The Black 76 Option Pricing Model

Professional quant traders rarely use Black Scholes Model while calculating the option greeks.

There are better models like Binominal Pricing Model, Trinominal Pricing Model. What I personally and Most of the Indian Startups as well as quants use is Black 76 Model.

Table of Contents

The Black 76 Model

The Black model (sometimes known as the Black-76 model) is a variant of the Black–Scholes option pricing model.

Black’s uses modeling a forward price as an underlier in place of a spot price. So, as per assumption of this model – The Interest Rate, The Dividend rate is always adjusted in futures price. So –

- Use Future Prices Instead of Stock Prices.

- Assume no Interest Rate.

- Assume no dividend etc.

Notes on Illiquidity

Ever heard of Brownian motion?

Brownian motion is defined as the uncontrolled or erratic movement of particles in a fluid due to their constant collision with other fast-moving molecules.

Future prices do not exhibit the same non-randomness of spot prices.

Consider a future price of stock just which just about to expire (or, about to get settled). Prior to the settlement/expiry, the spot price may be high or low but the future price will not be high.

Last Traded Price and Closing Price in NSE

You must have experienced this at the time of NIFTY or BankNIFTY’s weekly expiries? The last min huge movements does not affect the future price and option prices?

Although We have a separate exchange settlement mechanism in NSE –

- The Last traded price (LTP) usually differs from the closing price of the day.

- This because the closing price of the day on NSE is the weighted average price of the last 30 mins of trading.

- Last traded price of the day is the actual last traded price.

Brownian Motion

Now We are back to Brownian Motion.

Taking a clue from previous discussion, Now, the option prices also move super drastically when the move is too erratic near settlement right?

So, Black 76 Model will not work if the spot or futures price moves in a Brownian Motion.

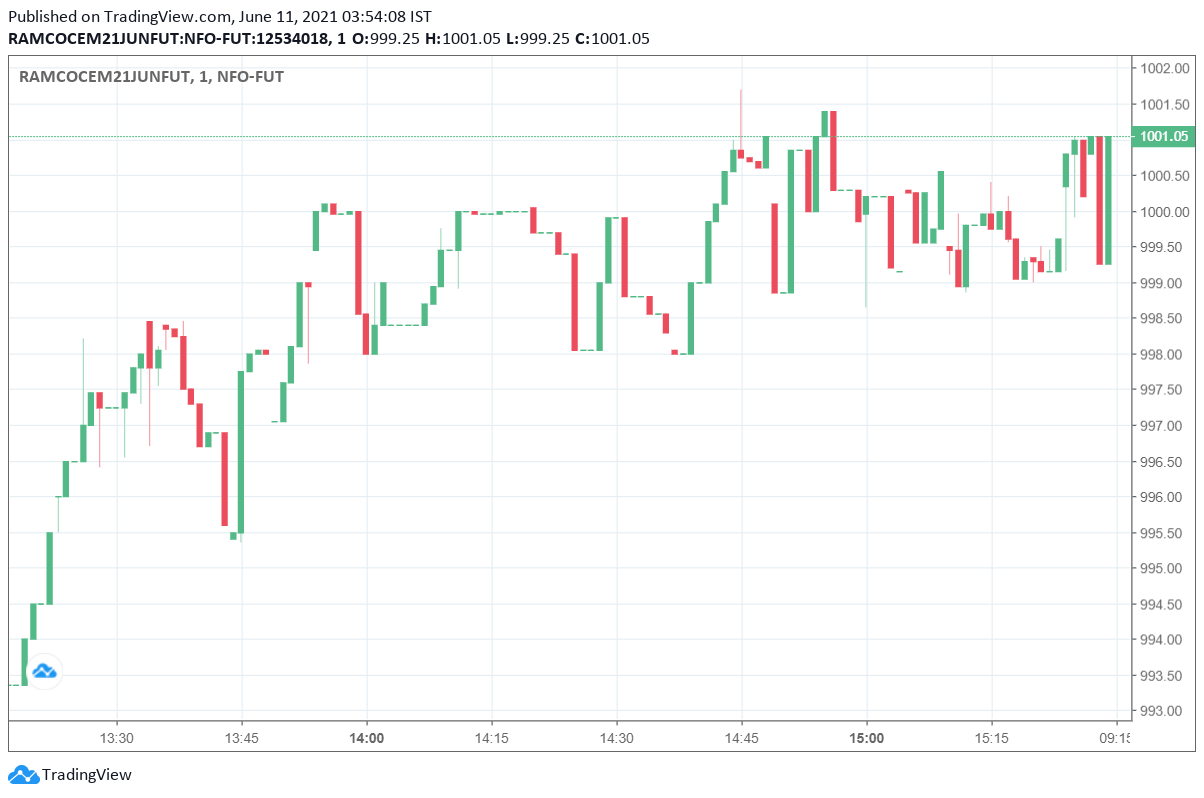

Now, if this is illiquidity, There is always Brownian Motion. Here is a futures chart of Ramco Cements –

So, Black 76 Model will not work if the futures price is illiquid.

- The model is widely used for modeling European options on physical commodities, forwards or futures.

- It is widely used on future contracts, bond options, interest rate cap and floors, and swaptions.

Faults on Black Scholes Model

Problem 1: Futures Pricing

If you see any single guy who is using Black Scholes Model, ask him how he handles the cases when “futures” price trade-in discount because that will result in a crisis.

- So, Futures price being traded in discount to the spot is obviously a nightmare.

- Crude Oil Futures even went negative which is impossible scenario.

Problem 2: IV Calculation

IV Calculation is what is which is interesting.

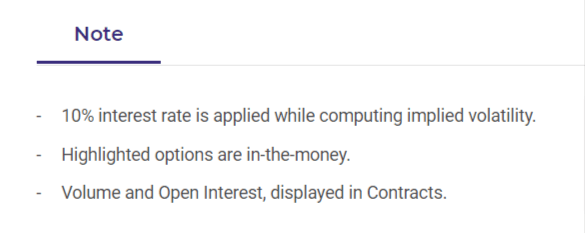

The way the NSE website throws the IV is calculated from the proper Black Scholes Model with their own twist (because the data never matches). If You go to “Option Chain” of any stock or index in NSE India website, You can see –

Black Scholes Options Pricing Model assumes that risk-free rate and volatility of the underlying are known and constant.

Black 76 Models reverse calculate the IV.

NSE assumes an interest rate of 10% all the time. So, right now, if someone is telling that he is using the NSE site’s IV in his professional quant models, he is not a professional.

*Not talking about Price Action Traders. Pure Quants.

** Actual Calculation should take RBI’s Interest value each day which will result in a massive difference.

There are arbitrage strategies often playable by higher AUM in events of RBI Interest Rate.

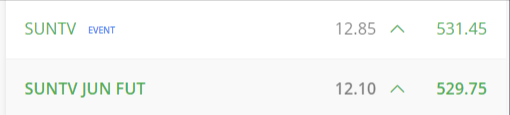

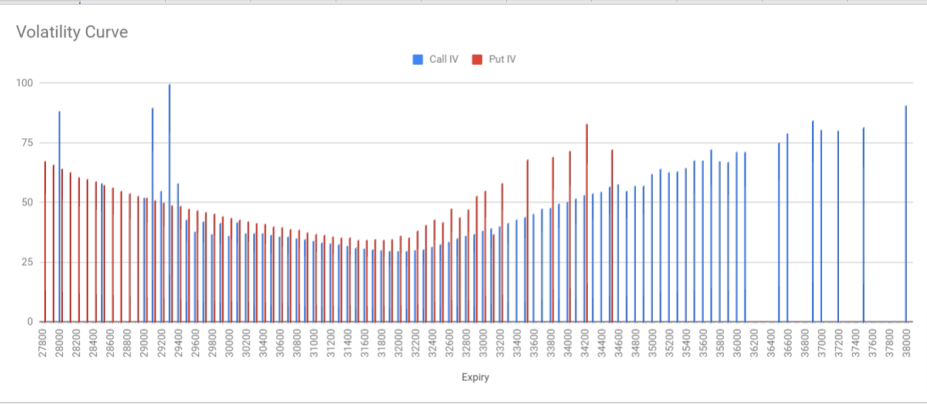

Problem 3: IV Mismatch of Put and Call Strikes

ATM Put and Call should have the same IV as per the theory of Black Scholes yet but as You can see in the image above – It is not realistically not true.

This is because of the assumption of a flat interest rate of 10%. Interesting Notation:

BankNifty is below 30900. 31000PE is ITM. I

n the Black 76 Model, We follow this assumption –

IV of 31000PE = IV of 31000CE (This is as per the Black Scholes Model too!)

So, Instead of 31000PE’s IV, We use 31000CE’s IV.

Problem 4: Interest Rate

Now, NSE’s assumption of 10% will impact in calculation of fair price.

This entire discussion is based on the theoretical Black 76 Model which is flawed in many ways but less flawed than usual Black Scholes.

Without talking about too much too much mathematics, Let’s introduce the thing called “Rho” which comes If interest rate is increased.

- Call Price will increase by “almost” the same amount of Call Rho (1% increment)

- Put Price will decrease by “almost” the same amount of Put Rho (1% decrement)

Now tell,

If RBI slashes interest rates, then –> Put prices will _____ and Call prices will ____

In reality, interest rates usually change only in increments of 0.25%. or decrements of 0.25%. I did some further calculations. When RBI increments or decrements interest by 0.25% the change in call put prices is about 6 INR. [Suppose BN is trading at 30000. 30000PE is trading at 100. The lot size is 25. So, change will be like 100.24 which is meh as you lose more than that in Slippage which tells discussing that without being trillionaire is baseless.]

You can read more about Rho here –

It is one of such theories like when Ashoka invaded Kalinga. You don’t know what to do with that information at the later stage of your life.

At this moment –

- There are two libs. One is Mbian.

- Another I used in my first day for JS for my some startup is this gist by some good guy . Check here and You can tweak as per your will!