Volatility Skew

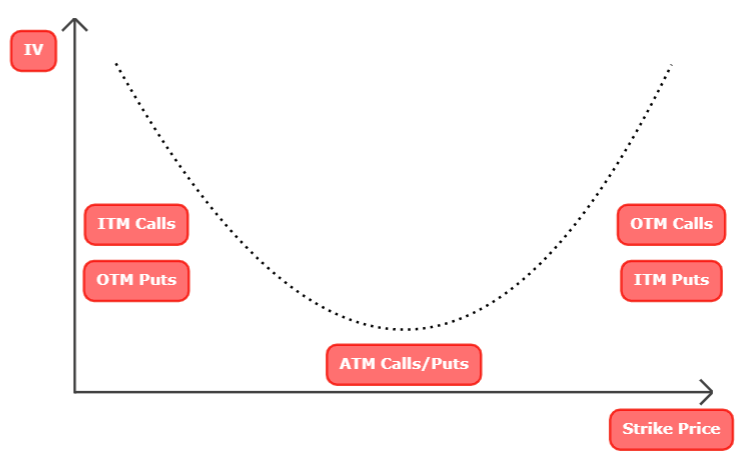

Volatility Skew refers to the difference in implied volatility of each opposite, equidistant option.

Theoretically,

- Call options and Put options of the equidistant strike price should have the same/similar amount of IV.

- So, Options in OTM Puts which are equally far from the Options in OTM Calls should have the same/similar amount of IV.

- ATM calls and puts should have the same/similar amount of IV.

But it doesn’t happen! Because, after the crash of Black Monday (Oct 19, 1987), there is an asymmetry or skewness in the pricing of put options and call options. The market fell sharply.

And, velocity attributes to skewness.

The OTM put options have been much more attractive to buyers because of the possibility of a massive payoff. So, IV in OTM puts is usually higher than the equivalent OTM calls.

The inverse relationship between the stock price and IV is a result of historical market evidence demonstrating that markets fall much more quickly than they rise.

In short, IV rises when markets decline; IV falls when markets rally.

Volatility Smile

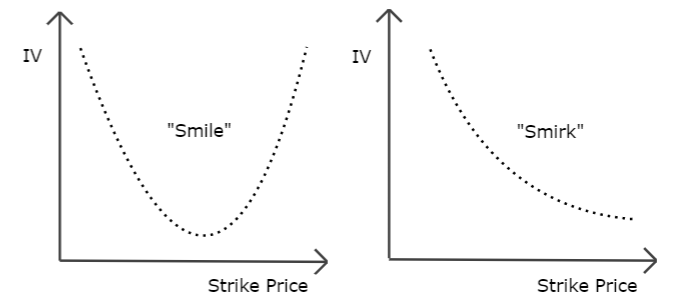

If we plot the shape of IV as a function of strike price for options of the same expiry cycle across the option chain, We should get a flat curve according to the theory of Black Scholes model.

So, When ATM options have lower IV than OTM options, the situation is known as Volatility Smile. We encounter an upward sloping graph as we move away from ATM options to OTM options.

Also, When OTM Put Options which are equally far from the OTM Call Options should have different IV, the situation is known as Volatility Smirk.

Notes:

- Volatility skew tells not all options on the same underlying and expiration have the same IV.

- Both the cases of Volatility Smile and Volatility Smirk falls are variants of skewness of Volatility.

- The OTM options are usually more expensive.

- OTM Puts are usually more expensive than OTM call options.