short strangles and straddles. This one is extremely risky and not advisable!

Vix drops over various reasons. News, Neutrality to the sentiment for which it rose in the first place, like, in this case, any positive news on coronavirus or crude oil will do the work. Also, in an environment of fear, no news is also good news!