The Olive Press

Ancient Greece was famous for Olive. Olives and olive oil have long been some of the main ingredients of the Greek diet, no matter how poor people may have been or what other means of survival they had.

I’m married to a Rajasthani Wife. She cannot survive without Ghee in Chapatis. Well, in her defense, She will tell, Bengalis cannot survive without potatoes and sugar. Well, that’s fair!

Given the importance of Olive oil, even the tiniest villages in ancient Greece used to have multiple (mostly 3) olive presses. In those days, the barter system was still valid. People exchanged services and goods for other services and goods in return. In India, We used to exchange cows. Imagine spending 10 cows on an iPhone. So most of the olive presses provided the facility to the villagers in exchange for a fee – traditionally 1/10th of the olive oil produced.

The annual olive picking season would typically take place in autumn. The rest of the years, it is like offseason. We, Indians, chase Govt jobs like a madman. In those days, working in the olive press was well compensated good job. There are anecdotal stories of men using family ties or other connections to find their way to a working spot in the press. Times were truly different.

Aristotle wrote in his book “Politics” about Thales of Miletus. Thales having good knowledge of meteorology was able to predict that there was likely to be a heavy crop of olives next summer.

Thales wanted to bank on this idea with leverage. The solution he came up with is considered as the first documented example of derivatives.

Generally, Olive presses go unused in Summer because Olive used to harvest in Autumn. So Thales put a down payment in the early years, for the hire of all olive-presses in Miletus and Chios (a large area in Ancient Greece) for the entire summer; and he managed to get at very very low rates because there was no higher offer available in the market.

When the summer came and simultaneous demand kicked in for olive presses, he profited on a huge scale.

That’s why and how it was invented – for Leverage!

The Meteor

So, this way, betting on the future of a commodity started beginning. It took many shapes and the concept evolved in a scary way. One of note-able Darwinism on this concept is Modern Day Life Insurance companies.

You are technically betting against them by giving a premium that You’re going to die in an accident. The chance of doing that is pretty low! That’s why you are paying less premium.

Suppose, what are the odds of a meteor falling to the Earth in the next 10 hours? I am Ok to give you 1000 Cr if you bet 1 INR on this fact. My risk here is 1000 Cr and my reward is 1 INR. While you’re having an amazing chance of winning 1000 Cr by betting only 1 INR.

Concept of Expiry

So, as it can be noticed, there is a concept of time is included in the deal. Thales’ contract had an expiry on the following Summer. Life Insurance companies’ contract has an expiry as well which is our timely death which is not more than 150 years, I guess. Similarly, my meteor falling contract is valid for – 10 hours.

The Rainfall

Uncertainty is premium

Let’s talk about two cases – The chance of having rainfall in the next 1 day (Case A) and the chance of having rainfall in the next 10 days (Case B). Obviously, predicting shorter duration has a higher probability of winning!

So, it is quite easy to assume, You’ll bet (read, gamble) less money in Case A than Case B because uncertainty increases with Case B so your chance of winning in Case B is higher.

If you’re in dilemma in choosing between Case A and Case B. That’s normal because of perceptive human nature. Introduce Case C which is The chance of having rainfall in the next 100 years.

Now you can see Case C has a higher probability of winning/profit (POP) than Case B whereas, Case B has higher POP than Case A.

POP (Case C) > POP (Case B) > POP (Case A)

So, think of the guy who is betting against you. He will ask for more money for Case B than Case A. His chance of winning is going less. It’s obvious. So, you’ve to pay more money for Case B than Case A now.

Liquidity

To maintain liquidity and fairness in the business, exchanges are formed. There are two kinds of options contracts in the Indian Market. One is the index options. One is stock options.

It is hard to find a group of people who are betting if a meteor is going to strike in the next 10 minutes or not. Right?

From among the stocks listed on the exchange, some good stocks are selected and grouped together to form an index. The values of the grouped stocks are used to calculate the value of the index. Any change in the price of the stocks leads to a change in the index value. An index is thus indicative of the changes in the market.

- NIFTY is a benchmark index. When we write NIFTY, we talk about the NIFTY 50 index which is a combination of 50 stocks.

- BANKNIFTY is a sector index which is a combination of certain Bank stocks.

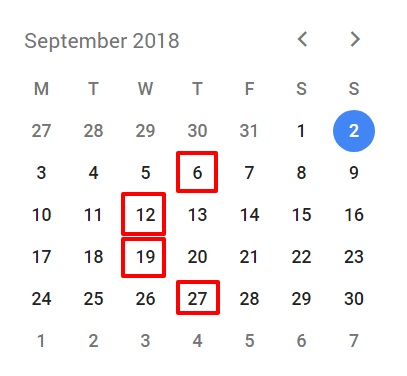

- Index options expire on the Thursday of each week. Its called Weekly Expiry.

- Stock Options expire on the last Thursday of each month. Its called Monthly Expiry.

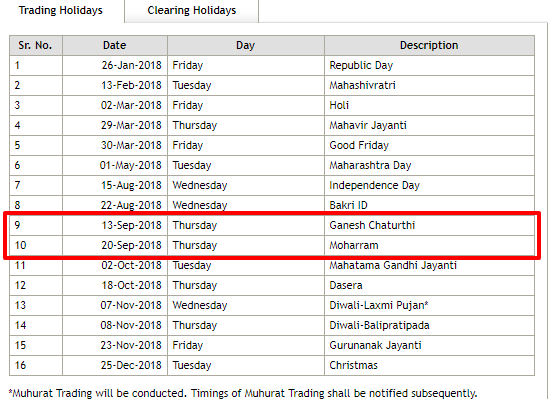

If Thursday is a trading holiday, the contracts expire on the previous trading day. The expiry rules change from time to time subject to SEBI. You can see the list of holidays from the NSE website.

This month has four weekly series. We have holidays on two Thursdays. So NIFTY and BankNIFTY will expiry in the following days –

- 6th Sep 2018

- 12th Sep 2018

- 19th Sep 2018

- 27th Sep 2018

Stock options will expire on 27th Sep 2018. Apart from, NIFTY and BankNIFTY, there is also another index namely NIFTYIT which is a sector index of IT companies but as it is illiquid, We will keep it out of our watchlist.