The Coffee Can Portfolio – Stock to invest for 10 years

This is an article way dated back to 1984 written by Robert who was a senior fund manager for Capital Group companies. This asset management firm has giant with AUM of 1.7 trillion USD as of today.

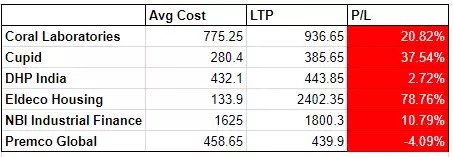

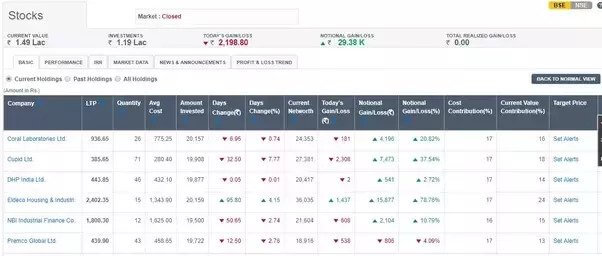

Based on the investment principle shared on the article, known as ‘Coffee Can Portfolio’, I made my portfolio stocks to hold and forget for 10 years in October 17 in a discussion happened in Unofficed Chat.

Portfolio appreciated by 19.5% so far in last three months.

Interested in the magic formula? I’ll tell the whole of it!

The story of a Lazy Client

Kirby joined a tin Capital group in 1965. Back then Capital Group used to provide investment advisory service only! The article made a stir followed by major VCs and investors like Softbank, Peter Thiel.

I will pull some excerpts from the above article that is necessary to this discussion –

The Coffee Can idea first occurred to me in the middle 1950s when I worked for a large, investment counsel organization, most of whose clients were individuals.

We always told our clients that we were in the business of preserving capital, not creating capital. If you wanted to get a lot richer than you already were, then you should hire someone else. We were there to preserve, in real terms, the client’s estate and the standard of living that it provided.

The potential impact of this process was brought home to me dramatically as the result of an experience with one woman client. Her husband, a lawyer, handled her financial affairs and was our primary contact. I had worked with the client for about ten years when her husband suddenly died. She inherited his estate and called us to say that she would be adding his securities to the portfolio under our management. When we received the list of assets, I was amused to find that he had secretly been piggybacking our recommendations for his wife‘s portfolio.

Then, when I looked at the total value of the estate, 1 was also shocked. The husband had applied a small twist of his own to our advice: He paid no attention whatsoever to the sale recommendations. He simply put about $5,000 in every purchase recommendation.

Then he would toss the certificate in his safe-deposit box and forget it.

This process of buying and not selling later led to a massive portfolio in just ten years. It was mainly because of one company which was worth 2000$ and transformed into $800000.

The company was called Haloid then which later emerged as Xerox.

Why Coffee Can

In Old west US, people used to secure their valuables by putting them in a coffee can which was placed under their mattress where it used to stay like buried treasures like decades.

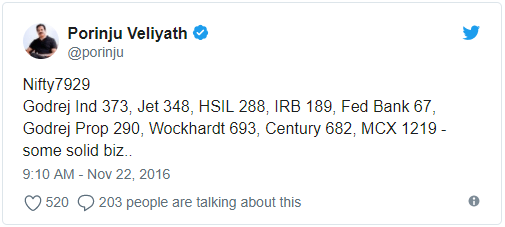

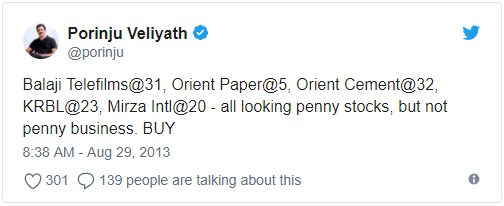

Let’s introduce the value investor in the top of a trading mindset. Why is Porinju this much famous?

Investors love him and follow him blindly. Traders hate him as generally it creates a huge bubble due to massive buying and it bursts costing money creating panic among retailers.

What traders see is a short-term view! But the same guy gave these stocks –

Also this –

You might want to check their current prices!

I did some research on Porinju’s twitter here – https://unofficed.com/wp-content…

As per our quantitative analysis on 170 investment ideas posted by him in the span of 7 years; it has made a staggering return of 386.25% XIRR basis.

Why pay an investment advisory? Join Twitter and Follow him!

Now you see why Softbank, Peter Theils invest in many places. They invest like turtle eggs. Thousands of eggs but only few get hatched and land on the sea.

I’m a fan of Silicon Valley soap from HBO –

Peter Gregory is the impersonation of Peter Theil. If you have read Peter’s Zero to One (or just review here – Zero to Some: A Critique)

Let’s come back to the stock market.

What is the stock selection criteria? The first set of rules were defined in a book named “The Unusual Billionaires”) by Saurabh Mukherjeea of Ambit Capital.

First, how you call a company, good company? Here are some rules set by the author –

- Choose market capital over 100 Cr.

- Always measure a company over a span of 10 years which rules out the complete ups and downs and other noise. It shows if company A can endure better than the rest of the people.

Now let’s improve the stock selection filter.

- The revenue growth should be of 10 % at minimum for past 10 years.

- The ROCE should be 15% at minimum for past 10 years.

India’s nominal GDP rate (Nominal GDP = GDP adjusted with inflation) is growing in an average of 14.3% over past ten years.

- The growth of the company should be at least 14.3% to beat the benchmark.

What is the difference between Earnings, Sales and Profit?

- Revenue = Sales

- Earnings = Revenue – Cost of Production

- Profit = Revenue – Expenses

ROCE

Now let’s talk about the second condition which is – “The ROCE should be 15% at minimum for past 10 years.”

Return on capital employed (ROCE) is Earnings Before Interest and Tax (EBIT) / Capital Employed. In Indian Stock market, ROCE is the biggest factor affecting the stock company.

If you are investing in some company, you are risking your money looking for some return right?

If over a long period a company gives 15% ROCE then you are assumed to have 15% annual profit compounded as a compensation (Read profit) to invest in that business.

You must know his logic so that you can modify accordingly.

- In India Government bonds give 8% return which is considered as a risk free return.

- Now equity has its own risk and hence as you’re risking your money you are supposed to demand higher returns for leaving the option of risk free return. Sounds fair? This is called equity risk premium.

Equity Risk Premium = long term US equity risk premium + slight more due to Indian’s rating (BBB as per S&P) = 4 + 2.5 = 6.5

Now adding 8 + 6.5 gives 14.5 which is roughly around 15%.

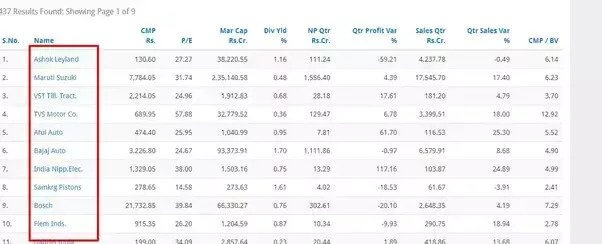

Now we know how to find it, Let’s find it!

Now let’s hunt these kinds of companies using screener.

- Market Capitalization > 100 AND

- Sales growth 10Years > 10 AND

- Average return on capital employed 10 Years > 15

This is the formula of finding Non-financial services companies for coffee can portfolio.

For financial services companies we need to add two more metrics which we shall discuss later on. Banks, NBFCs doesn’t thrive on ROCE only. It’s a bit more.

You have already found the beast companies. Cheers !!!

But, let’s tune it more as Screener.in doesn’t give 10 years of data; so we have limited arsenal for stock selection.

Here are the final rules for screening stocks modified by me –

- Market Capitalization > 100 AND

- Market Capitalization < 500 AND Sales growth 10Years > 10 AND

- Average return on capital employed 10Years > 15 AND

- Sales growth 5Years > 10 AND

- Average return on capital employed 5Years > 15 AND

- PEG Ratio 15 AND

- Debt to equity < 0.2 AND

- Price to Earning < 20 AND Price to Earning > 1

You can visit the screen I created here at – Amit’s Coffee Can

It’s good to be back in Quora.

This session originally happened on Unofficed Chat. I had taken a Sunday session on coffee can portfolio which is about making a portfolio which is hold and forget for 10 years. In the above scanner, the stocks were chosen and people were advised to get them each with 20K each and forget it.

The portfolio is already appreciated by 20% in last three months.

Happy Investing!

[…] Stock Picking Methods: The Astrological Call Strategy Earn 86% per year with ShopKeeper Startegy The Coffee Can Portfolio – Stock to invest for 10 years […]