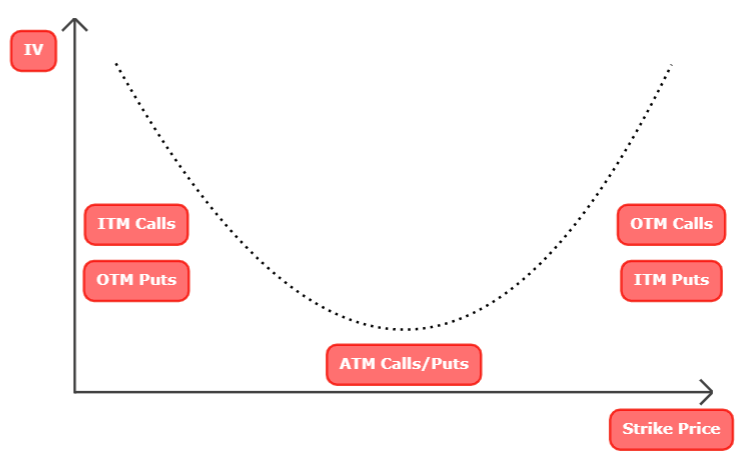

Volatility Smile

If we plot the shape of IV as a function of strike price for options of the same expiry cycle across the option chain, We should get a flat curve according to the theory of Black Scholes model.

So, When ATM options have lower IV than OTM options, the situation is known as Volatility Smile. We encounter an upward sloping graph as we move away from ATM options to OTM options.

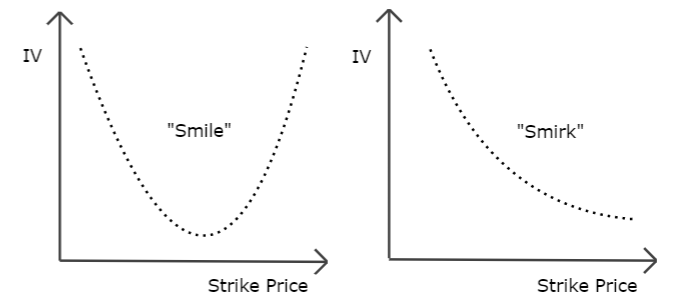

Also, When OTM Put Options which are equally far from the OTM Call Options should have different IV, the situation is known as Volatility Smirk.

Notes:

- Volatility skew tells not all options on the same underlying and expiration have the same IV.

- Both the cases of Volatility Smile and Volatility Smirk falls are variants of skewness of Volatility.

- The OTM options are usually more expensive.

- OTM Puts are usually more expensive than OTM call options.